Shale Daily | E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Oil Patch Still in Decline as U.S. Rig Count Grinds Lower

West Texas Intermediate (WTI) futures were up around $40/bbl Friday, but the latest weekly tally by Baker Hughes Co. (BKR) showed the U.S. rig count continuing to grind lower, including another round of double-digit losses in the oil patch.

The U.S. count fell 13 rigs overall to end at 266, down from 967 in the year-ago period. The declines included 10 oil-directed rigs and three natural gas-directed. U.S. operators have now laid down 526 rigs since March 13.

Two rigs exited the Gulf of Mexico on the week, dropping its total to 11, versus 24 a year ago. Twelve horizontal rigs and four directional rigs exited the patch, partially offset by the addition of three vertical units.

In Canada, four rigs departed for the week, two oil-directed and two gas-directed. That left Canada with 17 overall, down sharply from 119 a year ago.

The combined North American rig count ended at 283, versus 1,086 at this time last year.

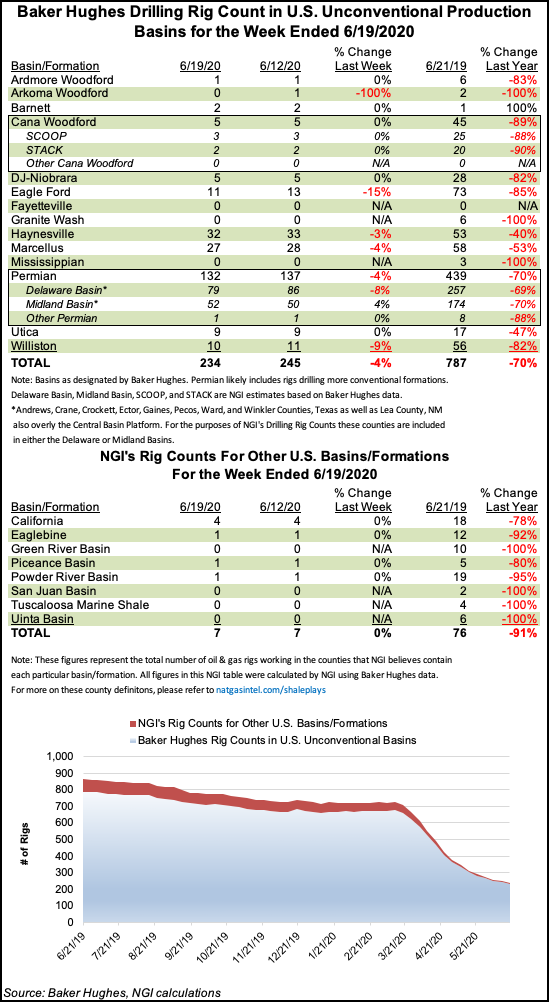

Among plays, the Permian Basin saw the largest weekly decline, falling five units to 132, versus 439 a year ago. The Eagle Ford Shale dropped two rigs week/week, while the Arkoma Woodford, Haynesville Shale, Marcellus Shale and Williston Basin each dropped one.

Among states, New Mexico dropped five rigs overall to end with 51, versus 100 in the year-ago period. Texas dropped three rigs, while Louisiana dropped two. North Dakota, Oklahoma and West Virginia each saw one rig depart for the week.

A far cry from the negative prices brought on by the Covid-19 pandemic earlier this year, WTI front month futures were flirting with the $40 mark Friday. Amid these signs of recovery for the oil markets, recent analysis shows demand far outpacing supply by 2021.

Although global oil demand is expected to fall by a record 8.1 million b/d in 2020 because of Covid-19, 2021 should be a much different story, the International Energy Agency (IEA) said recently.

In its June Oil Market Report (OMR), the global energy watchdog said it expects global oil production to fall by 7.2 million b/d in 2020, before recovering by 1.8 million b/d in 2021, assuming full compliance by the Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, with coordinated production cuts.

However, this modest recovery “comes nowhere close to meeting the forecast recovery in oil demand of 5.7 million b/d, even considering the need to draw down surplus stocks that built up in 2020,” researchers said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |