Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Ohio Production Gains Show Utica Growth, Promise in West Virginia

After four years of grabbing land, staking wells from north to south and fueling a rush of ongoing speculation, an annual production report released last week by the Ohio Department of Natural Resources (ODNR) demonstrates just how rapidly development in the Utica Shale has grown since it hit investor radar screens in 2010.

What’s more, a closer look at the data suggests that the play is still an emerging one, with production success still clearly evident to the north of a sweet spot unfolding in southeast Ohio, where operators are chasing a prolific dry gas window into West Virginia (see Shale Daily, March 26).

Long an oil and gas producing state, it’s widely understood that landmen began to arrive in Ohio between 2008 and 2009 to secure the Utica asset base, which has since revived the state’s industry. Combined unconventional and conventional natural gas in Ohio nearly doubled from 86 Bcf in 2012 to 171 Bcf last year, an increase driven mainly by high-volume horizontal fracturing (fracking) in the Utica Shale, according to ODNR’s 2013 production report (see Shale Daily, July 2).

That 97% year-over-year increase set a state record, while growth in other metrics details the play’s significant growth since 2010 when independents such as Chesapeake Energy Corp. and Gulfport Energy Corp. announced large acreage acquisitions throughout eastern Ohio.

In 2010, ODNR reported just two unconventional Utica wells. By 2013, it listed 385 wells, of which 352 reported more than 100 Bcf of natural gas and 3.7 million bbl of oil, up from 12.84 Bcf and 636,000 bbl in 2012 when only 85 wells reported production (see Shale Daily, May 17, 2013)

ODNR Director James Zehringer said last week during a presentation that ODNR estimated it would issue 1,300 horizontal Utica permits by this year. As of Tuesday, the department had issued 1,386 permits and estimates that it will issue another 700 permits this year and 800 in 2015.

That activity prompted the agency to more than double its staff and inspections since 2010 as well. ODNR oil chief Rick Simmers said well inspections went from 10,253 in 2010 to more than 23,000 last year.

“With the advent of shale drilling it was realized that oil and gas activity would increase substantially. So, in 2011 the legislature split the oil and mining divisions,” Simmers said. “At that time, the division had about 35 or so full-time employees. Since then, we’ve hired a substantial number of people and the number varies by day because we continue to evaluate and hire.”

Today, ODNR’s oil division has 120 full-time employees. It has added engineers, inspectors, geologists and expanded its legal staff and underground injection program. “We’re not just hiring for hiring’s sake,” Simmers said. “We’re being very careful in analyzing where our need is.”

David Mustine, director of energy, polymers and chemicals at the state’s economic development organization JobsOhio, said that in the last two years more than $6 billion has been invested in midstream infrastructure to build out pipelines and processing facilities in the state. That’s forced ODNR and the Ohio Environmental Protection Agency (OEPA) to continually update and “right-size” their regulations, said OEPA Director Craig Butler.

Simmers and Butler didn’t offer many details on their latest regulatory efforts. Simmers said his agency is working on 20 separate rulemaking packages dealing with injection wells, well pad construction and wastewater (see Shale Daily,Jan. 17), among other things, while Butler said his agency will roll out draft rules for oil and gas waste at landfills later this year.

Another aspect of Utica development that has stretched regulatory resources is the scope of development. ODNR has residency requirements for regional inspectors with development stretching from Trumbull County in Northeast Ohio to Washington County at the southeastern tip of the state.

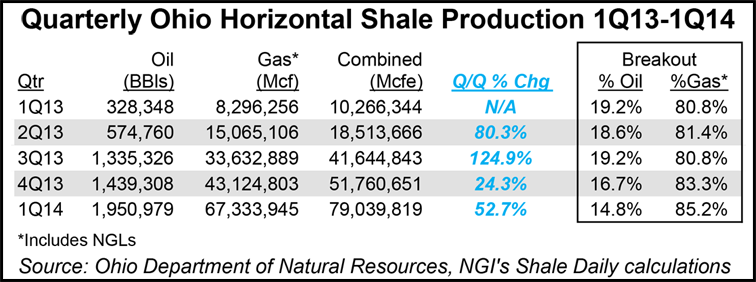

ODNR’s report showed that Belmont, Monroe, Noble, Jefferson and Harrison counties were the state’s top oil- and gas-producing counties. Although production stayed flat between 3Q2013 and 4Q2013 as midstream caught up to production (see Shale Daily, April 25; Dec. 31, 2013), volumes increased by 52.7% between 4Q2013 and 1Q2014, when 418 wells reported 67 Bcf of natural gas and 1.9 million bbl of oil.

The Utica’s gassy skew has had financial analysts comparing its early days to those of the Marcellus Shale (see Shale Daily, Jan. 2), but Topeka Capital Markets analyst Gabriele Sorbara said the the state’s top five producing counties turned out mostly wet gas with compositions that ranged from 66% in Harrison County to 100% wet gas in Jefferson County. NGL’s are not included in the state’s production report.

“Production is on a two-stream basis and somewhat difficult to interpret because of the lack of infrastructure and limited production history,” Sorbara said. “However, based on the data, the most prolific portions of the Utica Shale continue to be in the gassier areas closer to the West Virginia and Pennsylvania borders.”

In 1Q2014, Eclipse Resources Corp.’s Tippens well in Monroe County was the top producer, reporting 1.17 Bcf of natural gas, followed by Antero Resources Corp.’s Gary well also in Monroe, which produced 1.15 Bcf of natural gas. The next eight best wells all belonged to Gulfport Energy Corp. and were located in Belmont County.

Gulfport reported 2013’s best Utica Shale wells at the Shugert in Belmont County, which produced 2.5 Bcf of natural gas, and at the Boy Scout well in Harrison County, which produced 67,712 bbl of oil.

Both Belmont and Monroe counties border West Virginia where operators are at work on their first tests of the Utica in that state (see Shale Daily, May 16).

Topeka analysts continue “to believe the dry gas window is moving east into West Virginia,” where they project initial production rates will range between 30-50 MMcf/d and estimated ultimate recoveries will reach upwards of 25 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |