Offshore Leads Rig Gains as Market Tightening Forecast

The latest tally of rigs from Baker Hughes Inc. (BHI) showed offshore units making a comeback, gaining eight, while the land rig category added just three for a total gain of 11 rigs to 508 active in the United States. Meanwhile, analysts at Societe Generale see oil and natural gas markets tightening.

Louisiana led the states with a return of eight rigs to end the week at 43 active, up from 35. That’s still down 30 rigs from a year ago when the total was 73. But Don Briggs, president of the Louisiana Oil and Gas Association will likely take what he can get.

“As of September 2016, Louisiana lost more than 20,000 oil industry workers as the number of active rigs in the state declined more than 70% to a historic low of just 35 rigs,” Briggs said in a column published just before Friday’s rig count release. In it, he noted that some have compared the latest downturn to the “crash of 1986.”

Recovery will come, eventually, Briggs wrote.

“There’s no question the industry has changed over the last 10 years with the advent of the oil and natural gas shale plays,” Briggs wrote. “Our state is blessed with the Haynesville Shale in North Louisiana, and many geologists believe South Louisiana is home to many other ‘great rocks’ as well.”

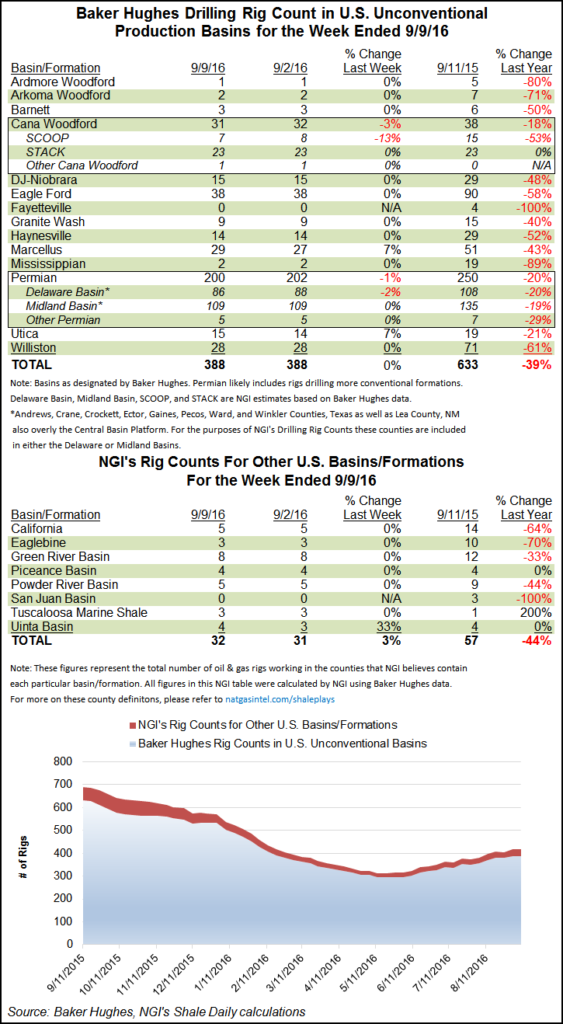

Reviewing its monthly data, BHI said the average U.S. rig count for August was 481, up 32 from the 449 rigs counted in July but down 402 from the year-ago tally of 883. The average Canadian rig count was 129, up 35 from the 94 tallied in July but down 77 from the year-ago total of 206.

For the week ending Sept. 9, Canada saw the departure of three rigs, bringing its tally to 134 and the North American tally to 642, representing a net gain of eight for the week. Three Canadian oil rigs departed, joined by one gas rig and offset by the return of one miscellaneous unit.

In the United States, oil rigs gained seven units while gas rigs added four. Six directional units came back, along with one horizontal and four vertical rigs.

Louisiana left all the other states in the dust with its gain of eight rigs; Texas came in second, adding four units to end the week at 245.

During the previous week, 14 U.S. land rigs came back, but seven offshore rigs left the game (see Shale Daily, Sept. 2).

Global oil markets have transitioned from “huge” oversupply during the second quarter of 2014 through the first quarter of this year to a “rough balance” forecast for the next four quarters, beginning with the current quarter, Societe Generale analysts said in a note published Wednesday.

“Driven by falling U.S. supply and healthy global demand, the 2H17 deficit should be bullish for prices next year,” Societe Generale said. “Driven by falling shale oil output, the U.S. continues to lead non-OPEC supply as a whole. U.S. output of crude (only) is projected to contract by 0.65 million b/d in 2016, but to decline by a more moderate 0.32 million b/d in 2017. We expect shale supply to bottom out in 2Q17 and then hold steady in 3Q17 and 4Q17.”

For natural gas, a market “reset” is expected by Societe Generale after storage injection season ends around early November. “The reset will then allow for the underlying fundamental tightening that is at play to once again take control of the narrative,” the firm said.

“We do see price strengthening re-emerging in November, holding through winter 2016-2017. The storage surplus is expected to be entirely erased in early winter 2016-2017. The market response to such a clear structural tightening during what will be the peak demand, and highly weather-vulnerable winter season, should be pronounced. A no- to slow-growth production start to 2017, as per our base-case expectation, will expose the market to more tightening through winter 2016-2017.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |