Oasis to Use Williston Cash Flow to Fund Permian Delaware Activity in 2019

Oasis Petroleum Inc. said it expects production to be essentially flat entering into 2019, and plans to use cash flow from its assets in the Williston Basin to fund a small outspend in the Permian’s Delaware sub-basin.

The Houston-based operator also cut its capital budget by more than 40%, marking $550 million at the midpoint for exploration and production (E&P) and related expenses in 2019, which would fund completion of about 70 gross operated wells in the Williston and nine-to-11 wells in the Delaware. By comparison, Oasis spent $942.2 million on E&P in 2018, when it completed and placed on production 121 gross wells, including 114 in the Williston and seven in the Delaware.

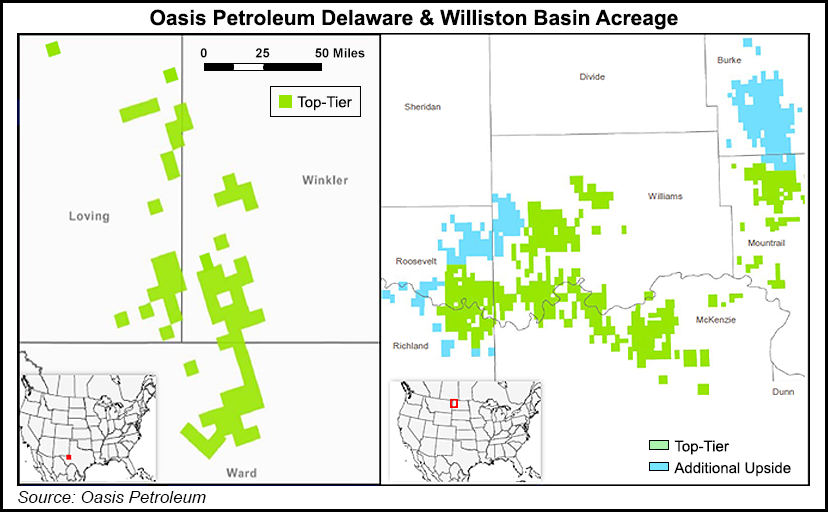

Oasis was a Williston pure-player until December 2017, when it acquired more than 20,000 net acres in the oil window of the Delaware for $946 million. Oasis has since bolted on additional acreage, boosting its position in the Delaware to more than 23,000 net acres. The company held 414,000 net acres in the Williston at the end of 2018.

“Going forward, development of the Williston will continue to be a significant driver of activity and provides a source of free cash flow to fund Delaware activity,” CEO Tommy Nusz said during an earnings call Wednesday. “Even with oil price trading well above $50 today, we intend to execute on our planned activity for 2019 and we’ll use excess free cash flow to reduce leverage.”

Nusz said Oasis would concentrate its Williston development activity for 2019 in the Wild Basin operating area, with additional completions across the Indian Hills, Alger and Red Bank areas.

Oasis’s plans for 2019 also include conducting a new spacing test in northern Alger, in advance of developing its top tier acreage at Alger and in the southern part of the Cottonwood area. In the Delaware, Oasis will conduct a three-well spacing test targeting the Wolfcamp A — two in the lower interval and one in the upper. Additional drilling across will target the Wolfcamp B and C and the Third Bone Spring.

The company released two rigs in 4Q2018 and kicked off its 2019 campaign with a five-rig program, with three rigs deployed in the Williston and two in the Delaware. COO Taylor Reid said Oasis would drop one of the Williston rigs “in the next month or so.” That’s a departure from plans the company unveiled for the year last November, when Oasis said it would enter 2019 running five rigs in the Williston and raise a third rig in the Delaware during the summer.

“This decision reflects the current commodity outlook and also drilling efficiencies that allow us to hold our acreage with fewer rigs than originally anticipated,” Nusz said.

Oasis reported production of 88,288 boe/d (76.2% oil) in 4Q2018, up 3.4% from the year-ago quarter. Production for the quarter included 82,300 boe/d from the Williston and 6,000 boe/d from the Delaware. Full-year production averaged 82,525 boe/d (76.5% oil) in 2018, up 24.8% from 2017.

During 2018, Oasis’s midstream subsidiary, Oasis Midstream Partners LP (OMP), completed the construction and startup of a second natural gas plant in Wild Basin, making it the second-largest natural gas processor in North Dakota. Oasis also dropped additional interests in midstream subsidiaries to OMP for $251.4 million.

Oasis reported net income of $222 million (70 cents/share) in 4Q2018, compared to net income of $124.6 million (52 cents) in the year-ago quarter. For the full-year, the company reported a net loss of $35.3 million (minus 11 cents) for 2018, compared to net income of $123.8 million (52 cents) in 2017. Revenues totaled $599.8 million in 4Q2018, compared to $434.9 million in 4Q2017. Full-year revenues totaled $2.32 billion in 2018, compared to $1.29 billion in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |