Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Oasis Putting Sights on Pulling Down Bakken DUCs Before Adding Rigs

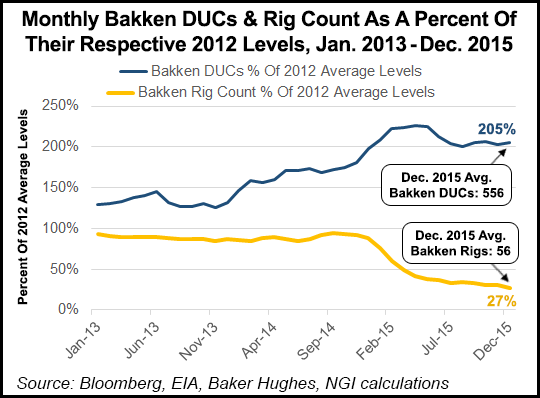

Oasis Petroleum Corp.’s senior executives are unsure when or at what commodity price they plan to “pull the lever” to redeploy rigs, but the Bakken Shale-focused producer is lining up its drilled but uncompleted (DUC) wells to start, many in the core of the North Dakota formation.

The Houston-based operator was cash flow-positive during 1Q2016 with flat operating costs, while production basically was flat from a year ago to 50,300 boe/d from 50,446 boe/d and from 4Q2015 output of 50,652 boe/d.

The key questions still not determined are how quickly the company works down its inventory of 83 DUCs, and at what price point it begins deploying more than the two rigs it has in play, CEO Tommy Nusz said during a conference call to discuss quarterly results.

“The question of the quarter is at what price point do you increase activity?” he asked. “It is a simple question with not necessarily a simple answer; there are a lot of moving parts. Similar to what other operators are saying, you start thinking about the $50-60/bbl range, but you have to play the very attractive economics off the prospects of outspending your cash flow.”

Once prices move higher, he said Oasis would have to consider the option of reducing the DUCs and the cost of the oilfield services to do it.

“There is also the condition of the macro [oil] market and the trajectory of the forward curve,” Nusz said. “It is a little too early to start laying out commitments” regarding what Oasis plans to do. “We just have to feel our way through this as we go. It is not just price, but surety of price.”

Analysts pressed management about how quickly the DUCs could be whittled down and what that might mean to increasing future production. COO Taylor Reid said the inventory has been kept flat, and 65 of the 83 total DUCs are in the core of the Bakken. Finding fracture (frack) crews may be an issue, however.

“We have the ability to focus on those DUCs and do some incremental completions,” he said of the core wells awaiting completion. “When we get into a price recovery, these are what we are going to look at because they are a pretty easy lever for us to pull. We have infrastructure in place for most of all those DUCs, so it is just a matter of lining up the frack crews and getting them online in pretty short order…”

Nusz said the DUCs are situated so they can be completed rather quickly as soon as the right price levels are in place.

“We could move beyond just staying flat and within cash flow as we are doing in the current world to possibly kind of jump-starting some of the completions while staying cash flow neutral,” he said. Reid said there would always be a cushion of 30-35 DUCs even when Oasis begins working down the overall number.

Asked if there was a point when it would be better to put another rig to work rather than concentrating on the DUCs, Nusz said the bottom line was most important.

“When you’re focused on cash flow and cash flow neutrality, I think you’re always going to go to the lower-cost alternative, and that is the DUCs,” he said. “The DUCs are always going to be your first order of business.”

For 1Q2016, Oasis reported a net loss of $64.4 million (minus 40 cents/share), compared with a loss of $18 million (minus 17 cents) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |