Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Oasis Entering Permian in $946M Deal with Plans to Sell Bit of Williston in 2018

Oasis Petroleum Inc., until now a pure-play operator in the Williston Basin, is ready to make a splash in the Permian Basin, after agreeing to acquire more than 20,000 net acres in the oil window of the Delaware sub-basin in a cash-and-stock deal valued at $946 million.

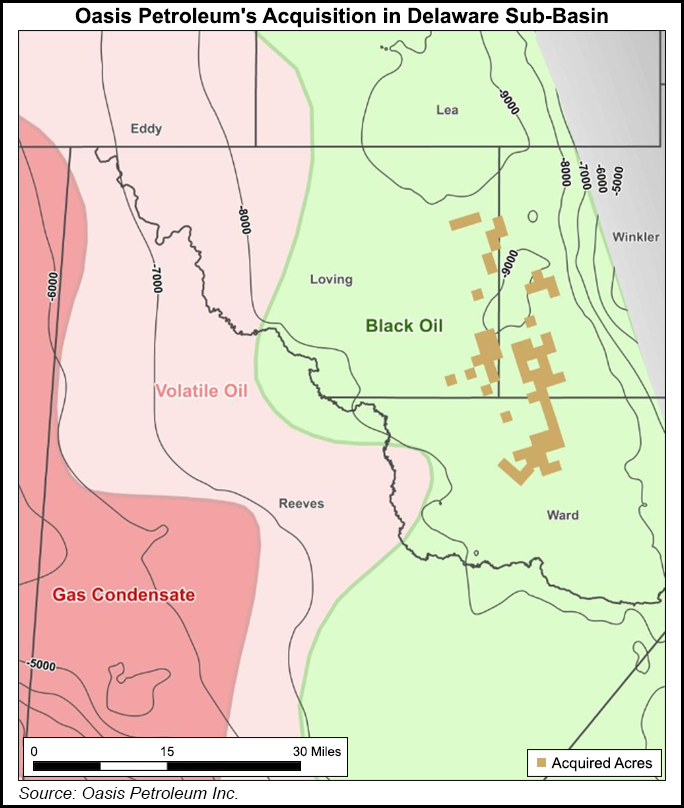

The Houston-based independent agreed to purchase from Forge Energy LLC 20,300 net acres spread across the West Texas counties of Loving, Reeves, Ward and Winkler. Oasis agreed to offer $483 million in cash and 46 million shares of common stock, which was valued at $463 million at the close of trading last Friday.

The purchase is expected to close in February with an effective date of Dec. 1, subject to customary conditions.

“Our new Permian assets deliver a consolidated position in the deepest and highest pressured part of the Delaware in the heart of the oil window,” said CEO Tommy Nusz. Forge and offset operators “have materially de-risked this position with recent well performance across the Wolfcamp and Bone Spring formations, giving us additional confidence in asset quality and well performance.”

According to Oasis, production from the acquired acreage totaled about 3,500 boe/d during November (78% oil), with a proved developed producing value of $170 million, based on strip pricing on Nov. 30. The acreage includes 601 gross operated locations (76% working interest) and 507 net core locations targeting the Bone Spring and the A, B and C intervals of the Wolfcamp formation. Oasis said the acreage held “extensive additional upside from other intervals.”

The acquisition mostly includes large contiguous acreage blocks, allowing Oasis to use longer laterals. The company said it expects the median lateral length to be about 8,000 feet. During 2018 Oasis plans to drill 16-20 gross wells, with six to eight completed across the acreage and capital spending of about $100 million. Initially, one rig would be deployed on the acreage, with the potential to add a second rig in the second half of 2018.

Oasis updated its production guidance following the announcement. The company said production was about 70,000 boe/d in October, and November’s operational production exceeded 72,000 boe/d, already surpassing its planned exit rate for 2017. In response to the increased production, 4Q2017 production guidance has been increased to 71,000-73,000 boe/d from 69,000-72,000 boe/d.

Oasis said it expects to continue running five rigs in the Williston, and is assuming one rig currently being run by Forge in the Delaware. The company added that it expects lease operating expenses in 4Q2017 to range from $7.00-7.50/boe, and differentials to range from 50 cents-$1.00/boe.

Williston production is expected to exceed 83,000 boe/d at the end of 2018, a figure Oasis said doesn’t include volumes to be divested through planned asset sales. The company said it expects Delaware production to grow to more than 5,000 boe/d exiting 2018.

Williston Sales Planned

Oasis expects to make up to $500 million in 2018 from selling some noncore acreage in the Williston’s Bakken Shale. It also has priced an underwritten public offering of 32 million shares of common stock to gain an estimated $305.6 million. A portion of net proceeds would be used to fund the Delaware acquisition. The remaining costs initially are to be financed with debt.

Separately, Oasis said the stock offering was “not conditioned on the consummation of the acquisition,” and that if the deal doesn’t occur it will use the net proceeds for general corporate purposes, which may include funding part of its capital budget for 2018. Oasis said it granted the underwriters a 30-day option to purchase up to 4.8 million additional shares of common stock. The offering is expected to close Wednesday (Dec. 13).

As of Nov. 30, Oasis said it had $333 million drawn and $10.5 million in letters of credit outstanding under its $1.6 billion borrowing base. Oasis also held $2.1 million in cash on that date.

Analysts said the Permian acquisition translated to roughly $38,000/acre, which is in line with other recent transactions in the Delaware.

“There are always going to be questions on execution when a company enters a new basin, and 2018 will bring its own challenges for new entrants into the Permian, with activity at white-hot levels,” analysts with Jefferies LLC said in a note to clients Tuesday. “Finding quality fracture crews and maintaining an on-time completion schedule will be some of the key challenges, but we think Oasis will be up to the task. Oasis has been a strong operational company in the Bakken, with a track record for efficient development.”

Wells Fargo Securities LLC analyst Gordon Douthat added that the Delaware acquisition raises questions over the company’s longer-term strategy in the Bakken, as well as the potential need for more scale in the Permian.

“It was probably the right decision long-term for the company, given the limited core inventory in the Bakken and the superior economics in the Delaware,” Douthat said. “But we believe the expensive cost of entry into the Delaware, along with dilution and uncertainty surrounding a strategic direction for the company, could pressure shares in the near-term.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |