Bakken Shale | NGI All News Access

Oasis Cuts Drilling Costs with Efficiencies

Continued drilling efficiency improvements are driving record production growth in the Williston Basin’s Bakken Shale and helping to push down costs, according to top Oasis Petroleum executive.

These drilling efficiencies, noted by various operators and energy analysts in recent weeks, are expected to drive down the average well costs for Oasis Petroleum by several million of dollars per well, said COO Taylor Reid. He spoke Tuesday in San Francisco at the Independent Petroleum Association of America’s (IPAA) OGIS conference.

Oasis recently paid $1.52 billion for 161,000 net acres in the Williston Basin in four separate transactions, growing its Williston position to 492,000 net acres with 43,000 boe/d of production and 215.6 million boe of proved reserves (see Shale Daily, Sept. 6).

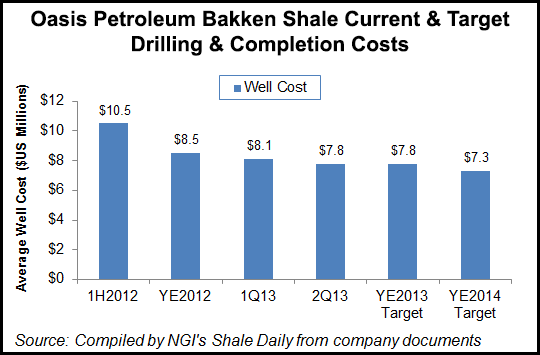

After peaking in mid-2012 at about $10.5 million/well in drilling costs, Reid said well costs should average about $8 million/well by the end of this year and $7.3-$7.5 million by the end of 2014.

“One of the things that we’ve had a lot of success on during the past couple of years is in pulling down the well costs,” Reid said. “In three years you’re going to see about a $3 million decrease in average well costs.”

Oasis is expecting a 50% increase in Bakken production growth this year, topping off at 33.8-35.8 million bbl, Reid told the IPAA audience. The oil-weighted producer currently has reserves exceeding 200 million bbl.

“As we move into 2014, we’re going to have even more of our activity concentrated on pad drilling,” Reid said. “All the work that we’ve been doing on subsurface spacing, and understanding the lower benches of the Three Forks [adjacent to the Bakken] is being used to then configure the optimal setup on the surface.”

This year 60-70% of the Oasis wells were on pads; next year that number will be 80%-90%, Reid said. “We’ll get more benefits of efficiencies from pad operations across the position.”

In the Bakken Shale, the well cost decline is a growing trend, according to North Dakota’s Lynn Helms, director of the Department of Mineral Resources (see Shale Daily, Oct. 1). “We can actually drill more wells with today’s technology at 185 rigs than we could in May of 2012 with 218 rigs. They’re just that much faster and better at what they do.

“The efficiencies continue to accrue in the drilling operations, but not so much in the [hydraulic fracturing] fracking operations where we’re still struggling a bit.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |