Markets | LNG | NGI All News Access

November Natural Gas Futures Give Up More Ground Ahead of Storage Report

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Regulatory

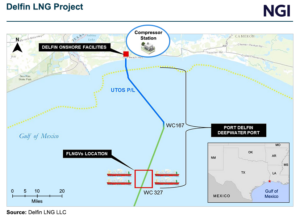

The U.S. Maritime Administration (MARAD) has ordered Delfin LNG LLC to submit an updated application to build and operate its proposed export project in the Gulf of Mexico. Seven years after the agency granted Delfin a record of decision (ROD) for the more than 13 million metric tons/year (mmty) capacity project offshore Louisiana, MARAD staff…

April 23, 2024Energy Transition

Energy Transition

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.