NOV Pivoting to More Onshore Technologies to Gain U.S. Unconventional Share

The oil and gas market finally is nearing an inflection point following the brutal downturn, setting the stage for a better 2018, National Oilwell Varco Corp. (NOV) CEO Clay Williams said Tuesday.

Williams and his management team, during a conference call, laid out 2017 and fourth quarter results for the Houston-based operator, which provides technology, equipment and services for onshore and offshore customers.

“After three extraordinarily difficult years, it feels to us that the market is nearing an inflection point,” Williams said. “Oil inventories are rapidly approaching normal levels, pushing oil prices up and facilitating the return, in our view, of a geopolitical risk premium.”

Industry surveys also point to a “modest” increase this year in upstream capital expenditures following a sharp decline in spending. “This all sets the stage for a brighter outlook for 2018.”

The executive team is positioning NOV “in the markets that matter most to our customers, by investing in technologies that drive better economics for our clients,” Williams said.

Translation: the mix has shifted to North America and to the onshore. NOV now generates about 65% of its revenue from land markets and 44% from North America.

However, Williams said the market remains cautious about what the upturn may look like.

“No. 1, it’s not clear that oil companies believe higher oil prices, at least not yet.” Exploration and production (E&P) companies are “under tremendous pressure” to generate a higher return on invested capital “and all projects appear to look to West Texas Intermediate as the benchmark.

“I believe the consensus view is that unconventional oil from the Permian Basin carries a roughly $45/bbl breakeven, and there persist fears that the oil price could revisit that level. “

The “E&P price index against which projects around the world are being judged, including the offshore, are closer to $45/bbl than the spot price of Brent, which is about $70/bbl.”

NOV’s customers also are struggling to obtain bank financing, as “banks and the regulators all want to reduce exposure to the oil and gas industry,” said the CEO.

A critical function of commodity prices is to signal producers whether to produce more or less.

“If the industry, at the behest of Wall Street, and due to the lack of bank financing, fails to respond to the commodity price signal by failing to produce more, well then, the commodity price will just continue to rise until somebody grows production,” said Williams.

Capital Discipline Drives Higher Prices

“In short, the newfound fidelity to capital discipline and lack of bank financing will likely, in my view result in higher oil prices on down the road.”

The last three years have been a “succession of bad breaks,” as the Organization of the Petroleum Exporting Countries, i.e. OPEC, “relinquished its traditional role of swing supplier, at least for a while,” allowing Libya and Iraq to meaningfully grow production. Iranian oil also returned to the market, while U.S. unconventional production grew despite the price downturn.

“These all contributed to an oversupply picture that got progressively worse in the first two years of the downturn,” said Williams. “That has since turned the corner and is rapidly improving.”

Meanwhile, the unconventional oil and gas plays are scoring well on marginal cost of supply and attracting a “disproportionate share of incremental capital.”

This year the United States should “break production records dating back to 1970…Within a decade, this unconventional shale technology has grown to account for five of six wells spudded in the United States and we are confident unconventional shale technology will be adopted elsewhere around the world too.”

NOV is taking heed, pivoting its portfolio to gain more exposure to unconventional drilling technologies and enhancing its estimable offshore offerings.

“We think the next upturn will see more widespread application of shale technologies to new rocks, both here and abroad, hence, our focus in this area through the past three years,” said Williams.

Tax Reform a Long-Term Benefit

Meanwhile, the U.S. tax reform enacted in late 2017 should provide a “meaningful, long-term benefit to NOV,” said CFO Jose Bayardo. “In addition to enhancing our ability to move cash around the world, we expect a reduction in the U.S. rate from 35% to 21%, will lower our overall long-term effective tax rate from approximately 30% to the low to mid-20% range.”

NOV made progress in the final quarter, but working capital levels “have remained frustratingly high through this downturn as a lack of cash and liquidity among our customers has made it challenging to turn inventory and accounts receivable into cash,” the CFO said.

“Consequently, we are heightening operational focus in this area in 2018 by further tying incentive compensation to improve capital efficiency and working capital performance. As our cash repatriation flexibility improves with new tax law changes and our free cash flow grows with our business and our heightened efforts around working capital, we will be focused intently on optimizing capital allocation throughout 2018.”

NOV reported a fourth quarter net loss of $14 million (minus 4 cents/share), compared with a year-ago loss of $714 million and a $26 million sequential loss. Revenue climbed 16% year/year to $1.97 billion. Net losses for full-year 2017 totaled $237 million (minus 63 cents/share). Revenue totaled $7.30 billion, with an operating loss of $277 million.

In its wellbore technologies segment, revenues climbed to $715 million in 4Q2017, a 3% sequential increase and up 35% year/year as demand outpaced global activity levels.

Completions/production (C&P) solutions segment revenues reached $690 million, 15% higher year/year and 1% higher than in 3Q2017. Growing deliveries of pressure pumping equipment and composite pipe offset lower revenues from offshore products.

Backlog for C&P capital equipment orders at the end of December was $1.07 billion. New orders during 4Q2017 were $501 million, representing a book-to-bill of 125% when compared to the $401 million of orders shipped from backlog.

Most of the C&P business units “secured orders in excess of 100% book-to-bill,” including “strong bookings for coiled tubing equipment.”

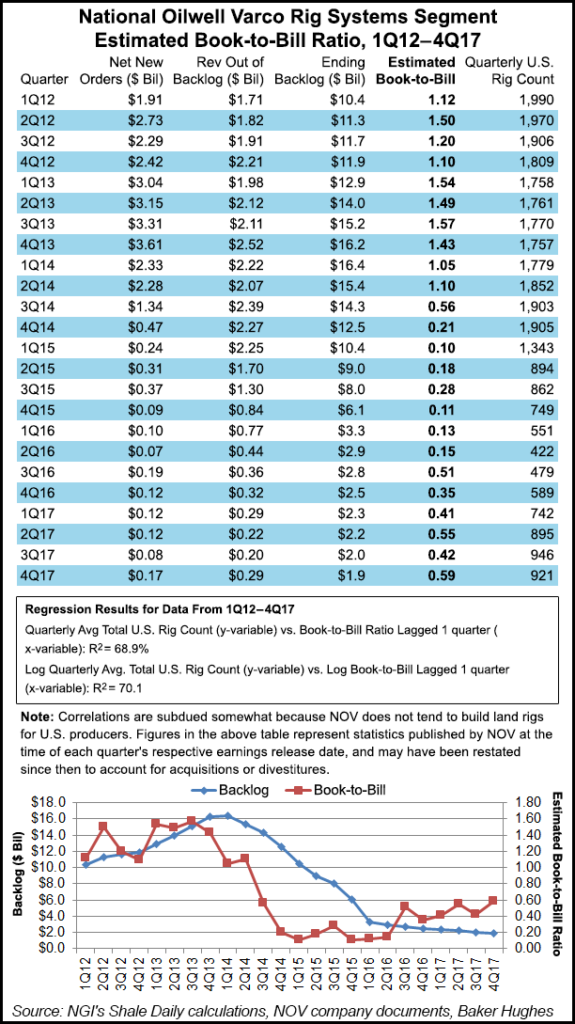

In the rig technologies segment, revenue was up 20% from 3Q2017 on improved shipments to customers that had deferred deliveries. The backlog for rig system capital equipment orders was $1.89 billion at the end of 2017, with new orders totaling $169 million during 4Q2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |