E&P | NGI All News Access | NGI The Weekly Gas Market Report

NOV Books 75,000 HHP in First Quarter as Shift to U.S. Onshore Continues

Drilling technology expert National Oilwell Varco Inc., which has steadily shifted its operational focus to U.S. land business, booked 75,000 hydraulic horsepower (hhp) fracturing equipment orders during the first quarter, bringing its total at the end of March to 150,000 hhp.

The Houston-based oilfield services operator said the most recent order included 30 fracture units, two blenders, one chemical unit, one hydration unit and a data van. It also booked orders for 30 high-specification well servicing rigs for the U.S. market along with 16 of its Novos automated rig operating systems, a key element of an initiative to improve drilling efficiencies.

“Our businesses that serve the improving North American land market generated solid sequential improvements in profitability and are growing quickly,” CEO Clay Williams said. “This lifted NOV’s consolidated mix of land revenues to 57% during the first quarter of 2017.”

NOV has been able to benefit from the two-plus years of “intense cost reduction” to capitalize on the “full-fledged recovery underway in North America,” Williams said during a conference call. “Throughout the downturn, we have been consistent in our focus on No. 1, managing what we can, namely cost, while, No. 2, pivoting toward technologies like horizontal drilling and hydraulic fracture stimulation, which we see benefiting disproportionately in the next upturn. Solid results in both areas enabled us to once again outrun declines in offshore markets and rig-building during the first quarter to post sequential revenue improvement overall.”

Bigger Completions Backlog

In NOV’s completion and production solutions business, or C&P, revenue jumped 8% from the fourth quarter and was 16% higher from a year ago at $648 million. Operating profits totaled $8 million, or 1.2% of sales. The C&P backlog for capital equipment orders at the end of March stood at $751 million. New orders during the quarter totaled $323 million, representing a book-to-bill of 90% when compared to the $359 million of orders shipped from backlog.

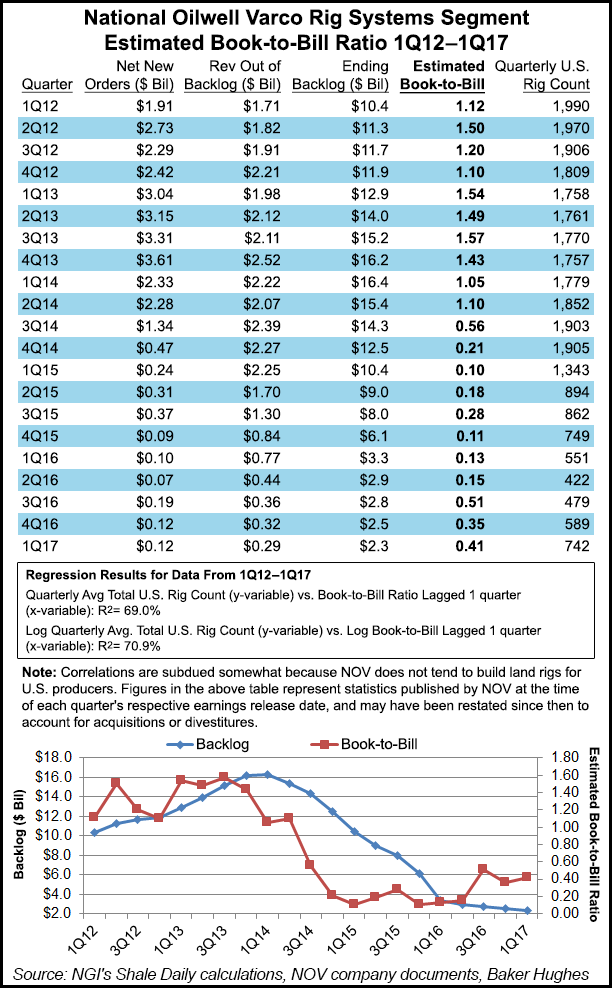

NOV’s rig systems segment generated quarterly revenue of $393 million, down 8% sequentially and 58% from 1Q2016, on operating profit of $9 million, or 2.3% of sales. The backlog for capital equipment orders in rig systems was $2.32 billion at the end of March. New orders during the quarter totaled $118 million, representing a book-to-bill of 41% when compared to the $285 million of orders shipped from backlog.

Rig aftermarket business revenue fell 5% from the fourth quarter and declined 18% year/year to $321 million on operating profit of $61 million, or 19% of sales. Wellbore technologies generated revenues of $555 million, an increase of 5% sequentially but down 12% from a year ago on operating losses of $57 million, or 10.3% of sales.

Escaping ”Velocity’ of Black Hole

The CEO waxed poetic when discussing the bleak conditions that consumed the global oilfield industry and exploration and production (E&P) sector during the historic downturn.

“As global oil supply and demand rebalanced and oilfield activity grinds higher, NOV is building escape velocity from the black hole the oil industry has been in since late 2014,” Williams said. “Oil demand has grown nearly every single year since the first commercial well was drilled in Pennsylvania in 1859, making the oil industry, in my view, the ultimate growth industry for the past 158 years. It’s fueled an unprecedented improvement in global standards of living as people figured out that plastics and transportation fuel makes their lives a whole, whole lot better.

“During each of the many down cycles this industry has endured, those of us engaged in the industry are forced to learn, once again, just how Darwinian this business can be and we are forced to learn once again of the necessity of drastic reductions in our expense base. Later during the subsequent upcycles, the world is forced to learn, once again, a double-digit reduction in global E&P capex [capital expenditure] results in diminished supply, and the world is forced to learn once again how important petroleum is to the world economy and the standard of living.

“That big lesson is coming. Last year E&P capex spending was just 50% of 2014 levels. Future supply will become a challenge.”

Inevitably Tighter Market

The United States “will continue to play a larger role in the supply of oil. This year has returned to production growth, plus we’ve seen lots of overseas barrels stored in our tankers overloaded into the U.S. market recently, two factors that led to our reported U. S. inventory increase, which in our view, contributed to oil prices dipping back below $50. Nevertheless, depleting production through the other 80-plus million b/d of supply and another year of growing demand, the industry’s 159th, will inevitably be tightening.”

However, NOV’s North American customers “are demonstrating that their economics work even at current oil prices in many North American basins by putting rigs back to work at an astonishing rate. On average, they added 275 land rigs in the first quarter as compared to the fourth quarter 2016, more than three rigs per day. At year-end, NOV was generating a third of its revenue strong North America. In the first quarter, that number was 37%.

In the offshore business, NOV did not see any empirical evidence of economics working for E&Ps at current commodity prices. Major project final investment decisions “remain scarce, and we’ve still yet to see significant tieback demand for subsea flexible pipe,” Williams said. Offshore rigs under contract declined 3%, or 15 rigs during the first quarter.

Among its new technology offerings, NOV recently introduced the QT-1400, a high-strength coiled tubing string with a specified minimum yield strength of 140,000 psi and more resistance to low-cycle fatigue cracking at high pressure. The coiled tubing is designed to improve operational efficiencies in “completing and refracturing long laterals onshore and offshore with a 54% further reach capability, 28% stronger internal yield pressure, and 23% higher yield load capability,” than NOV’s older system, QT-1000.

The company also has introduced two real-time condition-based monitoring (CBM) systems for intervention and stimulation equipment. The CTES CBM system is designed to maximize uptime and reduce maintenance costs associated with personnel and inventory requirements through early identification of potential failures by monitoring pump performance, filters and engine health in addition to hydraulic systems, lubrication systems and specific bearings on rotating machinery.

The Texas Oil Tools Stack Monitor is said to increase customer confidence of coiled tubing blowout preventer (BOP) performance by providing real-time data of the entire stack. Mounted in the control cabin, the Stack Monitor allows the customer to determine if the BOP rams are fully opened or closed from a safe distance from the operation. A faulty BOP is said to be one of the root causes of BP plc’s Macondo well blowout in 2010 in the deepwater Gulf of Mexico.

Record Runs in Permian

NOV also has introduced the Vector Series 50 motor, a short bit-to-bend downhole drilling motor with an electrical resistance tomography that allows extended operational hours, less aggressive rotation, and tighter curve sections.

“Using the new motor, an independent operator in the Permian Basin drilled back-to-back record runs, including their fastest lateral section,” management said. “The tool delivered 32% and 58% rate of penetration (ROP) improvement over Reagan County’s top five-performing wells” in West Texas. “Following similar successes around North America, NOV is adding additional Series 50 motors to its rental fleet.”

Subsidiary Grant Prideco’s newest connection, Delta, also completed its first commercial run for an independent E&P in the Permian Basin using 5.5-inch S-135 Delta 544 drill pipe to drill one of its “longest and fastest lateral wells in the area. The operator drilled a clean hole, eliminating casing run concerns and reducing the open hole friction factor from 0.34 to 0.24, a 30% reduction in torque and tension loads, to make it easier to reach total depth.”

Another NOV customer set a record for the longest lateral drilled in the Permian’s Midland sub-basin in West Texas. The bit drilled 10,927 feet in 138 hours for an average ROP of 79 feet/hour, “53% farther and 7% faster than the county’s Top 10 bit runs,” which has motivated the customer to continue using the drillbit for their Midland sub-basin laterals.

Net losses in the first quarter totaled $122 million (minus 32 cents/share), versus a year-ago loss of $119 million (minus 32 cents) and a sequential loss of $714 million (minus $1.90). Excluding one-time items, which included severance and facility closures, NOV lost $63 million (minus 17 cents) in 1Q2017.

Revenue between January and March of $1.74 billion climbed 3% sequentially but was off 20% year/year. Operating losses were $97 million in 1Q2017, or 5.6% of sales. Excluding one-time charges, the operating loss was $70 million, or 4% of sales.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |