Shale Daily | E&P | NGI All News Access

Northern Oil and Gas Expands into Williston Basin with Purchase from Ven Bakken LLC

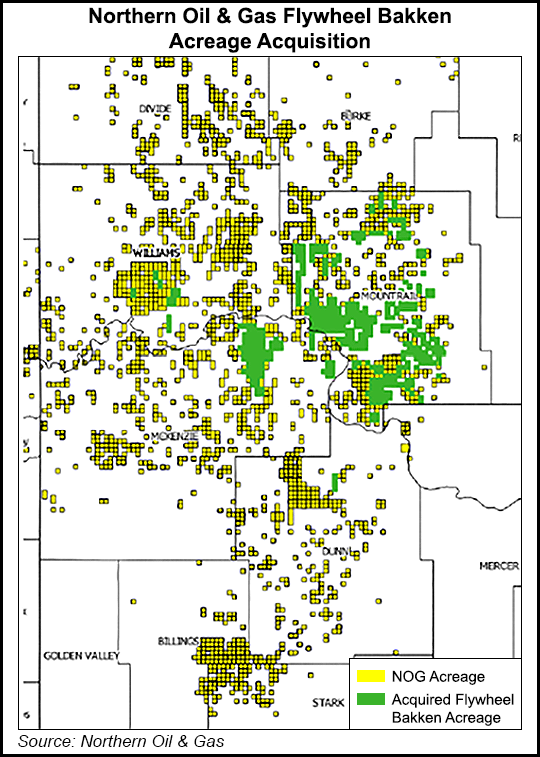

Northern Oil and Gas Inc. has expanded its holdings in the Williston Basin after acquiring properties from Ven Bakken LLC, a subsidiary of Flywheel Bakken LLC, for $165 million.

The assets acquired from Ven Bakken LLC “are outperforming Northern’s initial estimates with an increase in both current producing wells and wells in process,” management said.

“These assets will help drive our debt adjusted cash flow per share higher and our general and administrative expenses per barrel lower, said Northern CEO Brandon Elliott. “We have also helped to protect the additional cash flows from operations with the hedges we put in place at the time of the announcement.”

Production from the property is now expected to average around 6,650 boe/d in 3Q2019 and about 7,000 boe/d in 4Q2019, an increase from Northern’s prior estimate of 6,600 boe/d.

The acquired properties include nonoperated working interests in about 18,000 net acres consisting of 87.8 net producing wells, an increase of about 0.9 net well. There are an additional 4.1 net wells in process, an increase of 1.4. Northern said the acquired assets may include an additional 45.6 net undrilled locations.

“The divestiture of our nonoperated Williston basin asset will allow us to focus our resources on our core operated asset in the Fayetteville Shale and continue to create value for our shareholders,” said Flywheel CEO Justin Cope.

Flywheel acquired Fayetteville assets from Southwestern Energy Co. in December.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |