Markets | NGI All News Access | NGI Data

Northeast Surges as Forecasters Hint at Cool March, April; NatGas Futures Slide Post EIA Data

Spot gas prices for Friday delivery came in two sizes in Thursday’s trading: large, if you were in the Northeast dealing with lingering cold and an outlook for colder temperatures heading into the weekend, and small, if you were west of the Mississippi.

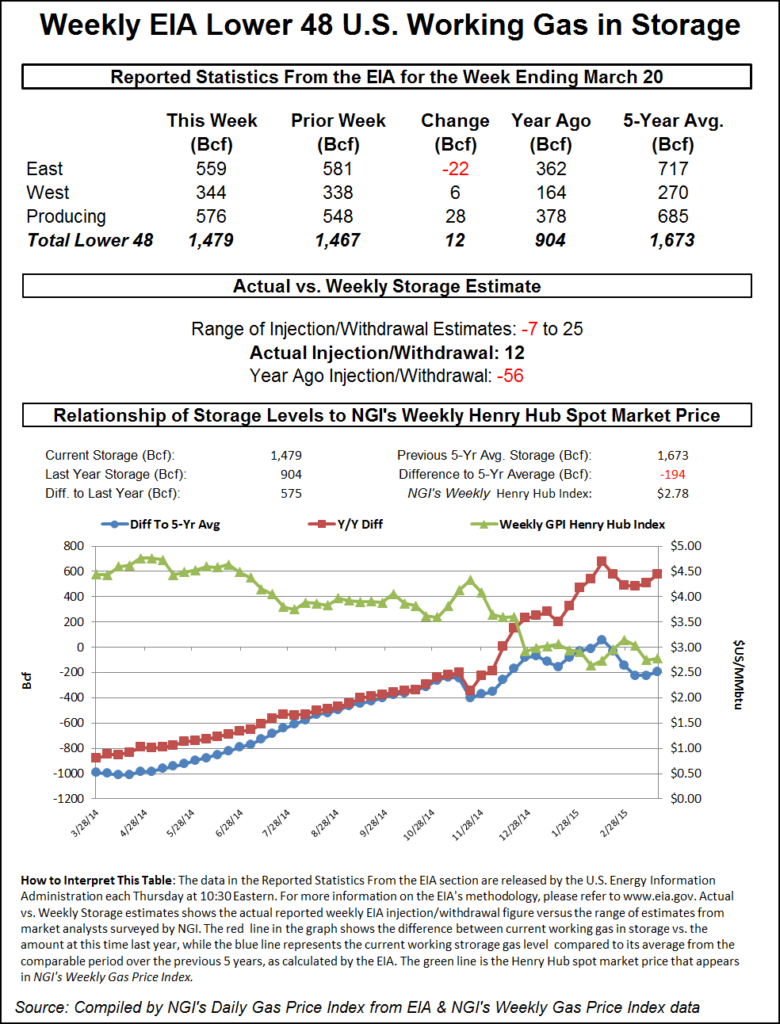

Gains in New England and the Mid-Atlantic averaged nearly 50 cents, but the Gulf Coast, Midwest and Far West saw declines of a few pennies to a nickel. Overall, the market managed a gain of 9 cents to $2.57. Futures traders keyed off an unsupportive storage report featuring a storage build of 12 Bcf and sent April lower by 5.1 cents to $2.672 and May down 5.2 cents to $2.688. May crude oil continued its winning ways, adding a stout $2.22 to $51.43/bbl.

Those large-sized prices were the result of forecasts of sliding temperatures in key market areas. AccuWeather.com forecast that Boston’s Thursday high of 56 would drop to 45 Friday and 38 Saturday, 11 degrees below normal. New York City was forecast to see its Thursday high of 59 slide to 51 Friday and 40 by Saturday. The seasonal high in the Big Apple is 54.

Friday deliveries to the Algonquin Citygates surged $1.96 to $5.15, and parcels on Iroquois Waddington added 12 cents to $3.08. Gas on Tennessee Zone 6 200 L rose $2.24 to $5.31.

More large-sized prices may be on the way, if forecasters are correct. According to Michael Schlacter, chief meteorologist at Weather 2000, “Rumors of the demise of winter 2014-2015 are premature. People should not underestimate what is possible in late March, the first half of April, with regards to snow and ice and heating degree days [HDD],” Schlacter told NGI.

“Sometimes people, being tired of a long winter or frustrated by oversupply and prices not reacting, write off the very end of the season, but based on our climate research and a seasonal shift, and based on this particular winter season showing a lot of ferocity still in Canada, with delivery mechanisms in place, there’s no reason why the next two or three weeks couldn’t produce the kind of weather that’s on par with what you might see the last week of November and the first two weeks of December (see Daily GPI, March 25).

Hefty gains in peak power prices also contributed to the appeal of incremental gas purchases for power generation. Intercontinental Exchange reported that Friday on-peak power at the ISO New England’s Massachusetts Hub rose $5.09 to $42.24/MWh and peak Friday power at the PJM West terminal gained $6.39 to $39.83/MWh.

In the Midwest prices came in steady to lower. Next-day gas on Alliance was seen at $2.78, unchanged, and packages at the Chicago Citygates were up a penny at $2.75. Gas on Consumers changed hands at $2.86, down a penny, and deliveries to Michcon were quoted at $2.84, down 3 cents.

In early bidweek trading, Midwest traders don’t seem to be buying into the notion that winter has any lingering punch that might affect spot gas pricing. NGI’s Bidweek Alert showed April fixed gas going for substantially less than current spot. Chicago Citygate was quoted at $2.68 and ANR SW was seen at $2.46. NGPL Midcontinent Pool changed hands at $2.44, and Panhandle Eastern came in at $2.34.

A Michigan marketer said they were buying gas “to make sure their customers were where they need to be at the end of the month. We paid $2.86 and $2.88 on Consumers for Friday.”

The marketer said their basis purchases were doing well as “Nymex prices are low, and we are hearing some favorable basis quotes on Consumers for April, between 17 cents and 20 cents,” he said.

Cash traders Thursday not only had to deal with a government storage report but also an advancing cold front and the subsequent drop in temperatures expected to follow. “Showers and thunderstorms will move across the eastern states on Thursday as a strong low-pressure system and associated cold front advance eastward over the Mississippi River Valley,” said forecaster Wunderground.com. “The system will continue pulling abundant moisture and energy northward from the Gulf of Mexico, allowing for moderate to heavy rainfall to develop from the Northeast through the Gulf Coast.

The 10:30 a.m. EDT release of EIA storage data elicited only a nominal response. April futures fell to a low of $2.686 after the number was released and by 10:45 a.m. April was trading at $2.649, down 7.4 cents from Wednesday’s settlement.

Traders see the market’s decline consistent with their market objectives. Steve Mosley of the SMC Report said, “we have seen the market give back all of last week’s gains and we are currently in another serious downward test of the $2.567 low. The market has been to as low as $2.649 after the Thursday EIA storage report.

“We will just have to see how this plays out as to whether this week’s downward market move is just part of the relatively brief, wide-swinging, upwardly biased consolidation that we expected for this year’s pre-summer recovery, or whether it is going to result in a late continuation of the winter seasonal decline that would finally achieve our $2.20-$2.55 winter target range.”

Prior to the release of the data analysts were looking for an increase averaging less than 10 Bcf. A Reuters survey of 22 traders and analysts showed an average 6 Bcf with a range of minus 7 Bcf to plus 25 Bcf. Analysts at First Enercast were looking for a 23 Bcf build and industry consultant Bentek Energy utilizing its flow model predicted a 7 Bcf increase.

Bentek said, “Production has picked up over the past two weeks and averaged 72.5 Bcf/d during the March 20 storage week, which is an increase of more than 0.5 Bcf/d from the previous week’s average. Production in the Northeast is driving the recent growth, mostly due to strong volumes hitting REX and pushing back into the Midwest.

“The diversification of supply in the Midwest is allowing for smaller withdrawals from facilities in the region, as evidenced by the weak withdrawal levels from ANR over the past two weeks. Furthermore, the increased supply in the region is allowing for the salt dome facilities to fill rapidly during the week, which is a trend that is likely to continue this shoulder season.”

Other traders saw a bearish report but still within the framework of a broad trading range. “Earlier in the week I was hearing negative numbers, but as of yesterday I was hearing +6 Bcf. We are still in a trading range from $2.50 to $3 and not much has changed,” said a New York floor trader.

“The build for last week was more than expected and also bearish compared with the 20-Bcf five-year average net withdrawal,” said Tim Evans of Citi Futures Perspective. “It also suggests a weaker background supply/demand balance, with bearish implications for the reports to follow relative to the base case.”

Inventories now stand at 1,479 Bcf and are 575 Bcf greater than last year and 194 Bcf below the five-year average. In the East Region 22 Bcf was withdrawn and the West Region saw inventories increase by 6 Bcf. Stocks in the Producing Region rose by 28 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |