Northeast NatGas Basis Seen as Muted Due to Mild Early Winter

In an otherwise quiet start to the week for natural gas forwards markets, New England prices took a nosedive as continued lackluster demand and an improving storage picture weighed on the market.

“There’s no weather yet, so the market is antsy,” a Northeast regional trader said.

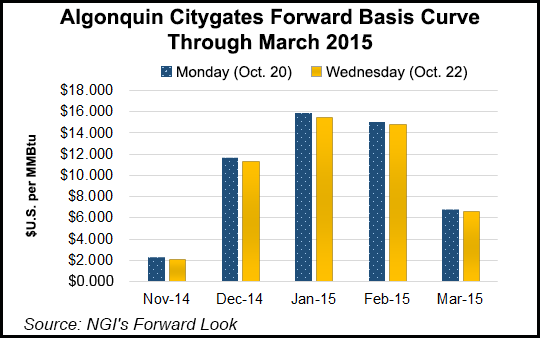

According to NGI’s Forward Look, Algonquin Gas Transmission citygates November basis lost nearly 15 cents between Monday and Wednesday to sit at plus $2.133/MMBtu, representing a full value price of $5.844/MMBtu.

Steeper declines were seen in the December and balance-of-winter packages. Algonquin December basis was down 29 cents to plus $11.338/MMBtu. The balance-of-winter package sat Wednesday at plus $12.09/MMBtu, down 20.2 cents from Monday.

“Ultimately, the winter is still pretty strong,” another trader said. “It will be interesting to see what happens. The strong forward basis only incentivizes switching.”

The current forward strip at Algonquin suggests marketers have been hedging their projected loads quite a bit, therefore pushing down cash prices relative to last year, even with similar weather, the trader said.

“No one seems to talk about how weak forward basis was this time last year. So, we’re going from complacency to paranoia,” the trader said.

Current weather forecasts show persistent moderate temperatures for the month of November. AccuWeather forecasters show high temperatures in the densely populated Boston area hovering in the 50s and overnight lows in the 30s and 40s. Early indications show highs dropping into the 40s the first week of December.

“The market wants to be bullish, but it seems all forecasters are calling for a cold first quarter, but warm to normal November. December is still the wild card,” the first trader said.

The lack of winter demand thus far is helping chip away at the deficit storage inventories are carrying from last year. The U.S. Energy Information Administration reported a 94 Bcf build to storage stocks for the week ending October 17, in line with market expectations.

“We’re going to end at 3.55-3.6 Tcf, and the longer it takes for the weather to come in, the closer we’ll get to last year,” the trader said.

In the East region, storage inventories jumped 47 Bcf to 1.872 Tcf, down 142 Bcf from the five-year average.

Other points in the Northeast also shifted lower further out the curve as a slew of projects boosting takeaway capacity in the region by more than 1 Bcf/d are expected to go online November 1, including Williams’ Northeast Connector and Spectra’s TEAM 2014 projects, among others.

TETCO M3 November basis slipped just 1 cent between Monday and Wednesday to reach minus $1.22/MMBtu, while the balance of winter was down 5.8 cents to plus $1.464/MMBtu.

Transcontinental Gas Pipeline zone 6-New York November basis actually picked up 4 cents between Monday and Wednesday to reach minus 84 cents/MMBtu, but the balance of winter fell 3.2 cents to land at plus $4.722/MMBtu.

Other markets across the U.S. and Canada moved less than a couple of cents this week as traders appeared content to leave their positions in place amid persistent shoulder-season fundamentals.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |