Infrastructure | Bakken Shale | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota NatGas Infrastructure Catching Up as Production Keeps Growing

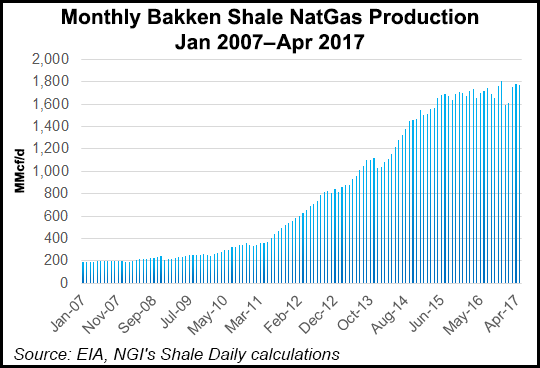

Natural gas production in association with North Dakota’s Bakken oil continues to increase, prompting midstream operators like home-grown MDU Resources Group’s WBI Energy Inc. (WBI) to accelerate the buildout of gas infrastructure.

Since 2010, Bismark, ND-based WBI has expanded its Bakken takeaway capacity for gas six-fold, and it anticipates having significant capacity additions online by late next year.

In releasing the state’s latest production totals last month, Lynn Helms, director of the Department of Mineral Resources, touted a 6% (100 MMcf/d) increase in gas production. “It emphasizes again, the producers’ concentration on the [five-county Bakken] core area where added oil production gets produced with a lot more gas,” said Helms. The state still is holding steady with a 90% gas capture rate, he said.

In the wake of this trend, WBI said last Thursday (June 29) that it plans to expand its Line Section 27 natural gas transportation system in the Bakken producing area in northwestern North Dakota. The $27-30 million expansion project will involve building nearly 13 miles of 24-inch diameter pipeline and associated facilities, increasing the line’s capacity to more than 600 MMcf/d.

“The targeted in-service date for the project is fall 2018, which is the same timeframe for completion as WBI Energy’s $55-60 million Valley Expansion project near Fargo, ND,” said a WBI spokesperson.

In North Dakota, there are two major interstate pipelines in addition to WBI: Alliance (1.6 Bcf/d) and Northern Border (2.4 Bcf/d), pipelines with delivery and receipt points in the state, including the Bakken Shale.

Alliance signaled earlier this year that it sees additional pipeline capacity being needed in North Dakota going forward. In response to what it considers high demand for service to the Chicago market hub, Alliance asked for nonbinding expressions of interest, noting that up to 500 MMcf/d could be added to the market. Alliance’s system is fully subscribed and “interruptible capacity is at a premium,” pipeline officials say.

“Alliance Pipeline is looking to potentially expand its current capacity, but I am not aware of expansion plans on Northern Border,” North Dakota Pipeline Authority Director Justin Kringstad toldNGI. “It is anticipated that as the state’s gas volumes increase, the North Dakota market share on Northern Border will continue to increase.

“In addition to WBI Energy’s system expansions, large investments in the state’s gas infrastructure have been made at the local level for gas processing and gathering,” Kringstad said.

WBI parent company CEO at MDU Resources, David Goodin called the Section 27 gas pipeline expansion a “good project right in our backyard” that responds to what he foresees as continued demand for reliable gas transportation in the Bakken. “This spring we added significant new compression to our system in the Bakken and surpassed 1 Bcf/d of subscribed firm capacity systemwide for the first time,” Goodin said.

“With these new projects in the Bakken, our natural gas transportation volumes continue to grow, and will be further enhanced by our Valley Expansion project in eastern North Dakota and western Minnesota. We remain optimistic about the growth opportunities at WBI Energy,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |