Infrastructure | NGI All News Access

North American Uptick Lifts 1Q for Schlumberger, BHGE, Halliburton and Weatherford

North American onshore drilling carried the “earnings growth torch” for Schlumberger Ltd. in the first quarter, even though softer pressure pumping pricing and activity caused less equipment to be reactivated than expected. Halliburton Co., Weatherford International plc and Baker Hughes, a GE Company, also reported tightening conditions, likely leading to better pricing in the months ahead.

Schlumberger, No. 1 oilfield services (OFS) operator kicked off 1Q2018 earnings season for the sector earlier this month in an upbeat call led by CEO Paal Kibsgaard. An unexpectedly slower quarter belies a strengthening market, he said.

First quarter results “largely reflected transitory factors,” with winter weather leading to reductions in the Northern Hemisphere and planned project startup costs weighing on equipment mobilization, reactivation and redeployment.

U.S. onshore pressure pumping, i.e. hydraulic fracturing services, was impacted by “weaker than expected activity as well as by softer pricing, inefficiency, rising supply chain costs and rail logistical challenges,” Kibsgaard told investors.

“In spite of this, we continued to deploy available fracturing assets, including equipment from our newly acquired capacity,” i.e., Weatherford International plc’s U.S. fracture business, acquired earlier this year with an estimated 1 million hydraulic hp.

“Onshore in North America, we experienced a slow start to the quarter due to freezing weather and as many shale oil operators took a conservative approach to ramping up activity after the holidays,” said Schlumberger Executive Vice President Patrick Schorn of New Ventures. “However, with oil prices stabilizing well above $60…drilling and pressure pumping activity started to ramp up in the second half of the quarter and showed healthy first quarter exit rates.”

The U.S. land hydraulic fracturing market should continue to improve during the second quarter, “both in terms of pricing and in operational efficiency and, therefore, we are continuing with our aggressive fleet reactivation and recommissioning program,” Kibsgaard said.

“In this market, we continue to be sold out to our differentiated directional and drillbit technologies as we again posted strong growth in the first quarter, and we still command a solid pricing premium…”

With more OFS operators adding horsepower capacity for onshore producers, the North American pressure pumping market should be nearly balanced in the short-term “from an equipment standpoint,” said the CEO.

“This means that fracture pricing will arguably be rangebound and driven by short-term or local supply demand variations and that any upwards pricing movement will likely be limited to passing on people and supply chain cost inflation.”

Schlumberger fracture fleet additions were less than expected in the first three months because market overcapacity led to lower utilization, inefficiencies and softer pricing, Schorn said. “These headwinds were compounded by inefficiencies and increased costs associated with rail, logistical issues impacting the supply of our sand in parts of our operations…”

What is clear to Schlumberger’s management team is that the global oil market has returned to balance, following the voluntary reductions in output by the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia.

However, underspending since late 2015 by exploration and production (E&P) companies could lead to worldwide oil supply shortages in the not-too-distant future. U.S. unconventional operators also face other challenges, said the CEO.

“At present, the collective spare capacity of the three core OPEC countries is only in the range of 3 million b/d,” he said. “There are also emerging questions around whether the very bullish production growth outlook for U.S. shale oil can be fully met as the industry is coming to face challenges linked to well-to-well interference as more infill drilling takes place, lower production per well as drilling increasingly steps out from Tier 1 acreage, as operators look to overcome growing infrastructure constraints, and as refineries approach current processing capacity for light oil.”

Based on global E&P capital investment plans and current worldwide oil stocks, “we believe it is increasingly likely that the industry will face growing supply challenges over the coming years, and a significant increase in global E&P investments will be required to minimize the impending production deficit,” he said.

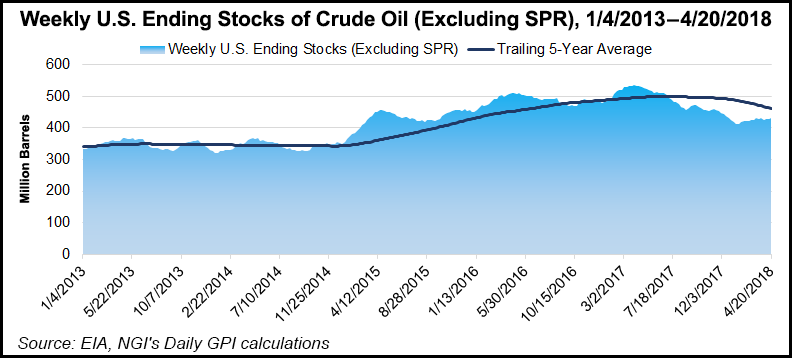

“The key indicator for this evolving trend continues to be global oil inventory levels and not U.S. inventories alone. Significant weekly swings in import and export levels often mask the actual evolution of the underlying U.S. supply and demand.”

Schlumberger’s net quarterly profits climbed to $525 million (38 cents/share) from year-ago earnings of $279 million (20 cents). Total revenue fell 4% sequentially but was higher from a year ago at $7.83 billion from $6.89 billion. North American revenue during 1Q2018 increased 52% year/year and climbed 1% sequentially to $2.835 billion, with land revenue up 4% sequentially.

BHGE Growth Tied to Unconventionals

Less than a year after General Electric Co. (GE) combined its oilfield business with Baker Hughes Inc., which created the No. 2 OFS by revenue, the venture appears to be paying dividends, while the backlog grows and costs decline.

In a conference call earlier this month that was led by CEO Lorenzo Simonelli said he sees more blue skies, not only for the OFS business but also a growing liquefied natural gas (LNG) market.

“We made strong progress in the quarter, securing several key commercial wins, executing on our synergy targets and delivering for our customers,” Simonelli said. “In the first quarter, we delivered $5.2 billion in orders and $5.4 billion in revenue. As expected, we saw growth in our shorter-cycle businesses and declines in our longer-cycle businesses versus the previous year.”

A lot of the expansion now and in the future is tied to U.S. unconventionals growth in oil and natural gas.

“In the oil market we see global demand rising at a steady pace, driven by an improved gross domestic product outlook for the United States and Europe,” the CEO told investors. “In Asia alone, strong economic growth is expected to add nearly 1 million b/d of demand in 2018.

“On the supply side, U.S. production grew to more than 10 million b/d, with first quarter average production up 7% versus the fourth quarter of 2017, driven mostly by shale.”

Like Kibsgaard, Simonelli gave a nod to OPEC and ally Russia, noting the draw on U.S. crude inventories “have pulled stocks closer to the five-year average. These factors have resulted in a market equilibrium, which we expect will keep crude prices relatively rangebound in 2018.”

Recent price stability “has resulted in a customer spend forecast that shows solid year/year growth for our short-cycle businesses, particularly in North America, where operators continue to grow rig count and well counts.”

Exploration and production customers are expected to increase their upstream capital expenditures (capex), with a caveat, he said.

“We continue to see them focused on capital discipline and limiting their capex spend to within their operating cash flows. We are seeing this both internationally and with the large independents in the United States.”

Meanwhile, BHGE is readying for a steady global energy shift to natural gas. BHGE expects LNG demand to more than double to 500 million metric tons/year (mmty) by 2030, “growing at a pace of 4-5% per year,” Simonelli said.

“We saw demand growth well above that projected pace in 2017,” as global LNG imports were up 11% from 2016. Import volumes were up again in the first quarter “with global imports up 9% versus the first quarter of 2017.”

Increasing LNG demand, coupled with the dearth of project final investment decisions (FID), “point to the LNG supply-demand balance tightening,” said the CEO. “Market data suggests that new LNG capacity is required in the early to mid next decade to meet demand, which should translate to project FIDs for which we are well-positioned.”

BHGE’s outlook for LNG “is becoming increasingly positive,” but “we did not see any project FIDs in the first quarter. We expect projects will begin to move as we progress through 2018.”

BHGE’s net income was $70 million (17 cents/share) in 1Q2018. Revenue totaled $5.4 billion. North America revenue totaled $1.094 billion in the quarter, flat sequentially, while international revenue fell 6% from the fourth quarter to $1.584 billion.

Halliburton Driven By ”Robust’ North America

Resilient activity in the U.S. land business between January and March helped power Halliburton to a 34% increase in revenues, and it broke a record for stages per spread in March, CEO Jeff Miller said during the company’s first quarter conference call.

Global revenue climbed to $5.7 billion, with adjusted operating income of $619 million, primarily driven by “robust” market conditions in North America.

“Today, all eyes are on North America as it continues to play a larger role as a global producer,” Miller told investors. “Activity in the U.S. remains resilient as our customers have a large portfolio of economically viable projects in today’s commodity price environment. We expect our customers to remain busy through the rest of 2018, creating significant demand for our Services.”

The steady rig count growth and “completions intensity is improving demand across all of our product service lines,” he said. “In addition, we believe the pressure pumping market is undersupplied today and will remain tight for the rest of 2018.”

Incremental horsepower is coming into the market, but the undersupply should persist, as wear and tear is degrading existing equipment with more fracturing (fracking) stages.

“I’ve been saying this for a bunch of quarters; degradation is real,” Miller said. “Roughly 50% of announced horsepower does not translate into new crews. I know this because we analyze the difference between horsepower additions announced and the related number of crews that are produced. This means that about half the newbuild equipment is being used to replace or add to crews already in the field.”

Degradation is driven by service intensity, which translates into equipment not lasting as long as intended and more maintenance costs.

“Maintenance costs are growing, and the costs are real,” said the CEO. “Today, we pump three to four times the sand volume through equipment compared to 2014. We’ve moved away from gel-based fracks to slick water fracks, increasing the abrasion on our equipment. At the same time, we increase the pumping rate, compounding the wear and tear on equipment.

“And with increased efficiency, we’ve improved utilization, achieving more pumping hours per day,” which also translates into more wear and tear.

U.S. activity today remains strong, but there is a squeeze across the supply chain. “The three most significant areas of supply chain tightness that we see are rail, trucking and labor,” Miller said.

For example, the first quarter was a tough one for sand delivery, as wintry weather delayed rail shipments to key operating areas, including the Permian Basin.

“I learned more about train logistics than I ever dreamed I would, proof that getting to the future first is not always fun,” Miller said. However, “this issue is temporary and is behind us.”

Another big bottleneck is in trucking, according to the CEO. “The issue today is not in tractors and trailers. It’s finding qualified drivers and dealing with congested infrastructure.”

The labor market also is tight. In some oil and gas basins where Halliburton operates, the unemployment rate is “just above 2%. That is tight. We have the advantage of being able to recruit nationally to find qualified field personnel. However, given the level of activity today, there will likely be wage inflation and additional pricing will be necessary for cost recovery.”

Halliburton’s income from continuing operations was $46 million (5 cents/share) for 1Q2018 versus a year-ago loss of $32 million (minus 4 cents). Adjusted income, excluding impairments and other charges, was $358 million (41 cents/share) compared with $34 million (4 cents) in 1Q2017. Operating income was $354 million, up from 1Q2017’s $203 million.

Weatherford Still Has Miles To Go

The No. 4 OFS, Weatherford, still has much work to do as it climbs out of a financial hole, but the revamp instituted last year has begun to take hold, CEO Mark McCollum said during a conference call to discuss the quarter.

He spent much of the webcast discussing the positives for the battered company, and attempted to provide as much transparency as he could to ensure investors believe the turnaround is working.

Weatherford is benefiting from an improving market environment, and it is well on its way to improving “accountability, efficiency and process discipline across the entire company.”

Pre-McCollum, Weatherford had been tarnished by some financial scandals and poor management, both of which the CEO promised to correct. But it’s not been easy, he admitted.

“The past three months have involved a lot of long hours and hard work as we finished the bottom-up planning stage of our transformation and moved into implementation,” McCollum told investors. “It has not been easy, and we still have a long way to go, but our transformation work is starting to make an impact on our bottom line as well as our processes and our culture.”

Weatherford is 10% toward its goal to reach $1 billion in run-rate profitability improvements by the end of 2019, he said.

“We expect these improvements to accelerate in the coming quarters as we continue to execute the nearly 1,600 transformation initiatives the organization is working on.”

Weatherford is working on “targeted pricing improvements, especially in areas where our prices have been well below market,” said McCollum. “Winning contracts that cost us more than we make are not really wins. Our focus now is on returns and profitability.”

Internal reviews also suggested the company was “leaving a lot of money on the table, so new procedures are being put in place to ensure we don’t do that going forward…The impact of these new processes and our more results-focused mindset will be evident in the coming quarters.”

For example, the company has 32,000 suppliers and only around 28,000 employees. “We have more than one supplier for every employee, and that doesn’t make sense,” said the CEO. “So we’ve already taken some early action to begin narrowing down our supplier list to the vendors who can offer us the most competitive deals, the kind of deals we should be getting given our position as a large multinational company. We weren’t really negotiating as a single large company before. Moving forward, we’re going to leverage that advantage.”

The ultimate goal is to improve productivity and cash flow, but “at its heart, this is a massive integration program,” he said. “Therefore, all the initiatives we’re working on are specifically and rigorously designed to standardize, simplify, where possible, systematized, but in all instances quantify our processes across the organization so that the achieved financial improvements are sustainable.”

Weatherford is zeroing in on where it has advantages, said McCollum.

“First, of course, is the strength of the U.S. unconventional market. Second, we have the confidence of our customers. U.S. operators recognize the strength of our portfolio and we’ve demonstrated to them the value of our integrated approach.

“So while leveraging our expertise in lift hardware, optimization software and fuel services, we can enhance decision making across the production lifecycle from initial lift selection, to lift transitions, to preventative maintenance.”

The strategies should create sustainable value regardless of market conditions, he said. Short-cycle investments are expected to drive the land market in 2018 and 2019. With that in mind, Weatherford is targeting opportunities in U.S. and Argentina unconventionals, as well as in Russia and the Middle East.

“Of course, the largest single market opportunity will continue to be in the United States, specifically in West Texas and Oklahoma,” McCollum said. “We expect a considerable amount of customer spend to be devoted to this area over the next few years…”

Weatherford’s net losses fell to $245 million (minus 25 cents/share) in the first quarter, which beat consensus, and led to a sharp turnaround from the year-ago net loss of $448 million (minus 45 cents). Revenue totaled $1.42 billion, down 4% sequentially but 3% higher year/year.

Operating losses came to $39 million, but excluding one-time charges, income was $40 million, which was 148% higher sequentially and a 145% improvement from 1Q2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |