NGI Archives | NGI All News Access

North American Unconventionals Shifting Global Energy Trade, Says IEA

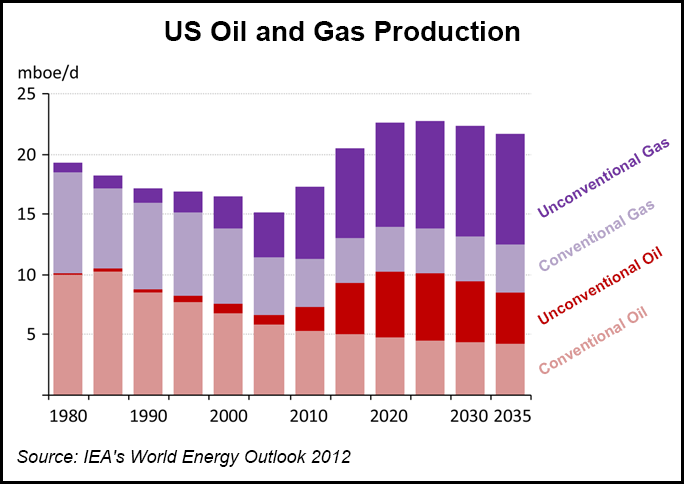

The United States will become the top producer of oil globally within five years, a net exporter of natural gas by 2020 and an oil exporter by close to 2030, all thanks to its massive unconventional resources, the International Energy Agency (IEA) said Monday in its annual flagship publication, the World Energy Outlook (WEO).

“North America is at the forefront of a sweeping transformation in oil and gas production that will affect all regions of the world, yet the potential also exists for a similarly transformative shift in global energy efficiency,” said IEA Executive Director Maria van der Hoeven.

“The global energy map is changing, with potentially far-reaching consequences for energy markets and trade,” the WEO report noted. “It is being redrawn by the resurgence in oil and gas production in the United States and could be further reshaped by a retreat from nuclear power in some countries, continued rapid growth in the use of wind and solar technologies and by the global spread of unconventional gas production.”

Ultimately recoverable resources, the measure of long-term fossil fuel production potential used in the WEO, “are considerably higher than proven reserves. As market conditions change and technology advances, some of these resources are set to move into the proven category, providing further reassurance that the resource base will not constrain production for many decades to come.

“In particular, large volumes of unconventional oil and gas are expected to be proven in many parts of the world, diversifying the geographical distribution of reserves. The costs of supply will undoubtedly be higher than in the past, as existing sources are depleted and companies are forced to turn to more difficult sources to replace lost capacity.”

Energy developments in the United States “are profound and their effect will be felt well beyond North America — and the energy sector,” noted IEA’s report. “The recent rebound in U.S. oil and gas production, driven by upstream technologies that are unlocking light tight oil and shale gas resources, is spurring economic activity — with less expensive gas and electricity prices giving industry a competitive edge — and steadily changing the role of North America in global energy trade.”

Close to 2020, the United States is projected to become the largest global oil producer (overtaking Saudi Arabia until the mid-2020s) and starts to see the impact of new fuel-efficiency measures in transport, according to IEA economists. “The result is a continued fall in U.S oil imports, to the extent that North America becomes a net oil exporter around 2030. This accelerates the switch in direction of international oil trade toward Asia, putting a focus on the security of the strategic routes that bring Middle East oil to Asian markets.”

The United States now imports about one-fifth of its total energy needs, but it is projected to become “all but self-sufficient in net terms — a dramatic reversal of the trend seen in most other energy-importing countries.”

The massive jump in domestic oil and natural gas production “will mean a sea-change in global energy flows.” In its new policies scenario, the WEO’s central scenario, the “United States becomes a net exporter of natural gas by 2020 and is almost self-sufficient in energy, in net terms, by 2035. North America emerges as a net oil exporter, accelerating the switch in direction of international oil trade, with almost 90% of Middle Eastern oil exports being drawn to Asia by 2035.”

Remaining technically recoverable resources of global conventional gas, including proven reserves, reserves growth and undiscovered resources, now is estimated at more than 460 Tcm, or 16,234 Tcf, an increase of around 60 Tcm (2,118 Tcf) from the 2011 WEO. For shale gas, remaining resources are estimated at 200 Tcm, or 7,062 Tcf, which includes the latest U.S. Energy Information Administration estimates of 81 Tcm (2,860 Tcf) for tight gas and 47 Tcm (1,659 Tcf) for coalbed methane (CBM) (see Shale Daily, June 27).

Oil production (net processing gains) rises from 84 million b/d in 2011 to 92 million b/d in 2020 and 97 million b/d in 2035. Crude oil production, which is the largest single component of oil production, is forecast to fall slightly between 2011 and 2035, with “sharp increases” in natural gas liquids output because of rising gas production and unconventional oil — mostly oilsands in Canada.

By 2015, U.S. oil production is forecast to increase to 10 million b/d then jump to 11.1 million b/d by 2020, overtaking frontrunner Saudi Arabia and second-place Russia, the WEO noted. The U.S. lead should last for a short while before Saudi Arabia ramps up oil output to 11.4 million b/d over the 2020-2030 decade, outpacing U.S. output. By 2035, U.S. oil production is expected to slip to 9.2 million b/d, lower than Saudi Arabia’s estimated 12.3 million b/d and behind Iraq, which is seen moving into second place. Russia would become the third largest oil exporter. By then real oil prices are forecast to reach $125/bbl, but the United States likely won’t be relying much on foreign energy, the IEA noted.

Overall, natural gas resources are expected to hit 790 Tcm [27,898 Tcf] by 2035, “or more than 230 years of production at current rates,” the WEO noted. Unconventional gas would account for “nearly half of the increase in global gas production to 2035.”

The prospects for unconventional production worldwide still are uncertain, IEA noted, and “depend, particularly, on whether governments and industry can develop and apply rules that effectively earn the industry a ‘social license to operate’ within each jurisdiction, so satisfying already clamorous public concerns about the related environmental and social impacts.”

Among the OECD regions, North American gas production is projected to continue to expand, thanks mainly to U.S. shale gas. Total domestic gas production grows from an estimated 650 Bcm (22.95 Tcf) in 2011 to 800 Bcm (28.25 Tcf) in 2035 in the WEO’s new policies scenario, putting the United States ahead of Russia as the largest gas producer in the world between 2015 and the end of the 2020s.

“Shale gas accounts for almost all of the increase in U.S. output, with conventional gas and coalbed methane output remaining close to current levels in 2035 and tight gas showing a gradual decline.” In Canada, gas production is projected to “climb gradually” through the WEO’s scenarios to 2035, reaching almost 190 Bcm (67.098 Tcf) by then, with higher shale gas and CBM offsetting a decline in conventional gas. Mexico’s gas output also is projected to increase to around 75 Bcm or 26.486 Tcf, with most of the increase coming in the second half of the projection period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |