Shale Daily | Markets | NGI All News Access

North American Unconventional Oil Proving Resilient, Says OPEC

North American shale and tight oil production should reach 7.5 million b/d in 2021, about 75% higher than in 2016, and peak after 2025, the Organization of the Petroleum Exporting Countries (OPEC) said Tuesday.

In the World Oil Outlook (WOO) to 2040, OPEC said it now expects North American unconventional oil output to reach 5.1 million b/d this year, which is nearly 25% higher than it had forecast in 2016. In last year’s report, OPEC projected U.S. tight oil operators would reduce output because of sustained low prices. However, the oil cartel said some of the productivity gains made in U.S. onshore may prove lasting.

OPEC’s output may be negatively impacted, but that won’t last forever, forecasters said. OPEC crude demand should remain unchanged until North American unconventional oil peaks after 2025.

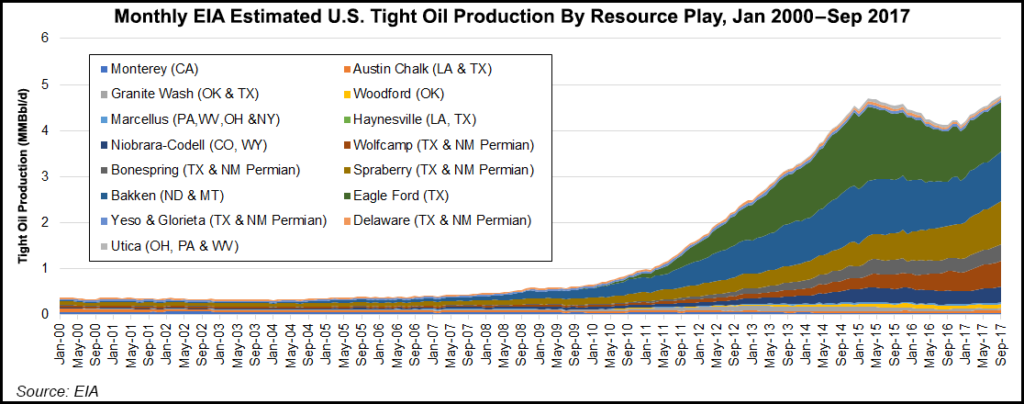

“U.S. tight oil is by far the most important contributor to non-OPEC supply, but it peaks after 2025,” the WOO said. U.S. unconventional oil “most strikingly” exceeds OPEC’s previous forecasts because of its “resilience and ability to bounce back. This growth is heavily front-loaded, as drillers seek out and aggressively produce barrels from sweet spots in the Permian and other basins.”

Oil supply growth beyond OPEC “is overwhelmingly driven by higher tight oil production, predominantly in the U.S. and to a lesser extent elsewhere,” said OPEC researchers. “As such, global tight oil grows 4.8 million b/d in the 2016–2022 period, mostly in the U.S., but the WOO also assumes some growth in Canada, Argentina and Russia — before peaking after 2025 and then declining modestly from around 2030.”

No tight oil volumes are expected from other countries outside of the United States, Canada, Argentina and Russia, OPEC noted.

OPEC and its allies, which include Russia, are scheduled to meet on Nov. 30 to determine whether to extend production curbs beyond March. Since the start of this year, OPEC and its allies have targeted reductions of about 1.8 million b/d to reduce global stockpiles. Saudi Crown Prince Mohammed bin Salman signaled in October that the kingdom was ready to support extending the agreement.

According to the latest WOO, shale/tight oil production should decline beginning around 2030. OPEC then would be required to increase output to 41.4 million b/d in 2040 from about 33 million b/d in 2025.

The WOO is in line with other forecasts, including by the International Energy Agency.

The OPEC report also briefly touched on the outlook for natural gas. Like other global forecasts, including by the U.S. Energy Information Administration and several Big Oil producers, gas is expected to increase more percentage-wise than oil to 2040.

“At the global level, the largest contribution to future energy demand is projected to come from natural gas,” the WOO said. “In absolute terms, demand for gas will increase by almost 34 million boe, reaching a level of 93 million boe/d by 2040. Its share in the global energy mix will increase by a significant 3.6 percentage points.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |