North American natural gas production bore the brunt of the Covid-19 pandemic’s impact on global gas output in 2020, but demand fared better in the lower price environment.

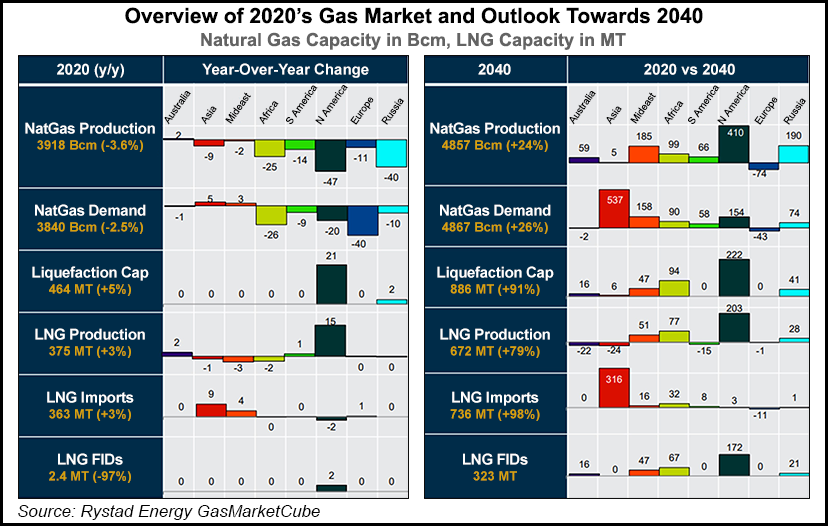

In its Gas Year 2020 review, Rystad Energy said North American gas production is estimated to have fallen 47 billion cubic meters (bcm) from 2019 levels to 1,103 bcm in 2020. Global gas output, meanwhile, is projected to have dropped 3.6% year/year in 2020, with total production at around 3,918 bcm for the year as low oil and gas prices led to lower exploration and production, according to the Oslo-based independent research firm.

Despite the widespread lockdowns that were implemented to slow the spread of the Covid-19 virus, Rystad said the low price environment shielded gas demand from a steeper decline...