NGI The Weekly Gas Market Report

E&P | NGI All News Access | Shale Daily

North America Likely Taking Biggest Hit from Pullback in Global Oil, Gas Drilling

The number of oil and natural gas wells likely to be drilled around the world this year is forecast to hit its lowest level since at least the early 2000s, with North America the most impacted from slumping demand in the age of Covid-19.

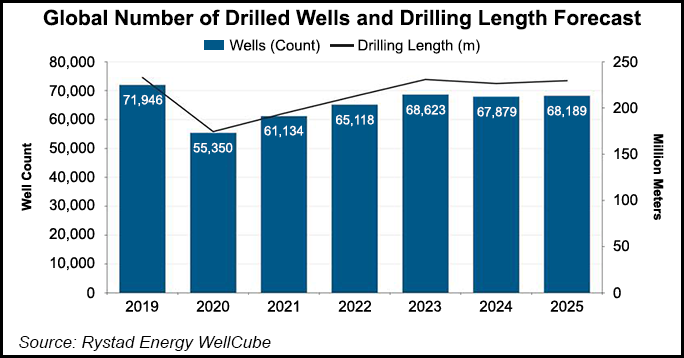

An analysis by Rystad Energy issued on Tuesday pegged the number of drilled wells globally this year to decline by 23% to 55,350 from 2019’s 71,946 wells.

The United States should remain the “hotspot” for onshore drilling tools, while Norway is expected to top offshore spending.

More than 80% of the U.S. onshore market spend on drilling tools is likely to be directed to the unconventional plays, with the Permian and Appalachian basins driving 60% of total spend. Some conventional activity in other U.S. basins also should draw spending this year.

“Our forecast, which extends to 2025, does not find it likely that last year’s number will be met or exceeded within the considered time frame,” the Rystad analysts said of global tool spending. “Drilled wells are expected to partly recover to just above 61,000 in 2021, as governments ease travel restrictions, boosting oil demand and prices. Then numbers will rise further to just above 65,000 in 2022 and remain just below 69,000 until the end of 2025.”

North America is seen as taking the biggest hit to drilling this year, with the rig count already at historic lows. A modest recovery is possible in the second half of this year, but drilling activity is likely to remain more than 50% below the levels seen at the same time last year.

Total oil production from the Anadarko, Appalachian and Permian basins, and the Bakken, Eagle Ford, Haynesville and Niobrara formations, is expected to decline to 7.49 million b/d in August from 7.55 million b/d in July, according to the Energy Information Administration’s latest Drilling Productivity Report issued Monday.

Total gas production from the Lower 48 plays is forecast to be 79.55 Bcf/d in August, compared with 80.27 Bcf/d in July, with only the Bakken forecast to see an uptick.

Most of this year’s global wells are planned for onshore regions, according to Rystad.

Of the 55,350 total wells expected, 2,238 are to be offshore and 53,112 onshore. Before Covid-19, Rystad had forecast that the well count would increase from 2019 to 74,575, with 2,896 drilled offshore and 71,679 onshore.

However, most exploration and production (E&P) companies have sharply reduced their activity for 2020 because of the pandemic and the pullback in demand.

“Both new wells and drilling lengths will be pared down as E&Ps scale down investments, affecting the entire supply chain associated with these services,” said Rystad’s Reza Hassan Kazmi, energy services analyst. “This includes drilling tools, which will decline by 35% in 2020 compared to 2019.”

Rystad defines drilling tools to include blowout preventers, downhole tools, drillbits, drill pipe, jars, drill collars and other equipment except for downhole pumps used for artificial lift.

Drilling length, another key driver for drill pipes, drill collars, heavyweight drill pipes and drillbits, is forecast to decline by 25% this year before improving in 2021. A decline in the number of wells may not result in a proportional reduction in total drilling lengths, as drilling depths per well may vary by region, Rystad noted.

Drilling tool purchases are forecast to decline to $10 billion from $16 billion in 2019. North America spend is likely to take the biggest hit, with spending in Africa down by 36%, and Russian spending off 27%.

“Overall, onshore markets are expected to recover as early as 2021 and grow at a rate of 7% annually toward 2025, while offshore markets will see some highs and lows and will maintain an overall flattish level towards 2025,” according to Rystad’s team.

Even with the overall stagnant growth, “Brazil, Australia and China will continue to offer exciting opportunities in the short term with 20-40% growth prospects for offshore drilling in these countries, while the UK, Guyana and Mexico look promising in the medium to long term.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |