Looming winter freezes could drive elevated demand for natural gas in parts of the northern United States, while festering drought conditions in the Southwest could fuel consumption when weather heats up next spring to offset lighter hydropower.

Elsewhere, demand could prove lighter than normal.

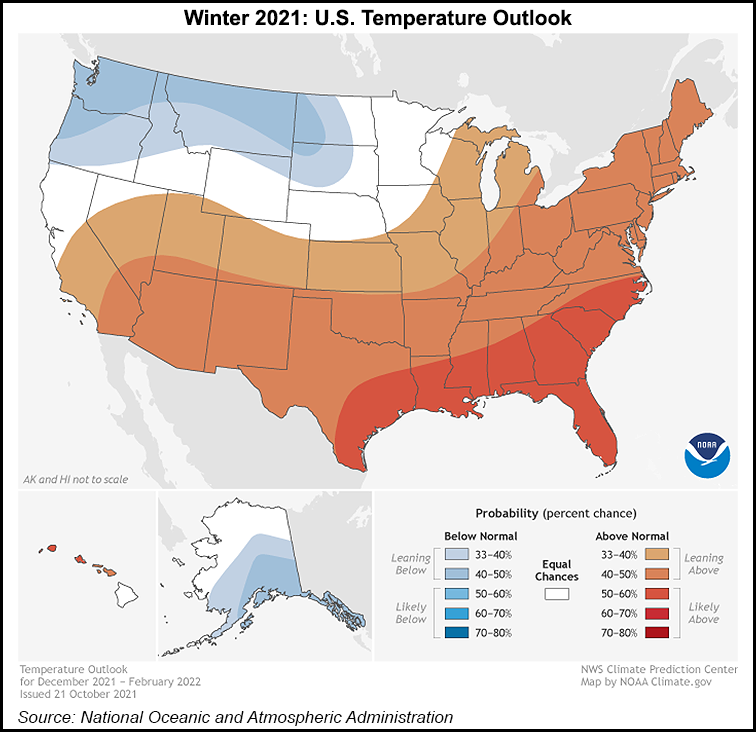

These were among the takeaways from the National Oceanic and Atmospheric Administration’s (NOAA) winter weather outlook, issued Thursday.

A swath of the Lower 48, from the Pacific Northwest into the Northern Plains, could experience a colder than usual winter, driving strong heating demand and supporting prices. NOAA’s outlook, which extends from December through February, also calls for wetter-than-average conditions across portions of the Pacific Northwest, northern Rockies,...