Infrastructure | LNG | Markets | Natural Gas Prices | NGI All News Access | Shale Daily

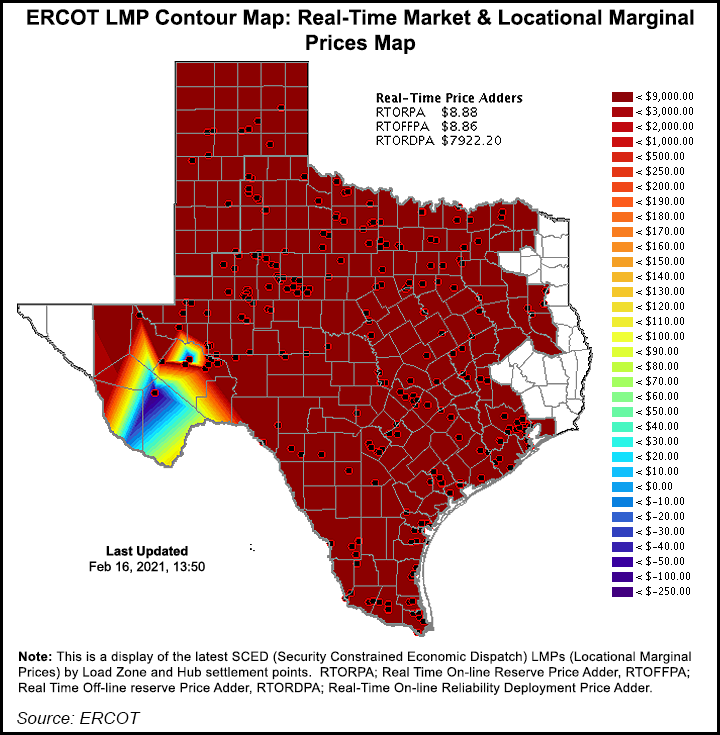

No Easy Answers as Texas Power Grid, Natural Gas Market Rocked by Unprecedented Cold Snap

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |