Infrastructure | NGI All News Access | Regulatory

NJ Ratepayer Advocate Still Questioning Need For PennEast

New Jersey’s ratepayer advocate continues to oppose the PennEast Pipeline LLC, repeating its position in a filing with FERC Monday that the project’s backers have not shown the additional capacity is needed to meet demand.

The New Jersey Division of Rate Counsel [NJDRC] first questioned the need for PennEast in a September filing with the Federal Energy Regulatory Commission [CP15-588].

PennEast responded the following month with a report from Concentric Energy Advisors that countered the NJDRC’s findings. According to that report, NJDRC’s position shows “a lack of understanding of how LDCs [local distribution companies] (and other shippers) contract for pipeline capacity for a myriad of reasons, and not solely to meet their demand requirements.”

But in Monday’s filing, NJDRC fired back that while it “does not dispute that these other factors may play a role in evaluating a proposed pipeline, they are ancillary to an even more basic demonstration: that the LDC customers of the pipeline in fact need the capacity in order to serve customers.”

NJDRC said its analysis of the factors at play — such as regional basis differentials and pipeline construction costs — does not show PennEast resulting in cost savings for ratepayers. The group also questioned whether it would result in added supply diversity or flexibility, arguing that “numerous outlets currently exist for gas produced from the Marcellus and Utica shales…Moreover, PennEast acknowledges that its LDC-affiliates that have executed precedent agreements already obtain substantial amounts of gas from the Marcellus and Utica shales.”

Citing regulatory filings from New Jersey utilities, NJDRC further questioned whether PennEast would be needed for projected load growth. LDC customers on PennEast “have experienced minimal load growth during the past years of very low gas prices” and “project very limited new load growth,” according to NJDRC.

Capacity on PennEast is nearly fully subscribed, which project backers have asserted in and of itself demonstrates market need for the project.

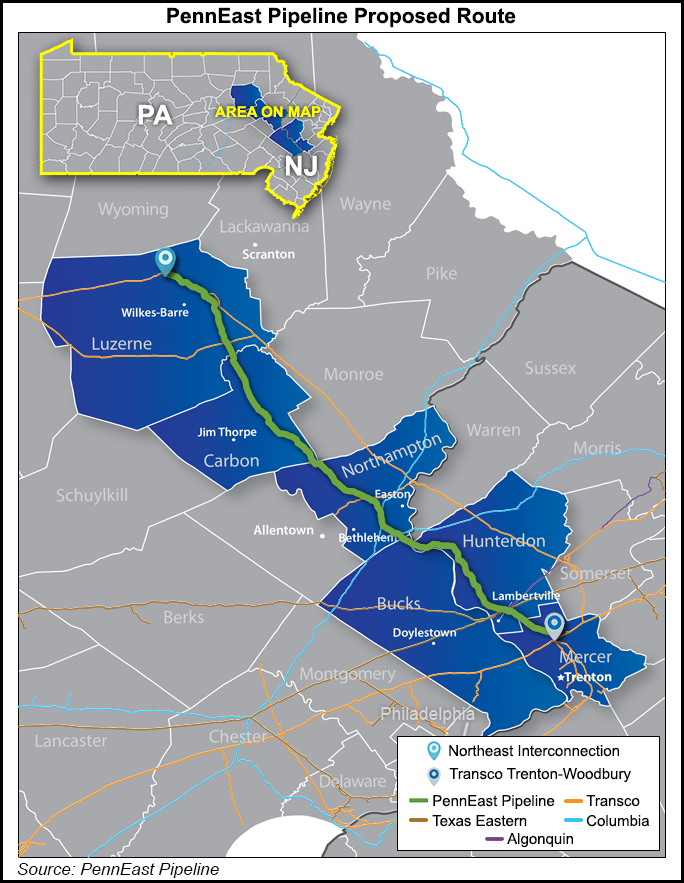

PennEast received a favorable draft environmental impact statement from FERC in July. The 114-mile, 36-inch diameter greenfield pipeline would transport 1.11 million Dth/d of Marcellus Shale gas to markets in Pennsylvania and New Jersey.

FERC recently pushed back the deadline for PennEast’s final environmental impact statement by two months.

PennEast is a joint venture backed by NJR Pipeline Co., Public Service Enterprise Group, SJI Midstream, Southern Company Gas, Spectra Energy Partners LP and UGI Energy Services.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |