Infrastructure | NGI All News Access

NGV Growth (or Lack of) Claims Debated

Contrary to recent business media reports and auto industry sales research, natural gas vehicle (NGV) growth, at least in the fleet trucking sector, is robust and not the lackluster picture that is being painted, according to officials with NGVAmerica, a Washington, DC-based trade association.

Their bullish claims of 20% growth in the NGV truck market come on the heels of a Wall street Journal report that natural gas-powered truck sales were “crawling” and a report from automotive research firm Edmunds.com noting that while sales of gasoline-powered new cars have soared this summer, sales of electric vehicles (EV) and other alternative, hybrid vehicles are sagging.

Ron Eickelman, NGVAmerica chairman and the president of Agility Fuel Systems, countered that demand remains strong for compressed natural gas (CNG) fuel systems that his company supplies for original equipment manufacturer (OEM) factory installations.

Calling it “extraordinary,” NGVAmerica President Rich Kolodziej said the market for heavy-duty NGV trucks is growing at an annual rate of about 20%. That growth, Kolodziej said, is taking place “in a market where change generally comes slowly and the vehicles have a long service life.”

Nevertheless, while reporting a “leveling off” in the sales of EVs and hybrids in recent research, a spokesperson for Edmunds.com said her firm didn’t look at the natural gas sector in its recent research.

IHS Research’s automotive unit, looks at overall NGV sales but doesn’t break out trucks and passenger cars, or fleets versus individually purchased vehicles.

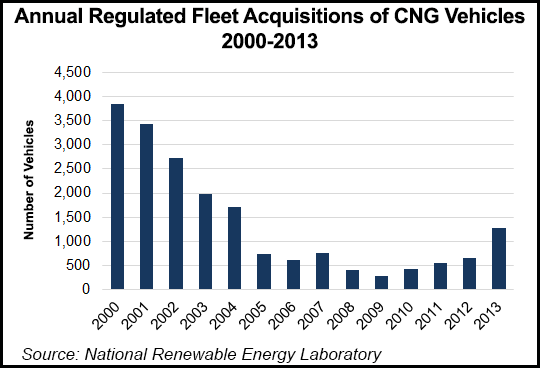

Critics in both the EV and NGV sectors are pointing to bullish projections for the number of vehicles that would be on the road by now, and in both sectors the current statistics are falling far short. For example, President Obama a few years ago projected one million EVs and hybrids on the road by 2015, while Edmunds.com data shows the total now is a little more than 500,000.

For natural gas, NGVAmerica acknowledged that the NGV trucks have not fulfilled some of “the more optimistic forecasts,” but this should not “detract from the real, solid expansion of natural gas trucking.”

NGVAmerica points to the refuse truck and transit bus sectors where considerable growth is taking place. In refuse, more than half of the trucks sold last year were NGVs, and that is projected to hit 60-65% this year. For public transit, up to 30% of the buses ordered are for NGVs. The association contends that the natural gas transportation sector in its entirety needs to be analyzed, including medium- and light-duty trucks, light-duty vans, SUVs and cars, and now heavy-duty off-road equipment, rail locomotives and marine vessels.

Underscoring the industry hype, on Thursday global truck leasing/renting giant Ryder Systems Inc. announced steps to help Anheuser-Busch convert its entire 66-vehicle Houston-based tractor-trailer fleet to run on CNG. This marks Anheuser-Busch’s first conversion of an entire fleet and represents a significant milestone in demonstrating the company’s commitment to reducing environmental impact in logistics, the beer maker said.

In the meantime, states and industry players also continue to attempt to pump up the use of NGVs through government incentives and industry technology advances. Pennsylvania and North Carolina took separate actions on the incentive front in recent days.

A third, and “likely final” round of state NGV grants was announced by Pennsylvania Gov. Tom Corbett and the state’s Department of Environmental Protection, offering another $6 million to help pay for incremental purchase and conversion costs among heavy-duty NGV fleet operators.

In fiscal 2014-2015, projects are limited to no more than half of the incremental purchase or retrofit costs per vehicle, and a maximum of $25,000/vehicle.

In North Carolina, the state’s Clean Technology Center issued a final request for proposals for more than $1.3 million in transportation technology-related emission-reduction projects. Grants will cover up to 80% of a given projects costs as part of the state’s $6.2 million, three-year Clean Fuel Advanced Technology program.

Previously approved proposals sent more than $3 million to 30 public and private organizations for NGV trucks and fueling equipment, similar propane applications, biodiesel and EV projects.

“In order to be eligible [for funding], a project must show reduced transportation-related emissions within 24 eligible North Carolina counties,” a state spokesperson told Fleet & Fuels newsletter.

On the technology front, British Columbia, Canada-based Thermex Engineered Systems has developed a flameless CNG circulation heater for overnight warming of the high-pressure regulator and engine block in NGVs. And separately, Quantum Technologies reported it is filling $700,000 in orders for its rail-mounted and back-of-cab CNG storage modules for heavy-duty trucks.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |