E&P | NGI All News Access | NGI The Weekly Gas Market Report

NGP-Backed Bravo Buys Arkoma Reserves, Wells

Tulsa-based private Bravo Natural Resources LLC is spending $250 million to buy a batch of natural gas-heavy Arkoma Basin reserves and operating wells in southeastern Oklahoma.

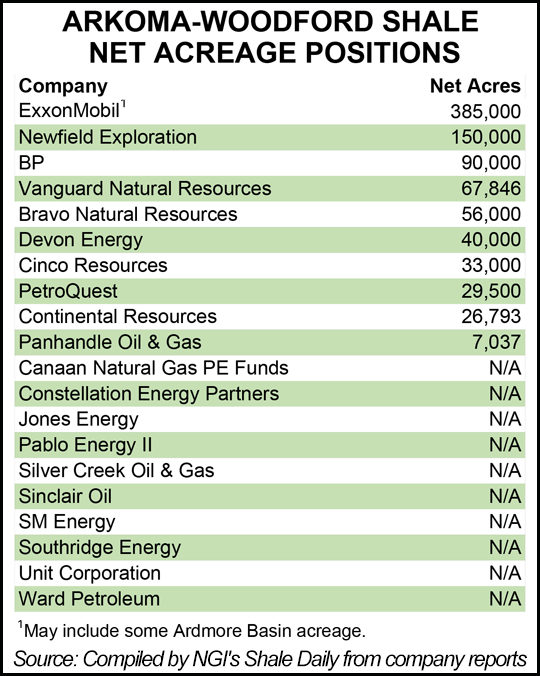

The transaction with Oklahoma City’s Canaan Natural Gas PE Funds includes 56,000 net acres prospective for horizontal, liquids-rich Woodford Shale development.

Bravo is securing through the deal 950 operated and nonoperated wells that producing primarily from the Hartshorne Coal and Woodford formations. Net proved reserves total 286 Bcfe, with output currently 33 MMcfe/d net, weighted to natural gas and liquids.

CEO Charlie Stephenson called the purchase “an excellent set of assets…that include long-lived natural gas producing assets” with “potential development in the liquids-rich horizontal Woodford formation in the Arkoma Basin of Oklahoma.”

Bravo was formed last December with a private equity (PE) commitment of more than $200 million from Natural Gas Partners (NGP) through its fund NGP Natural Resources X LP. Bravo is focused on the North American onshore, where the management team has expertise.

Stephenson has a long history in managing NGP-backed enterprises. He also runs Angus Natural Resources LLC, funded by the PE, and previously was CEO of NGP’s Bravo Natural Gas LLC.

Prior, Stephenson was operations manager for Unit Petroleum Corp. and at one time was the drilling manager of Samson Resources, the exploration unit of Samson Investment Co., which was bought out by PE companies that included NGP in 2011 (see Shale Daily, Nov. 28, 2011). Samson also was headquartered in Tulsa.

COO Robert Schaffitzel spent 15 years with Samson Resources before coming aboard at Bravo. CFO Trent Richey was treasurer for SandRidge Energy Co. from 2007 to 2013, when he joined Bravo.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |