Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Nexus Start-Up Delayed to 2018, DTE Confirms

The Nexus Gas Transmission pipeline, originally planned for service in late 2017, won’t start up until sometime in 2018 due to the ongoing wait for a certificate decision from the currently quorumless FERC, executives for backer DTE Energy Co. said Wednesday.

During a conference call to discuss the Detroit-based utility’s 2Q2017 results, CEO Gerard Anderson acknowledged that developers have been forced to revise the schedule for the 255-mile, 1.5 Bcf/d greenfield natural gas pipeline as the project application languishes in the Federal Energy Regulatory Commission’s mounting backlog.

“The FERC quorum has not yet been restored, and as I said on the first quarter call, we expected a year-end 2017 in-service date if we received the FERC certificate by the end of the second quarter or sometime within reach of mid-year,” Anderson said. “We also said that if the FERC certificate wasn’t received within that timeframe, then the project might get pushed back to 2018. Well, that’s where we are now, with the in-service date in 2018.

“…But even though the process is taking longer than we’d like, we’re still feeling very good about the project itself. We continue to make progress on the pipeline in the interim. We have all the materials and equipment, nearly all of the right-of-way easements, we’re in the final stages of obtaining the necessary permits and our construction contracts are in place,” he continued. “To put it plainly, we’re completing the steps that are in our control, and once we receive the FERC certificate, we will go immediately to work, and we will, at that time, provide a more precise projected in-service date.”

COO Jerry Norcia said a project as large as Nexus will require about seven to 10 months to complete.

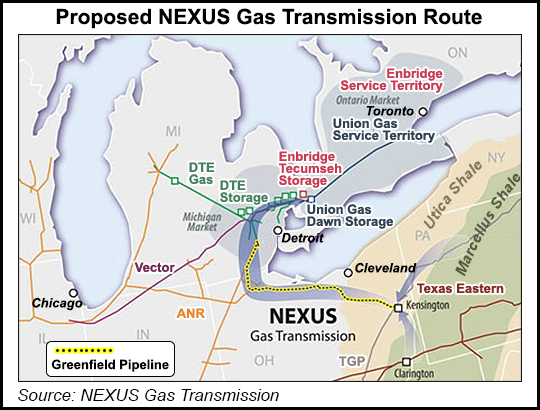

Nexus, a joint venture between DTE and Enbridge Inc. subsidiary Spectra Energy Partners LP, would run from eastern Ohio into Michigan and is designed to transport additional volumes of Marcellus and Utica shale gas to markets in the Midwest and Canada. Management said during Wednesday’s call that the project remains roughly two-thirds subscribed under firm commitments.

Nexus follows a similar route to the 3.25 Bcf/d Rover Pipeline, which is roughly 95% subscribed. But while Rover and several other high-profile natural gas projects received FERC’s blessing prior to the Commission losing its quorum in February, Nexus got left behind despite being ripe for a decision.

The project has faced pushback in Michigan, where regulators have scrutinized the ratepayer-backed Nexus commitments proposed by DTE subsidiaries operating in the state. ANR Pipeline Co. also weighed in during proceedings, arguing that DTE didn’t adequately consider alternatives — including Rover — before committing to Nexus.

Anderson said the success of the Millennium Pipeline (26%-owned by DTE) and DTE’s Bluestone Gathering system “gives me confidence that we will see similar results” from projects like Nexus.

Nexus should attract more firm commitments once it receives a certificate from FERC, Norcia said.

“We’ve got significant interconnectivity along the Nexus pipeline that I think will yield more firm contracts. In terms of timing, a lot of the conversations are revolving around providing those potential shippers certainty as to when the pipeline will go into service,” Norcia said. “I think the moment that we get our FERC certificate and start construction, we’ll start to move to close on some of those firm service agreements.”

He added, “Our current commitments are underpinned 50% by” local distribution companies (LDCs), “so it’s a demand pool, and our LDCs are actively in the region looking to secure supply. We have not had any issues in that regard. The other half of our commitment is from producers.” Based on conversations with producers, “they are prepared when we go into service to fill the pipe.”

Norcia said the producer activity in the Appalachian Basin has been encouraging as DTE looks at expanding its Link Lateral and Gathering system in northern West Virginia and southwestern Pennsylvania.

“We’re seeing the producers drill and fill our capacity positions, and we are in a number of conversations that could lead to an expansion,” he said. “But we haven’t secured any of those at this point. But we’re feeling very good about the volumes and the drilling ramp that we’re seeing, the reserves that these producers are drilling into. It’s certainly proceeding well in line with plans…we’re feeling very encouraged by the pace of drilling, the level of activity in the area and the growth we’re seeing on the pipe.”

Asked about the competing Rover project’s ongoing construction woes, Anderson and Norcia said they don’t foresee Nexus running into the same problems.

“We’re very aware of the technical issues that Rover is experiencing. I will tell you that Enbridge/Spectra and ourselves have been involved in many pipeline projects and have a tremendous amount of experience in building pipelines, and we feel that we’ll proceed in a way that’s environmentally responsible and follow best practices in the industry,” Norcia said. “We have not in our past experienced these types of problems, and we don’t expect to experience any of them on this pipeline either.”

Added Anderson, “Look, we built a lot of pipes in the past, and we plan to do it the right way. We plan to do it in an environmentally responsible, well-planned way.”

DTE reported $2.86 billion in revenues for the quarter, up from $2.26 billion in the year-ago quarter.

The utility reported a quarterly net income of $177 million (99 cents/share), compared with a net income of $152 million (84 cents/share) in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |