Story of the day

EQT Plans MVP Expansion to Serve Data Center Boom in Southeast

Markets

Natural Gas Futures Retreat as Freeport Hiccup, Expected Bearish Storage Print Spook Traders

More operational wobbles at the Freeport LNG terminal and worries of an expected bearish government storage print Thursday triggered another bout of selling in natural gas futures Wednesday. At A Glance: Freeport LNG Train 3 trips EQT sees curtailments through May Analysts expect above-average build The May Nymex contract dove around 10.0 cents in the…

April 24, 2024Infrastructure

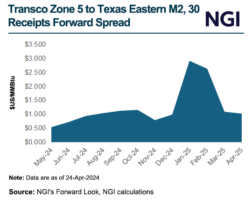

Gulf Coast LNG Construction Milestones Mount, Foreshadowing Growing U.S. Natural Gas Demand

The outlook for added feed gas demand in the coming months is beginning to firm, portending a possible tight supply balance next year. Earlier in the week, Cheniere Energy Inc. asked FERC for permission to connect the first train of its Stage 3 expansion at Corpus Christi to power and gave an update of its…

April 24, 2024Energy Transition

Mexico’s Sheinbaum Promises Energy Continuity Amid Sector Challenges

With only weeks remaining until Mexico’s June 2 presidential election, members of the energy industry are weighing in on what the sector might look like during an administration led by Claudia Sheinbaum of the Morena coalition, who has a commanding lead in national polls. On the campaign trail, Sheinbaum has explained that she would continue…

April 24, 2024Markets

Natural Gas Futures Flop as Market Eyes LNG Weakness — MidDay Market Snapshot

Amid signs of ongoing issues at a major U.S. LNG export terminal, and with physical market prices pointing to weak near-term fundamentals, natural gas futures were headed for heavy losses as of midday trading Wednesday. Here’s the latest: May Nymex futures down 13.2 cents to $1.680/MMBtu as of 2:11 p.m. ET Day-ahead Henry Hub prices…

April 24, 2024Trending News

Infrastructure