Newfield’s Anadarko Volumes Hit High End of 4Q Guidance

Newfield Exploration Co. expects total U.S. onshore output for the fourth quarter to hit 185,000-200,000 boe/d net, the high end of its forecast, boosted by gains in the Anadarko Basin.

The independent, headquartered in The Woodlands north of Houston, issued the guidance in a Securities and Exchange Commission Form 8-K filing, done in conjunction with a planned appearance at the Goldman Sachs Energy Conference.

The guidance precedes Newfield’s takeover by Encana Corp., which clinched a deal last fall to buy the company in a stock trade at the time worth an estimated $5.5 billion, as well as assume $2.2 billion net debt.

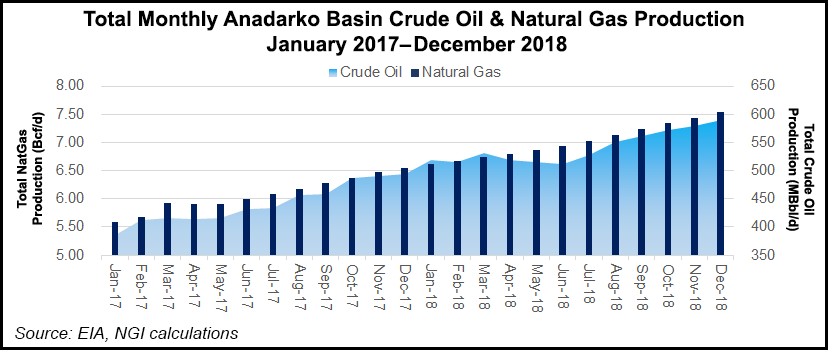

Newfield has an estimated 360,000 net acres in two deep regions of the Anadarko better known by their acronyms, the STACK and SCOOP, i.e. the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, and the South Central Oklahoma Oil Province.

In the SEC filing, Newfield said Anadarko liquids production between October and December totaled 80,000-86,000 b/d, with net oil output above the midpoint of guidance at 42,000-44,000 b/d.

Proved reserves across the company at the end of 2018, 99% weighted to the U.S. onshore, are expected to be 15% higher year/year, up around 100 million boe to more than 780 million boe.

The largest source of expected reserve additions came from the Anadarko Basin, management said. Estimated reserves in Oklahoma grew by an estimated 118 million boe from 2017 and total more than 545 million boe, or around 75% of total reserves.

International oil liftings during the fourth quarter were estimated at 237,000 boe/d net, also at the high end of guidance.

Newfield expects to have replaced 240% of its 2018 full-year production volumes with the anticipated addition of the proved reserves, which have a life index of around 11 years.

The producer said it invested $1.4 billion last year, in line with guidance, excluding $115 million of capitalized interest and internal costs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |