NGI Archives | NGI All News Access

New RFF Maps Detail States’ Shale Gas Regulations

Resources for the Future (RFF) has released an update of its ongoing project to compare regulations in 31 states with current or near-future shale gas development. The latest series of maps shows more than 27 different elements of regulation nationwide.

The most recent version attempts “to distinguish between those states that regulate an activity via the permit process and those that don’t regulate at all,” RFF said, a distinction that was lacking in its previous studies.

The maps detail items ranging from how many feet a well must be from a structure or from a water source, to requirements for casing, and flowback wastewater storage and disposal, including pit liners and wastewater injection wells.

For instance, West Virginia requires wells to be situated no closer than 625 feet from a building, while Louisiana, North Dakota and Pennsylvania set the minimum distance at 500 feet. New York, which currently is studying a rewrite of its rules, has the lowest distance of 100 feet. A number of states set the minimum distance from well to building at 200 feet and the overall average of states with shale in play is 261 feet. Maryland has set the distance at 1,000 feet.

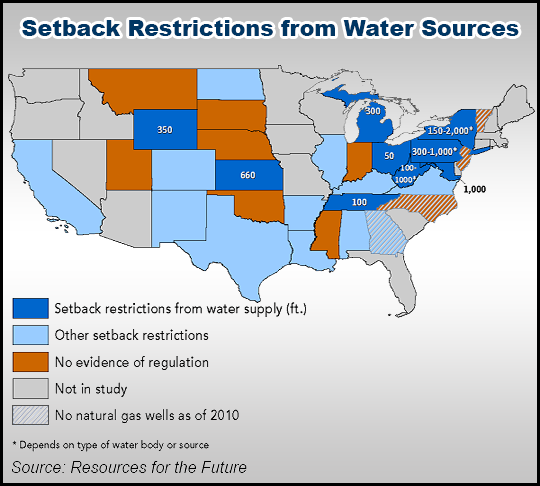

The maps also show comparative information on setbacks from water resources and restrictions on water withdrawals.

Almost one-third of states surveyed (nine) have setback restrictions from some body of water or water supply source. Six of those nine have setback restrictions from municipal water supplies (measured from the well) ranging from 350 to 2,000 feet, with an average of 885 feet.

RFF said the nine states with setback restrictions from water supply are Wyoming (350 ft.), Kansas (660 ft.), Tennessee (100 ft.), West Virginia (100-1,000 ft.), Ohio (50 ft.), Michigan (300 ft.), Maryland (1,000 ft.), Pennsylvania (300-1,000 ft.) and New York (150-2,000 ft.).

“Michigan also has setback restrictions from municipal water sources that are measured from other pieces of equipment such as well separators and storage tanks, but not from the well, and vary depending on the type of water supply,” RFF said. “Kansas, New York, Pennsylvania and Ohio have additional setback restrictions from other water sources such as lakes, streams, and private water wells. New Mexico and Arkansas measure setback restrictions from pits and tanks, respectively, but not from wells.”

The RFF maps also make state-by-state comparisons on rules for well plugging and abandonment, and well inspection and enforcement, from accident reporting requirements to the number of state agencies regulating shale to the number of wells per inspector. In only eight states, including Ohio, North Dakota and California, do inspectors have to monitor fewer than 140 wells each. Inspectors in Pennsylvania, Michigan, Alabama and Arkansas have to monitor between 141 and 360 wells each. In Texas, Oklahoma, Kansas, Missouri, Wyoming, Virginia and Alabama there are between 501 and 1,630 wells that each inspector must monitor. Data was not available for some states, RFF said, ading that many states are proposing to hire more inspectors. The figures are estimates only because the number of wells RFF used came from 2010 records, while the survey of number of inspectors is more recent.

The maps examine severance tax calculation methods and compare the states in terms of percentage and cents/Mcf. Montana collects the highest amount at 22.14 cents/Mcf, while severance taxes for veteran production states Louisiana, Oklahoma and Texas, run 16-18 cents/Mcf. Illinois and California have the lowest severance taxes at right around one cent/Mcf (see Shale Daily, Aug. 9).

Resources for the Future said the current set of maps is a draft and the final report will be released later this fall. Meanwhile, “shale gas regulation is very complex, and the amount of research needed to create these maps is very large. We’re confident that the maps give an accurate picture of the state of American shale gas regulation. But we also know that they do not capture every detail and that there are likely to be errors.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |