Regulatory | Infrastructure | NGI All News Access

New Jersey Rate Counsel Wrong About PennEast, Pipeline Tells FERC

The backers of the proposed PennEast Pipeline filed comments Monday at FERC refuting claims by the New Jersey Division of Rate Counsel (NJDRC) that the pipeline is not needed and would be an unfair burden on utility ratepayers.

PennEast Pipeline LLC hired Concentric Energy Advisors to address the comments. Its 22-page report said, “…the NJDRC comments demonstrate a lack of understanding of how LDCs [local distribution companies] (and other shippers) contract for pipeline capacity for a myriad of reasons, and not solely to meet their demand requirements.

“Clearly, the price of transportation capacity and the delivered cost of natural gas to a shipper are important considerations, as well as numerous non-price factors such as reliability, diversity and flexibility, which are attributes sought by state regulatory commissions. The numerous benefits that pipeline capacity options can provide have been widely recognized. These are substantial and important benefits that are relevant in a public interest determination.”

NJDRC had told the Federal Energy Regulatory Commission that the pipeline’s proposed return on equity (ROE) is excessive [CP15-558] (see Daily GPI, Sept. 16), but Concentric said the ratepayer advocate got its analysis wrong.

“As a threshold matter, PennEast’s existing shippers will not pay the recourse rate as assumed by the NJDRC comments, but rather all have elected to pay a negotiated rate,” Concentric said. “Thus, there is no basis to NJDRC’s claim that New Jersey LDCs will pay the proposed 14% ROE reflected in the recourse rate. Moreover, the NJDRC comments focus on the authorized returns of New Jersey and other LDCs, as well as other projects that are not greenfield pipeline projects, in evaluating the proposed ROE…

“The Commission has historically not relied on LDCs as a risk-comparable proxy group for existing or greenfield pipeline projects. Thus, the examples offered by the NJDRC comments are not relevant to establishing the cost of equity for a greenfield pipeline project. Moreover, there is significant precedent of the Commission approving the ROE proposed by PennEast for other greenfield natural gas projects, including those in the same region.”

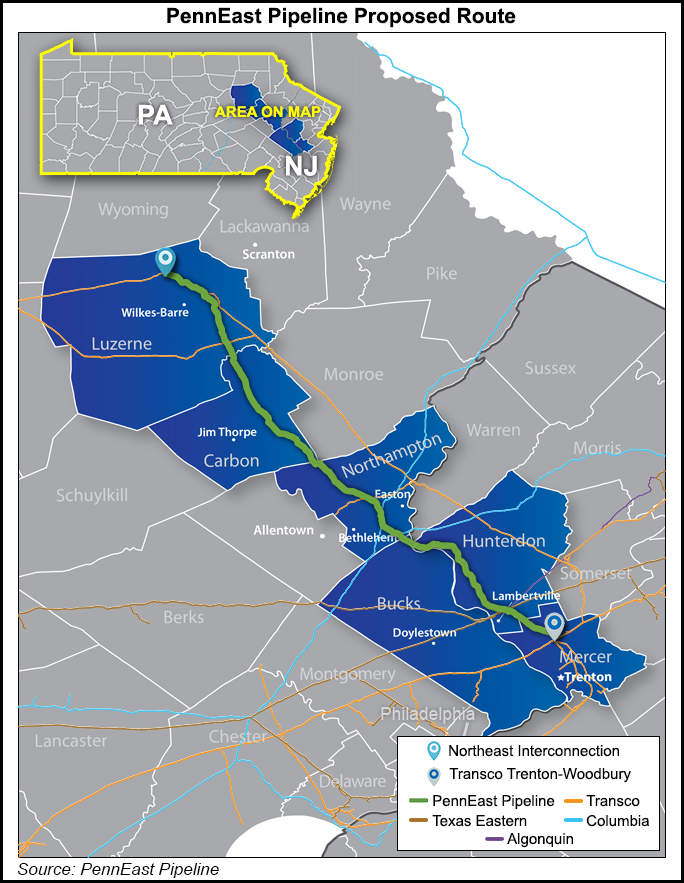

The 114-mile, 36-inch diameter greenfield PennEast would transport 1.11 million Dth/d of eastern Marcellus Shale gas to markets in Pennsylvania and New Jersey. New Jersey Natural Gas Co. is the largest taker of capacity with 180,000 Dth/d. PSEG Power LLC and Texas Eastern Transmission each have 125,000 Dth/d. South Jersey Gas. Co. has 105,000 Dth/d, and Consolidated Edison Company of New York Inc., Elizabethtown Gas, and UGI Energy Services LLC each have 100,000 Dth/d.

PennEast is a joint venture owned by AGL Resources Inc. unit Red Oak Enterprise Holdings Inc. (20%); New Jersey Resources’ NJR Pipeline Co. (20%); South Jersey Industries’ SJI Midstream LLC (20%); UGI Energy Services LLC’s UGI PennEast LLC (20%); PSEG Power LLC (10%); and Spectra Energy Partners LP (10%). The partnership is managed by UGI Energy Services.

The pipeline has also been opposed by environmentalists (see Shale Daily, Sept. 26).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |