New Fortress Energy Inc. (NFE) said Monday it has signed an agreement to supply natural gas to two power plants owned by Mexican state power utility Comisión Federal de Electricidad (CFE) in Mexico’s difficult-to-reach Baja California Sur (BCS) state.

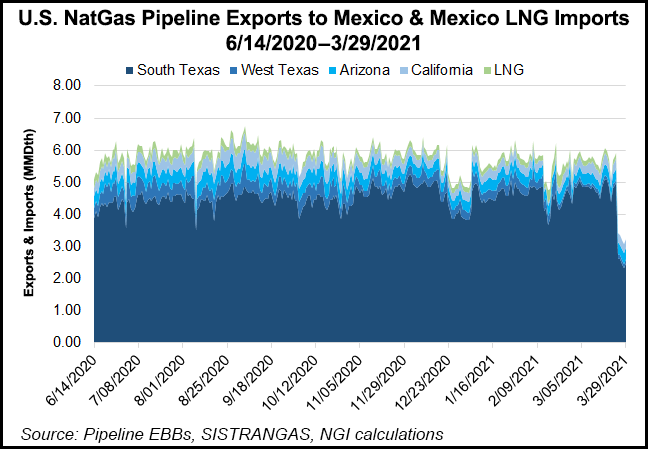

NFE will supply the equivalent of about 250,000-500,000 gallons (20,000-40,000 MMBtu)/d of liquefied natural gas (LNG) imported via NFE’s receiving and regasification terminal under construction in the port of Pichilingue.

The terminal is expected to be complete and begin supplying gas to CFE in May, said NFE.

The gas will be consumed by CFE’s CTG La Paz and CTG Baja California Sur open-cycle plants, which can be configured to run on diesel fuel or natural gas.

NFE CEO Wes Edens said the supply agreement will...