E&P | NGI All News Access | NGI The Weekly Gas Market Report

Never Too Early to Prep For Restructuring Deals, Lawyer Says

With recent strengthening of oil prices, the outlook for the next wave of exploration and production company restructurings has improved somewhat, an attorney in the Baker Botts LLP financial restructuring practice told NGI’s Shale Daily. If the improvement sticks, it will be none too soon for many. For now, though, a painful reckoning continues.

“…[A] lot of people held out last year hoping the market would come back quicker than it has at this point in time. And so the onslaught [of bankruptcies/restructurings] you’re seeing this year is the result of a couple of things,” said Baker Botts Partner Manny Grillo.

“…[H]edges have burned off, adversely affecting cash flows. People have started to try to sell assets now…You see more asset dispositions right now than I think people were hoping for or had expected. M&A volume is up. I think people thought it would start last year, but nothing really happened last year. More is going on this year.”

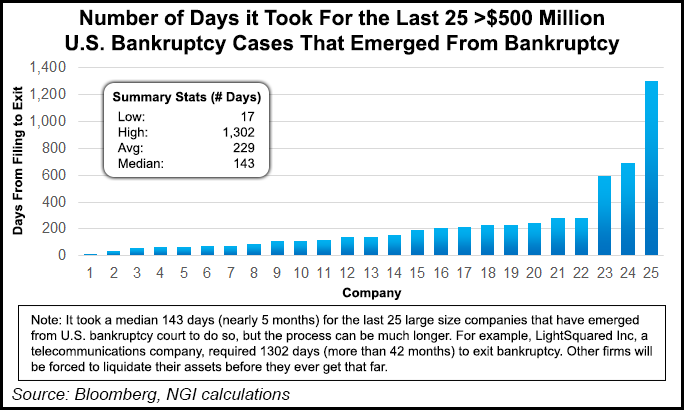

It’s never too early to begin preparations for a restructuring. The “lead-in work” for a prepackaged bankruptcy takes months to put together. “It takes more time than people think,” Grillo said. “Everyone says, ‘well, a ‘prepack,’ I’ll be in and out of bankruptcy in a month or 45 days or even 60 days.’…You can never really start early enough, even if you’re not in a position where cash flow would be an issue today.”

Debt maturities even as far out as 2018-2019 are a problem as refinancing opportunities, at least for now, have dried up. “The question is how do you spend your time between now and then,” Grillo said. “Are you making interest payments and just hoping that you’re not sucking too much wind? Or do you get out in front of it and try and deal with it, at least to sort of alleviate the burden on your capital structure?”

A prepackaged bankruptcy, negotiated in advance with lenders, can be an “extremely desirable” way to go. Such an arrangement usually doesn’t delve into a company’s operational issues but sticks with addressing institutional debt overhang, converting debt to equity. “If you start early, too, the hope is that you’ll be able to save a piece in the form of primary equity or warrants for your existing equities so that they have a chance to participate,” Grillo said. Bondholders and noteholders, being sophisticated as they are, understand that that’s sort of the price of getting a deal done before it becomes a crisis.”

Prepackaged deals don’t always work, as was seen last year when oil prices failed to live up to assumptions and adequately support company valuations. “The deals that failed in 2015 were because prices continued to decline; valuations got lower, and therefore the amount of equity that you could distribute to your creditors decreased, meaning that more people were out of the money,” Grillo said

An example is the continuing bankruptcy process of Samson Resources Corp. Tulsa-based Samson filed for Chapter 11 bankruptcy last September and said a restructuring would provide “a significant deleveraging” as well as $450 million of new capital (see Shale Daily, Sept. 17, 2015). However, the bankruptcy is still ongoing; Samson filed an amended plan last month, citing a decline in natural gas prices.

Grillo said the Samson bankruptcy, among others, had anticipated oil prices being above $60/bbl “and natural gas kind of following along.

“…And the bottom line is that when prices precipitously declined lower than that at the beginning of this year and even toward the third or fourth quarter of last year, those deals kind of fell apart, resulting in the liquidation of Endeavor [International Corp. (see Shale Daily, Oct. 13, 2014)] and sort of the continuing morass that is the Samson bankruptcy.”

Some confidence has returned to the market in terms of company valuations, Grillo said. “Everyone is feeling…better about the prospects of doing a restructuring now with what is hopefully a more stable floor at a higher number than had been in the first quarter of this year.

“When people were negotiating deals last year the assumption was that prices would remain above $60-65. So I think if you get to the $65 range again…I think that you’ll see more companies able to survive. To the extent that it stays below $60-65…I think $65 seems to be the number where you can get more people to survive given the circumstances.”

Something that’s a bit different about this bust cycle compared to those of years past is the character of the upstream assets involved. With the ascendance of the shale plays, producers usually know where the oil/natural gas resources are; the challenge is to produce them economically. Without having to hunt for the oil/gas, spending can turn the tap back on more quickly. This has positive and negative implications in the current environment, Grillo said.

“…[I]f you’re deciding to spend and drill and take it out of the ground, you know it’s going to be there,” he said. “The flip side is there is still somewhat of a glut and oversupply and so people have scaled back their capital spending and expect to continue to scale back their capital spending into 2017. They know what’s there. They know they can pull it out…[T]he certainty is a good thing. The problem with the certainty is that there still is an oversupply in the marketplace. It’s starting to diminish but it’s still there.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |