Net-Zero Oil? Oxy, SK Trading Clinch First Contract for Permian DAC Supplies

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

Markets

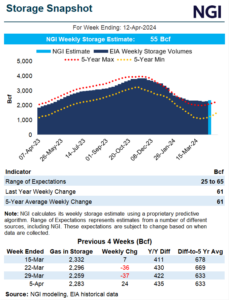

Lighter shoulder season demand and soft export data overshadowed bullish production estimates and weighed down natural gas futures to kick off trading this week. At A Glance: Weak near-term demand Production remains softer NGI models 55 Bcf injection The May Nymex gas futures contract on Monday settled at $1.691/MMBtu, down 7.9 cents day/day. Cash prices…

April 15, 2024Infrastructure

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.