Infrastructure | Markets | NGI All News Access | NGI The Weekly Gas Market Report

NERC Concurs with FERC, Says Texas, California Facing Power Gen Shortages During Summer

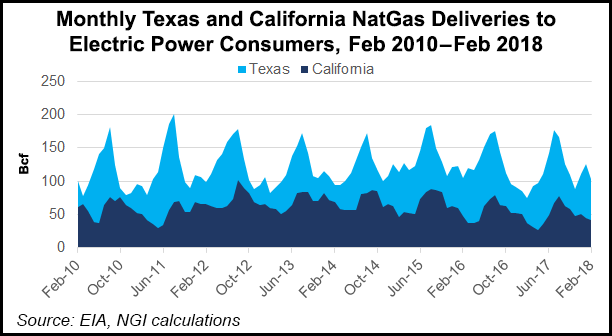

Texas is facing a dicey summer when it comes to electricity generation because of power plant retirements, while California may be natural gas-constrained because of limits to the state’s largest storage facility, according to an assessment by the North American Electric Reliability Corporation (NERC).

In its 2018 Summer Reliability Assessment issued Wednesday, NERC said the loss in Texas of 5,000 MW of generation because of plant retirements over the last year is a concern for Texas this summer. And California is facing a limit on natural gas output because of Aliso Canyon storage facility constraints.

NERC’s assessment provides a high-level view of resource adequacy to identify issues that have the potential to impact bulk power system planning, development and system analysis over the summer months.

“The sizeable gap in generation resources for the 2018 Texas summer peak and the natural gas situation in California pose potential reliability concerns,” said NERC’s Thomas Coleman, director of reliability assessments. “Effectively and efficiently addressing future reliability risks, whether they occur in the next year or in 10 years, requires NERC to continually build upon its analyses while enhancing collaboration with industry and government partners.”

While roughly 2,100 MW of additional generation is anticipated, it would not be available until after the 2018 summer, NERC noted.

The Electric Reliability Council of Texas (ERCOT), the grid operator that covers most of the state, plans to address a projected generation shortfall this summer by seeking voluntary load reductions from utilities if needed to maintain a reliable bulk power system.

The generation and potential reliability gap shows ERCOT’s projected 2018 summer reserve margin to be about 11%, nearly 3% below their recommended level and down roughly 4% from their 2017 summer projection.

“The risk of load shedding caused by insufficient reserves in the ERCOT footprint would increase under extreme summer conditions, such as above-normal temperatures and higher-than-expected generation outages, the assessment finds.”

ERCOT in its summer assessment issued in late April said resource changes since last summer had reduced reserve margins because of the retirement of 4,449 MW of coal capacity over the past year and 806 MW of gas-fired capacity in late 2017. It also cited a delay in constructing resources, totaling about 2,100 MW, that are not going to be available to serve load during the peak.

NERC and the Western Electricity Coordinating Council also have worked closely with the California Independent System Operator regarding gas output from Aliso Canyon. The California Energy Commission earlier in May said inadequate gas supplies for electricity generation in Southern California again would hover over the region this summer.

“The operational constraint at Aliso Canyon continues to affect the availability of natural gas for power plants in Southern California,” NERC noted. “Below-normal hydro generation projected this summer exacerbates this potential reliability concern.”

In addition to the Aliso Canyon constraints, the need for “fast-ramping gas generation and other flexible resources across California also presents a reliability challenge for the bulk power system during the 2018 summer because of the state’s high penetration of renewables,” according to NERC.

“Grid operators in California and across North America are increasingly looking to fast-ramping gas units and other flexible generation capacity to keep the bulk power system reliable because the output from wind and solar, both utility-scale and behind-the-meter, can change frequently and sometimes unexpectedly,” Coleman said.

FERC, in its Summer 2018 Energy Market and Reliability Assessment issued a few weeks ago, said gas demand from power generators could approach record highs this summer. While reserve margins are expected to be adequate in most regions, the Commission cited potential concerns specifically in California and Texas.

The Energy Information Administration expects gas power burn in June, July and August to average 35.16 Bcf/d, about 0.3 Bcf/d less than the record high set in summer 2016 and 3 Bcf/d higher than last year, the Federal Energy Regulatory Commission said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |