NGI Mexico GPI | Markets | NGI All News Access

Near-Term Heat, Stronger LNG Demand Spark Rally for Natural Gas Futures

Natural gas futures climbed Wednesday as much of the fundamental supply/demand backdrop became increasingly supportive of prices. Prices rallied strongly early in the session, but then gave up some ground, leaving the July Nymex gas futures contract up 4.4 cents to $1.821. August picked up 3.9 cents to settle at $1.915.

Spot gas prices also were markedly higher day/day, with double-digit gains boosting NGI’s Spot Gas National Avg. up 13.0 cents to $1.735.

Facing what is expected to be another plump storage injection on Thursday, the natural gas market obviously took other factors into consideration on Wednesday. The latest weather models continued to add heat to the forecast through the weekend, with daytime temperatures expected to reach the upper 80s to 90s from Texas to the Southeast, according to NatGasWeather. Parts of the northern United States also were expected to move well into the 80s, increasing national power burns to a “formidable” 35-plus Bcf/d, the firm said.

Also aiding the gas market were higher feed gas volumes being delivered to U.S. liquefied natural gas (LNG) terminals. NGI data showed feed gas deliveries jumping more than 0.6 Bcf day/day to around 4.5 Bcf/d. Furthermore, production was off 0.5 Bcf, according to Bespoke Weather Services.

“LNG is moving up off the lows, and that, along with some near-term heat, gave daily cash prices a boost this morning, igniting the rally,” Bespoke said.

The firm pointed out that some of the price gains were given back after midday weather models trended slightly cooler, and the market is also taking into consideration some lower demand risks centered on Tropical Storm Cristobal’s arrival along the central Gulf Coast this weekend into early next week.

Although meteorologists have noted a lack of deep heat content in the western Gulf of Mexico (GOM) and the presence of wind shear that may limit further intensification of the storm, the potential impacts to Gulf Coast production cannot be deemphasized, according to Genscape Inc.

The firm said last year, Hurricane Barry impacted GOM production from July 9-23 by nearly 17 Bcf, affecting 12 pipelines, 283 platforms and causing the evacuation of 10 rigs during its peak.

“Although the relative strength of Barry was smaller than storms in the past, its path through the Louisiana coast impacted a highly concentrated area of production, resulting in a max production shut-in of approximately 1.8 Bcf/d,” said Genscape analysts Preston Fussee-Durham and Nicole McMurrer.

Similarly, in 2017, Hurricane Nate made landfall near the mouth of the Mississippi River in Louisiana and caused gas volumes to be reduced by as much as 2.6 Bcf/d, curtailing nearly 16.8 Bcf of total production over its duration, according to the analysts.

“While it remains too soon to determine exactly where Tropical Storm Cristobal will come ashore, current track projections suggest Gulf Coast production impacts could materialize,” they said.

Nevertheless, Bespoke said the recent $1.60-1.90 range for prompt-month prices is likely to remain in place for several more weeks given how much time is left in the storage injection season and all of the uncertainties over supply and demand. With the Energy Information Administration (EIA) storage inventory report coming out Thursday, “that is all the more reason to be neutral here.”

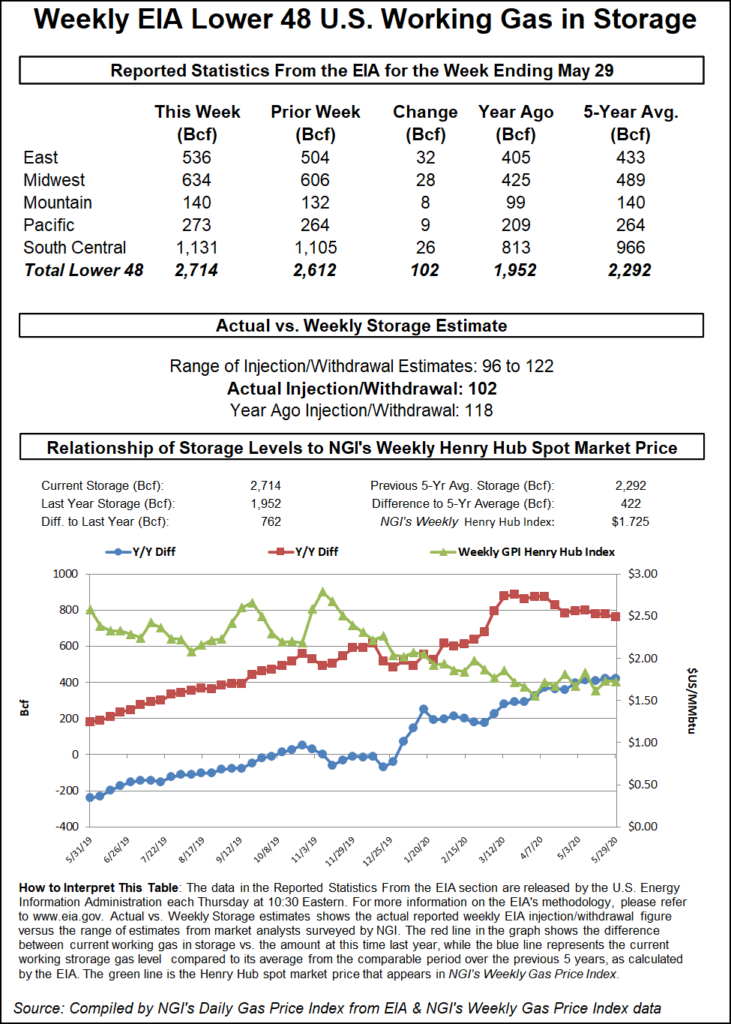

The firm is estimating a build of 106 Bcf in the report, which falls a few Bcf below consensus. A Wall Street Journal poll of 12 analysts, brokers and traders produced injection estimates ranging from 96 Bcf to 122 Bcf, with an average of 110 Bcf. A Bloomberg survey had a tighter range of forecasts with a median of 111 Bcf, while a Reuters survey landed at a 110 Bcf injection. NGI estimated a 104 Bcf build.

“Anything higher than 110 Bcf is viewed as bearish per our models, while a build of 100 Bcf or less could lead to a bullish reaction in prices,” Bespoke said.

Last year, the EIA recorded a 118 Bcf increase in storage for the similar week, while the five-year average build stands at 103 Bcf.

Looking ahead, plummeting LNG feed gas demand is likely to be the one of the largest near-term factors driving gas, according to analysts. Although it is unclear how quickly the dynamic will play out, continued feed gas demand below 4.0 Bcf/d may spur faster revisions, EBW Analytics Group said.

“It continues to appear that the market may have underestimated the extent of global demand weakness, likely yielding downward pressure.”

Severely depressed European and Asian prices from the Covid-19 impacts as well as a mild winter that left storage inventores plentiful, are preventing higher capacity utilization in the U.S. market. This has offset roughly 4 Bcf/d of the 5 Bcf/d in production losses over the past several months, according to Mobius Risk Group. As a result, the net supply/demand impacts are “limited,” and temperatures are still not elevated enough to generate meaningful cooling degree days (CDD).

“These dynamics are what has the Nymex natural gas curve essentially sitting in a holding pattern,” the Houston-based firm said.

However, even with the Covid-19 pandemic and unprecedented LNG feed gas volatility, summer weather still plays a “critical” role in balancing the natural gas market, EBW noted. The first three weeks of June are set to register 44 CDDs and 57 Bcf of above-normal demand.

Further out, EBW said while swelling storage, weak LNG demand and a projected increase in associated gas production may carry the forward curve lower through the middle of summer, a rebound may begin to take shape. This could occur as the year/year storage surplus shrinks, and production resumes declines.

Furthermore, the back half of summer may be hotter than the front half, if current forecasts materialize, and it is possible the economic rebound may gather strength, the firm said. Even LNG may begin to load floating storage by late summer, though most analysts expect to see significant cancellations through October.

“Although a plethora of moving pieces makes for a complex outlook — and bearish relapses entirely possible — if the most-likely storage trajectory appears as it does currently, a sharp rebound in Nymex futures is possible this fall,” EBW said.

Spot gas rose sharply Wednesday as the cheap price environment incentivized strong power burns just as temperatures are starting to rise across the country.

NatGasWeather said Texas, the South and Southeast were expected to be “very warm” through the weekend, with highs of upper 80s to 90s for “moderately strong” cooling demand. Though this has been the pattern for more than a week now in those regions, the higher temperatures are now forecast to spread into other areas of the Lower 48, with highs from Chicago to New York City projected to reach the 70s and 80s.

The more widespread heat is driving up demand for power generation to levels more typical of early July, according to Genscape. The firm pointed out that low spot prices are incentivizing gas to take a larger share of the generation stack as cheap gas displaces coal.

“Genscape’s gas burn for power estimate for Wednesday’s gas day is over 35 Bcf/d, which would be a new high for the year,” said analyst Dan Spangler.

The largest price gains on Wednesday were seen in the middle of the country, where Henry Hub jumped 20.5 cents to $1.765 and Carthage climbed 14.5 cents to $1.710.

Chicago Citygate next-day gas also posted a solid 13.5-cent increase to reach $1.780, while most markets farther east rose by the single digits. Transco Zone 6 non-NY spot gas moved up 6.5 cents to $1.560.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |