Markets | NGI All News Access | NGI The Weekly Gas Market Report

Natural Gas Trading Volumes Hit Record High in 2015, According to NGI Analysis of FERC Form 552 Data

Natural gas trading volumes soared 9.4% higher last year than in 2014, likely because of continued increased production, the retirement of coal-fired electricity generators, and a probable increase in consumption because of lower prices, according to an analysis by Natural Gas Intelligence (NGI) of 2015 Form 552 buyer and seller filings with FERC.

Total volumes bought and sold increased for the first time in four years, reaching 125,386 TBtu, compared with 114,603 TBtu in 2014 (see Daily GPI, May 28, 2015), according to NGI‘s analysis. It was the highest single year on record since the Federal Energy Regulatory Commission began publishing Form 552 data seven years ago (see Daily GPI, July 6, 2009).

The volume of fixed-priced and basis deals, which are the two types of transactions that are eligible to be included in the calculation of U.S. natural gas spot market indices, increased to a combined 26,087 TBtu, up 4.8% from the 24,904 recorded in 2014 (see Daily GPI, June 5, 2014). And the amount of gas bought and sold on index continued to rise. A total of 97,240 TBtu of gas was transacted on index in 2015, compared with 87,578 in 2014. The amount of gas transacted via basis deals has been trending lower, falling from 9,660 TBtu in 2008 (7.8% of the annual total) to just 6,973 TBtu in 2015 (6.1% of the yearly total).

“About a third of the increase is companies that didn’t report in 2014,” said Patrick Rau, NGI director of strategy and research. “There were several more recorded entries this year than there were last year. The rest of it is probably largely the result of lower prices. You saw pretty good increases across the board in every category except midstream, and that makes sense, particularly if there’s less gas processed most likely because wet gas drilling was down.

“But there were healthy increases for electricity generation, as you can imagine, with coal-fired plants retiring and just low prices means that probably more gas got burned relative to coal. Maybe more interesting is that there were quite big increases in volumes for both marketers and financial trading companies — companies that tend to live on volatility.” That includes firms like Goldman Sachs and EDF Group, which were both in the Top 10 this year.

“The whole financial trading sector and the marketing sector, their volumes are up by a healthy amount, and they’re the one’s who’ve really led the increase,” Rau said. “It’s interesting because volatility at the Henry Hub is still low. It’s been declining and it declined last year. So this tells me we may be seeing more regional volatility throughout the country.”

Industrial end-user demand was up almost 18%, and utility volumes were up nearly 10%, likely the result of lower prices. Producer volumes, the largest sector of the market, increased about 2%.

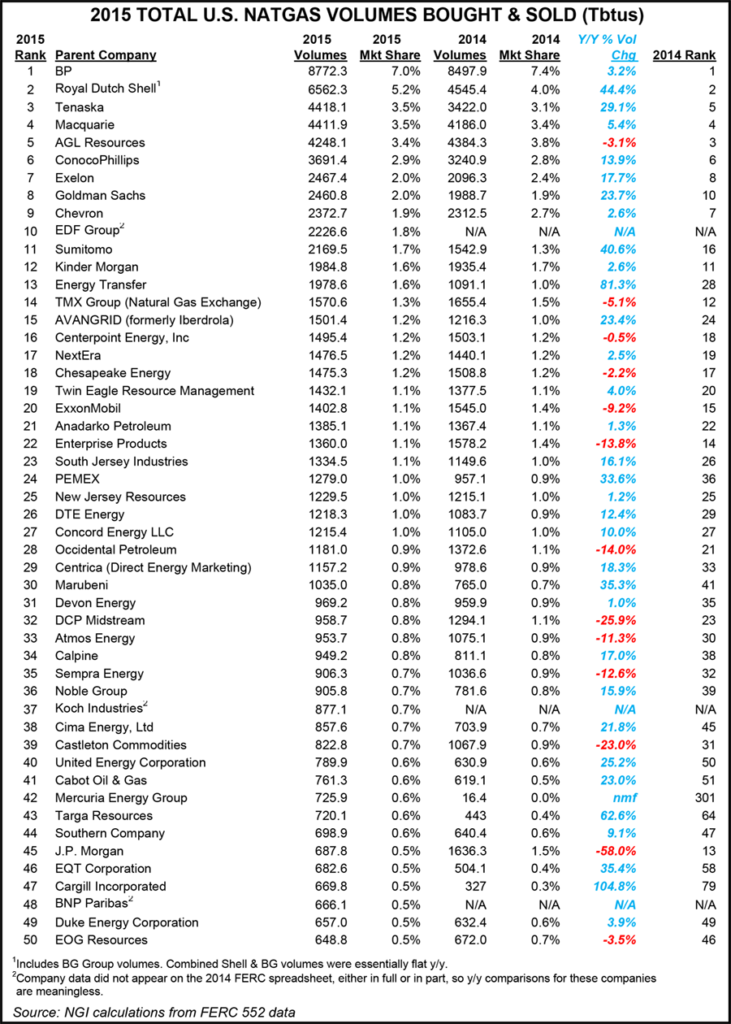

BP plc remained the most active company in 2015, with volumes up 3.2% compared with 2014, but its market share decreased to 7.0% (8,772 TBtu) from the previous year’s 7.4% (8,498 TBtu).

Shell is still No. 2 with 5.2% of market share, compared with 4.0% in 2014, thanks to a 44.4% increase in volumes (6,562 TBtu last year, up from 4,545 TBtu in 2014). Those numbers include a full year of trades by BG Group, which merged with Shell earlier this year (see Daily GPI, Jan. 28). However, the Shell total, compared to combined Shell and BG numbers, is nearly flat.

Tenaska moved up two slots to No. 3 with 4,418 TBtu and 3.5% market share, compared with 3,422 TBtu and 3.1% market share in 2014. Macquarie held steady at No. 4 (4,412 TBtu and 3.5% market share). AGL Resources, which in last year’s analysis moved up to No. 3 with 4,385 TBtu and a 3.8% market share, this year fell to the No. 5 spot with 4,248 TBtu and 3.4% market share. AGL’s 2015 volumes did not include anything from Southern Company, which is in the process of acquiring AGL.

ConocoPhillips hung on to the No. 6 spot with 3,691 TBtu and 2.9% market share in 2015, compared with 3,241 TBtu and 2.8% in 2014. Exelon moved up one position to No. 7 with 2,467 TBtu and 2.0% market share, compared with 2,096 and 2.4% in 2014.

Goldman Sachs, which was No. 29 in 2013 and No. 10 in 2014, edged up two more spots in 2015 to No. 8 with 2,461 TBtu and 2.0% market share. Chevron was No. 9 with 2,373 TBtu and 1.9% market share, followed by EDF Group at No. 10 with 2,227 and 1.8%. EDF Trading held the No. 5 spot in 2013, but data for the company was not included in FERC’s 2014 report.

Companies moving into the Top 50 included Koch Industries (No. 37); Cabot Oil & Gas (No. 41); Mercuria Energy Group (No. 42); Targa Resources (No. 43); EQT Corp. (No. 45); Cargill Inc. (No. 47) and BNP Paribas (No. 48). Among the biggest risers within the Top 50 were Mercuria, which jumped 259 notches, Cargill, which was up 32 spots, and Targa, which was up 21 spots.

Companies dropping out of the Top 50 were JPMorgan, falling 32 spots to No. 45, DCP Midstream, dropping 9 places to No. 32, and Enterprise Products, which fell 8 spots to No. 22. The DCP and Enterprise Products declines are likely the result of less wet gas being processed in 2015.

In its analysis, NGI pooled information so that each company’s total includes data from subsidiaries. This was done to give a more complete picture of parent company activity. NGI‘s analysis covers data taken directly from a spreadsheet located on FERC’s website, with a single exception: Energy Transfer (No. 13, with 1,979 TBtu and 1.6% market share) data were added to the FERC roundup data.

An NGI survey of leading natural gas marketers in North America earlier this year found a 2% decline for full-year 2015 compared to 2014 sales (see Daily GPI, March 4). Overall declines continued into 1Q2016, though several mid-level marketers, including Tenaska, were picking up speed (see Daily GPI, June 3).

The NGI survey ranks marketers on sales transactions only. FERC, in its Form 552 tallies both purchases and sales.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |