Natural Gas Traders Hold Futures Positions Intact Ahead of Storage Report; Cash Mixed

Price action in the natural gas futures market has been as exciting as watching paint dry so far this week, and Wednesday’s swing brought the action down another notch. The Nymex May gas futures contract settled a meager one-tenth of a cent higher at $2.70, while June rose 0.3 cents to $2.742.

Spot gas prices were mixed, with large upswings in some unexpected regions and deep sell-offs in New England. Much like futures, however, the NGI Spot Gas National Avg. eventually rose just a half-cent to $2.375.

Aside from some expected brief blasts of chilly air in the coming weeks, the natural gas market is immersed in a mild shoulder season amid lofty year/year production growth. However, those bearish factors are being countered by lower sequential production, weak nuclear generation and price-elastic demand increases, according to Mobius Risk Group.

“These contradictory forces have temporarily led to stasis near the $2.70 mark, and until cooling demand begins in earnest, the risk of a 20-cent or greater move at the front of the curve is likely skewed to the downside,” the Houston-based firm said.

Weather models have been rather inconsistent in recent runs, although overall, data reflects an active but not quite cold enough pattern for the second half of April, according to NatGasWeather. “Even with this active pattern with periods of below-normal temperatures, weekly storage builds are still expected to continue to print larger than normal, highlighting production has become much too strong when compared to periods of normal temperatures.”

However, a bullish surprise from the Energy Information Administration’s (EIA) weekly inventory report or extended weakness in dry gas production could balance downside price risk, according to Mobius.

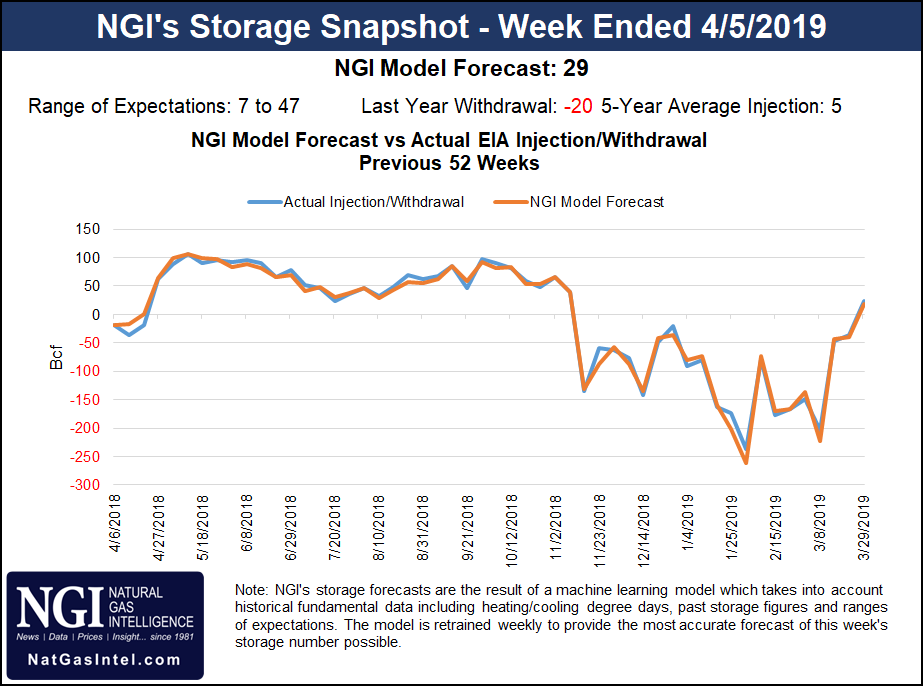

Estimates for Thursday’s EIA report point to an injection in the low 30 Bcf range. This would compare with last year’s 20 Bcf withdrawal and the five-year average injection of 5 Bcf.

A Bloomberg survey of 11 analysts showed estimates ranging from a 7 Bcf build to a 47 Bcf build, with a median of 33 Bcf. NGI projected a 29 Bcf injection.

Last week, the EIA reported a 23 Bcf build that left inventories as of March 29 at 1,130 Bcf.

Tudor, Pickering, Holt & Associates Inc. (TPH) noted that while its estimate for the storage report was below consensus, it sees potential for the following week to report a 100-plus Bcf build, or five times the five-year average, which would likely prove to be a negative catalyst for natural gas markets.

“Flow data for the current week shows residential/commercial demand falling off a cliff, down around 9 Bcf/d week/week, which combined with depressed liquefied natural gas (LNG) demand and a slightly weaker pull from power and industrial, has total demand down roughly 12 Bcf/d week/week,” TPH analysts said.

If these numbers hold for the balance of the week, it’s possible next week’s storage report may show a 100 Bcf-plus build, relative to a five-year average build of 20 Bcf and a 36 Bcf draw last year, TPH said. Such a build versus norms “would reduce the storage deficit to 24%, down from 34% in just three weeks, further reducing any concerns over seasonally low storage levels.”

Adding to the bearish sentiment is data suggesting that the amount of nuclear capacity offline this spring appears to have peaked and is now in decline. There is currently about 15.3 GW of nuclear capacity offline, according to Genscape Inc.

Outages appear to have peaked at 22.5 GW on April 1 and in recent days, a handful of plants have come back online; two more are scheduled to return to service on Thursday. Meanwhile, some notable outages have only begun.

“On a hypothetical 1:1 gas-burn replacement, current outages equate to a little less than 3 Bcf/d of gas burn,” Genscape senior natural gas analyst Rick Margolin said. At the April 1 peak, the 1:1 gas-burn replacement was shy of 3.9 Bcf/d. Despite remaining outages, however, current capacity on outage has fallen below the same date last year and is expected to remain lower year/year.

“At this point last year, there was about 21.8 GW offline, and on this date in 2017 there was 23.5 GW offline,” Margolin said.

For all the downside risk in the market this spring, by mid-summer, there should be another one to two trains of LNG exports in full service, and Cheniere Energy Inc.’s Sabine Pass LNG export facility should be once again running near capacity, according to Mobius. Genscape’s cameras have already detected activity suggesting Sabine Pass Trains 1 and 2 could be returned to service within the next few days.

On Monday, “Genscape infrared monitors observed activity at the flaring equipment for Trains 1 and 2,” analyst Allison Hurley said. “This flare has been off since March 22 when Trains 1 and 2 were fully shut down.” Later on Monday, “our cameras detected other signs of activity that are believed to be precursors for startup. Our LNG team believes these indicate full restoration within a matter of days.”

The growth in feed gas deliveries to LNG export facilities, coupled with the fact that year/year production growth could begin to fade at that point in time, suggests risk/reward will be more balanced, according to Mobius. While there has been much discussion of late regarding the impact and likely duration of lower global LNG pricing, two key factors are often omitted.

“Approximately 90% of the world’s population lives in the Northern Hemisphere (where mild spring weather is the norm) and over half of the world’s natural gas storage is in the United States. As a result of these two factors, pricing in destination markets for U.S.-sourced LNG will remain comparatively more volatile in the spring and shoulder for the foreseeable future. In summary, we do not see the global market as being systemically oversupplied, but simply suffering from slack shoulder season demand,” Mobius analysts said.

Spot gas prices across the country were mixed as the same storm bringing high winds and blizzard conditions to a large area of the central United States will also trigger severe thunderstorms from parts of the Plains to the Midwest this week.

The storms were expected to target some areas that were hit hard by flooding in recent weeks and other areas that are currently experiencing flooding from the Mississippi River, according to AccuWeather.

Storms were expected to first erupt over central Kansas and south-central Nebraska and advance eastward Wednesday night. As these storms move along over northeastern Kansas, eastern Nebraska, northwestern Missouri and southeastern Iowa Wednesday night, “there is the potential for more hail, but also damaging wind gusts and perhaps a few isolated tornadoes,” AccuWeather senior meteorologist Alex Sosnowski said.

As the storm over the Plains continues to intensify Thursday, the risk of severe weather will continue but will be farther to the east when compared to Wednesday, according to AccuWeather. Thunderstorms are forecast to ramp up over far eastern Missouri and western Illinois throughout Thursday.

“The storms are likely to reach severe levels during Thursday afternoon and evening as they cross the Mississippi River,” Sosnowski said.

There is a chance that severe thunderstorms extend farther north into the Lower Peninsula of Michigan and farther east across Indiana, Ohio, Kentucky and Tennessee Thursday night, according to the forecaster.

The soggy weather did little to spark demand and the lack of significant swings in the cash market were proof. Ironically, the perpetually weak Permian Basin and Western Canada were the two regions where spot gas prices soared.

Waha, which has moved in and out of positive territory so far this week, once again climbed back above zero as next-day deals jumped 50 cents to average 25 cents.

With Waha pricing continuing to hover around zero despite the resumption of El Paso Natural Gas compression capacity, the path forward for incremental natural gas production points to a material increase in flaring over the next six months, according to TPH. “While regulatory messaging has thus far been accommodative, the dramatic acceleration of Environmental Safety Group (ESG) reporting and board interest raises the question of how flaring fits into that discussion.”

Flared natural gas contributes to industry emissions with liquids-rich associated gas generally having a higher concentration of byproducts given lower combustion efficiency, according to the firm.

“Though ESG concerns alone may not drive a wave of takeaway commitments, when combined with transport economics that are well in the money, we suspect willingness to contract among the upstream community will see a step-change in coming months,” TPH analysts said.

Kinder Morgan Inc.’s planned Gulf Coast Express and Permian Highway would add roughly 4.1 Bcf/d of capacity versus the more than 5.0 Bcf/d of residue production growth that TPH expects through exit to exit 2018-2021, “necessitating ratable greenfield capacity adds beyond the current queue.”

Meanwhile, north of the U.S. border, NOVA/AECO C next-day gas rose nearly 30 cents but still averaged below $1.00. Maintenance on the Nova Gas Transmission Ltd. (NGTL) system has entered the fray to add further volatility to AECO benchmark pricing, according to TPH. Export volumes along West Gate (Gas Transmission Northwest) have dropped roughly 400 MMcf/d from week-ago levels with maintenance along the system expected to wrap up Friday (April 12).

“Pricing has certainly been on a wild ride over the past week ranging from C21 cents/Mcf to C$1.44/Mcf as maintenance has curtailed exports and, combined with a lack of accessible storage, pricing has now been driven to shut-in levels,” TPH analysts said.

After the West Gate maintenance concludes, the firm isn’t anticipating any meaningful outages until early May, when 1.6 Bcf/d of NGTL volumes are expected to be impacted thanks to Edson area pipeline maintenance work.

Looking down the road, pipeline owner TransCanada Corp. is planning to further expand West Gate capacity with another 114 MMcf/d of expansion work effective this November, “of which we expect the majority of that volume will be filled by Tourmaline Oil Corp.’s Gundy asset” TPH said.

Back in the United States, some California points posted solid losses of as much as 16 cents. PG&E Citygate next-day gas dropped 13.5 cents to $3.31.

In the Northeast, New England prices plunged around 40 cents, while points along the Transcontinental Gas Pipe Line barely budged. On Tuesday, Millennium Pipeline declared a force majeure because of an unplanned outage affecting flows through its Corning, NY, compressor station. As a result, deliveries to its Corning interconnect with Empire Pipeline have been limited to 49 MMcf/d effective gas day April 9 intraday 1 cycle.

“Deliveries to Empire at Corning have averaged 73 MMcf/d and maxed at 104 MMcf/d over the last two weeks,” Genscape analyst Josh Garcia said. There was no estimate for a return to service.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |