Markets | Natural Gas Prices | NGI All News Access | Uncategorized

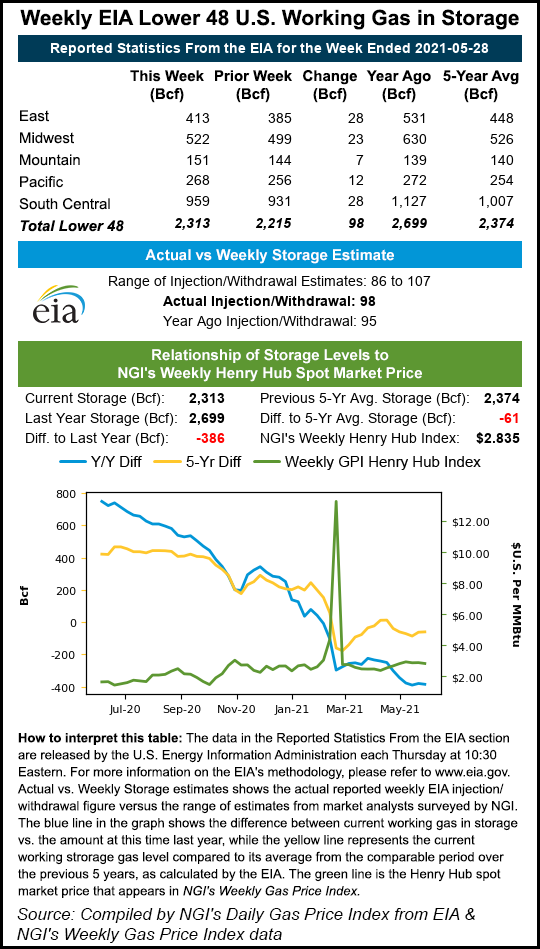

Natural Gas Spot Prices Prove Resilient as Big Gains Seen Across U.S.; Futures Soar Above $3

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |