Both natural gas and oil production from seven key U.S. onshore plays is set to decline in September, continuing a downtrend that began earlier this year, according to the latest Drilling Productivity Report (DPR) published Monday by the Energy Information Administration (EIA).

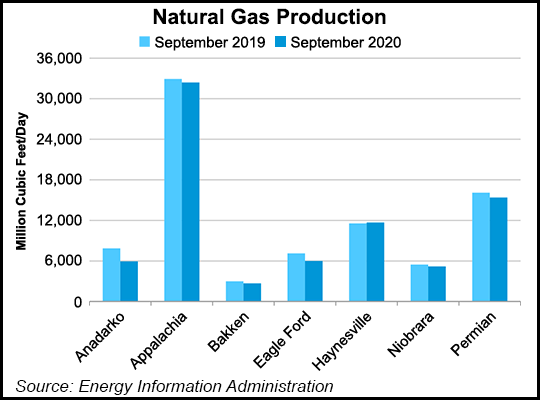

EIA expects natural gas production from the Anadarko, Appalachian, Denver Julesburg-Niobrara and Permian basins, as well as from the Bakken, Eagle Ford and Haynesville shales, to fall by a combined 421 MMcf/d from August to September, hovering at just over 79.2 Bcf/d.

Oil production from these regions is expected to decline by a combined 19,000 b/d month/month, with total output projected to remain at just over 7.5 million b/d.

While the majority of plays are expected to show declines, the Bakken and...