Marcellus | Daily GPI | E&P | Earnings | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report

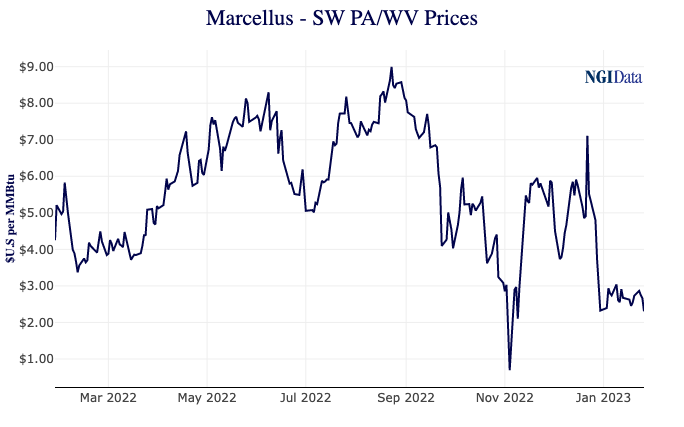

Natural Gas Price Volatility ‘Simply Noise’ for Heavily Hedged CNX, Says CEO

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |