Natural gas production from seven key U.S. onshore regions is set to drop from November to December, extending a trend of falling output that has held for most of 2020, according to data published Monday by the Energy Information Administration (EIA).

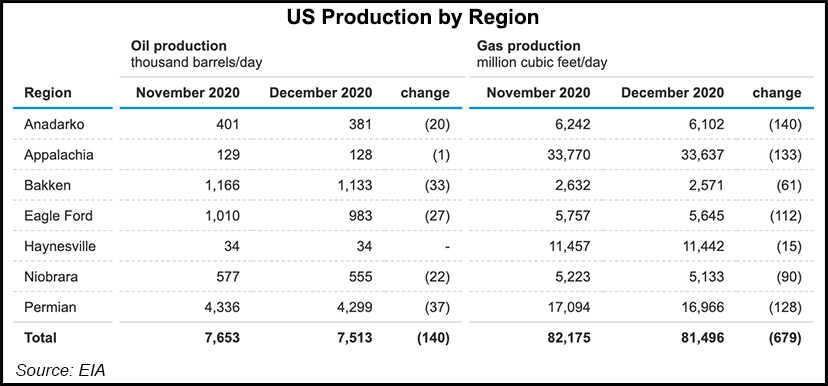

In the latest monthly release of its Drilling Productivity Report (DPR), EIA said it expects gas production from the Anadarko, Appalachian and Permian basins, as well as from the Bakken, Eagle Ford, Haynesville and Niobrara formations, to decline 679 MMcf/d month/month (m/m) to 81.496 Bcf/d in December.

The last time EIA modeled a m/m increase in natural gas output from the seven plays was from January to February of this year. The declining output coincides with a sharp pullback in the U.S. rig count amid the economic fallout of...