Infrastructure | NGI All News Access

Natural Gas Generation Nabs Growing Share of Installed U.S. Microgrid Capacity

Natural gas-based generation made up 30% of installed microgrid capacity in the United States in 2019, according to research from Wood Mackenzie.

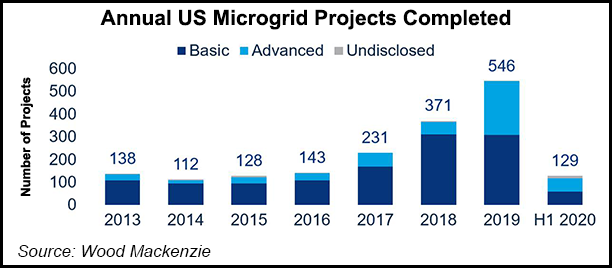

Last year saw a record 546 microgrids installed in the country, according to the firm’s analysis.

Wood Mackenzie analysts see natural gas as a percentage of annually installed microgrid capacity rising to 38% by 2025.

However, this “will not necessarily lead to significant increased demand in natural gas consumption,” Wood Mackenzie research analyst Isaac Maze-Rothstein told NGI’s Shale Daily. “While legacy microgrids often used combined heat and power running as baseload generation, an increasing percent of new generation is relying on natural-gas based reciprocating engines that are used for peaking…”

They are “only run to help customers avoid demand charges, provide grid services or during a power outage,” he said. “With the exception of fuel cells, there is a broad shift from legacy baseload generation to new peaking, onsite generation.”

Even though 2019 saw a record number of microgrids systems installed, annual capacity was down 7% from 2018, with most of the systems installed under 5 MW.

Distributed fossil fuel generation accounted for 86% of installed microgrid capacity in 2019, according to the consultancy.

“Although most of the power distributed via microgrids came from fossil fuel generation last year, we believe that microgrids in the U.S. will become increasingly reliant on renewables technologies,” Maze-Rothstein said. “Through our five-year forecast we are optimistic that solar, wind, hydropower and energy storage will grow to account for 35% of annually installed capacity by 2025.”

California regulators in June approved a multi-billion-dollar microgrid program in a bid to lessen the impact of planned wildfire preventive grid shutdowns by the state’s major investor-owned utilities.

A recent study by the Brattle Group concluded that natural gas microgrids “provide the most economic value for the required level of resilience.” With a low upfront cost, the gas systems can “nearly break even” on the basis of earned market revenues, according to the report.

Despite 2019 capacity beating records, the outlook through 2025 is more conservative because of the coronavirus impacts, according to Wood Mackenzie. The first half of 2020 was the slowest start to the year for the microgrid market since 2016, with project delays forecast through 2025.

There were 129 microgrid projects completed in the first six months of this year.

Shelter-in-place orders and social distancing have delayed permitting, engineering, construction and interconnection processes for developing microgrids, according to Wood Mackenzie. “While these challenges are being felt now, some developers have expressed concerns around originating new deals as some customers wait to see how the pandemic and recession impact their core business,” Maze-Rothstein said.

“Starting in the second half of 2022, we expect to see the challenges of originating new deals during 2020 impacting capacity additions through 2024.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |