NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Futures Tumble as Injection Season Demand Likely to Take a Hit from Virus

With the coronavirus pandemic imperiling not only public health but also energy demand, natural gas futures joined in a wave of selling across the broader economy Wednesday. Undercutting the previous four-year front month low, the April Nymex contract settled at $1.604/MMBtu, down 12.5 cents

In the spot market, heavy discounts from coast to coast sent NGI’s Spot Gas National Avg. plunging 17.0 cents to $1.475.

Wednesday’s trading saw the front month probe down to $1.555, well below the $1.611 intraday low recorded in March 2016, a level analysts have pointed to as a key long-term support target. Prior to March 2016, one would have to go back to the 1990s to find the last time natural gas traded at such low levels.

Traders seemed to have their pick of bearish factors to consider Wednesday, at least in the near term.

In addition to milder trending weather data, demand losses from school and business closures because of the coronavirus outbreak and “additional huge losses in oil and equity markets” also likely factored into the sell-off, according to NatGasWeather. The midday Global Forecast System data also dropped an additional 7 heating degree days from the outlook, the forecaster said.

“The pattern remains a bit too warm” beginning next Wednesday (March 25) through April 1 “as the only relatively cool air is expected across the West Coast and near the Canadian border,” NatGasWeather said. “No change to our view, as it would take much colder trends for next week and beyond for the pattern to be considered bullish” given “quite comfortable” conditions expected for much of the country over the next couple weeks.

Shoulder season-like conditions can tamp down natural gas demand in the best of times, but these are not the best of times. Even the “optimistic best-case scenario” for the coronavirus fallout could still remove a sizable chunk of demand during the injection season, according to EBW Analytics Group.

“A wide range of potential outcomes remains possible,” but the best case probably destroys at least 150 Bcf of demand, the firm said. “In our most likely scenario, demand destruction could reach 500 Bcf if industrial demand and power sector burn mirror past recessions.”

U.S. liquefied natural gas export shut-ins also appear “highly likely later this summer as quarantine measures spread. In a bearish scenario, natural gas demand losses may exceed 1 Tcf.”

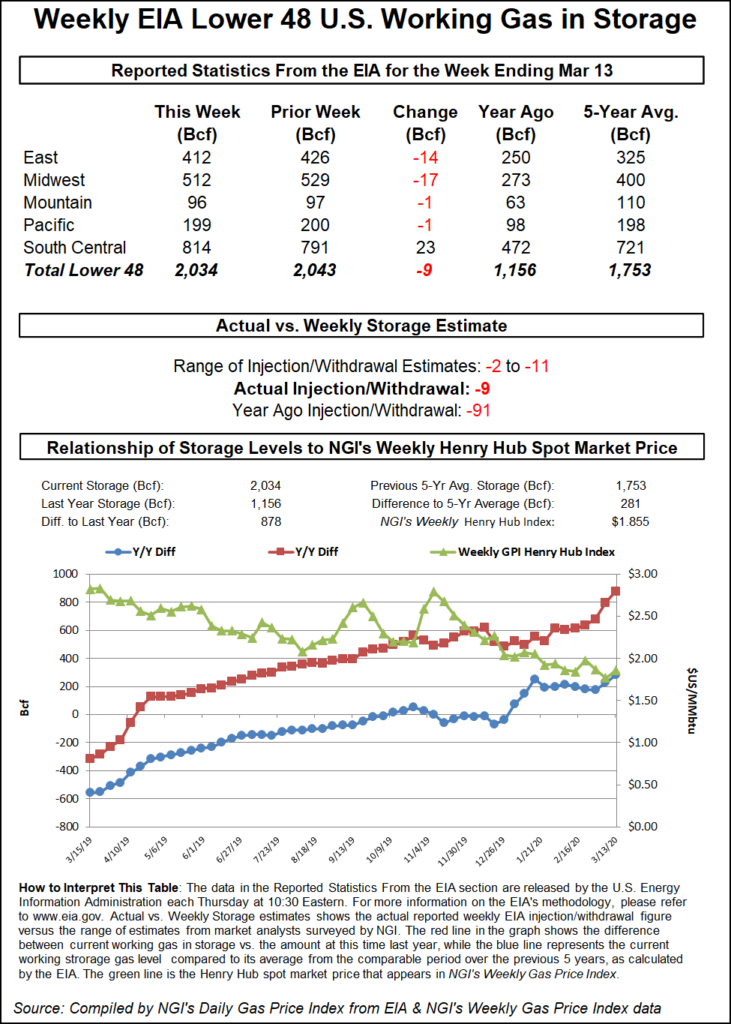

Meanwhile, Thursday’s Energy Information Administration (EIA) storage report is likely to show a much lighter-than-average withdrawal for the week ending March 13, according to estimates.

A Bloomberg survey showed a median estimate for a 3 Bcf withdrawal, while a Reuters poll landed on a consensus pull of 6 Bcf. Estimates ranged from minus 2 Bcf to minus 11 Bcf. NGI’s model predicted a 1 Bcf withdrawal.

Last year, EIA recorded a 91 Bcf withdrawal for the similar week, and the five-year average is a pull of 63 Bcf.

Energy Aspects issued a preliminary estimate for a 5 Bcf withdrawal for this week’s report. The firm noted daily readings of cross-border flows into Mexico trending around 5.7-5.9 Bcf/d last week.

“Quicker flows have been supported by a recovery in NET Mexico volumes to pre-Sur de Texas-Tuxpan levels of 2 Bcf/d (up 0.2 Bcf/d month/month),” Energy Aspects said. “Deliveries into Sistrangas via Monte Grande have also averaged higher, at 0.2 Bcf/d.

Whether a result of mild temperatures or a sign of the demand impacts of social distancing taking hold, spot prices tumbled throughout the country Wednesday, especially for western U.S. hubs that had strengthened recently on below-normal temperatures moving through the region.

“Much of the country will remain warmer than normal the next few days for very light national demand as highs reach the near-ideal 70s and 80s across the southern U.S. while remaining mild from Chicago to New York City with upper 40s to 60s,” NatGasWeather said.

A cold shot moving into the central part of the country by Friday is expected to spread to the Great Lakes, Ohio Valley and Northeast over the weekend, driving up demand as lows range from the single digits to 30s, the forecaster said.

With an uptick in weather-driven demand still a few days out, hubs in the Midwest and East fell by double digits, in line with a 16.5-cent sell-off at Henry Hub. Chicago Citygate dropped 15.5 cents to $1.490, while Algonquin Citygate fell 17.0 cents to $1.415.

On the opposite coast, SoCal Citygate plunged 39.0 cents to $2.110, while PG&E Citygate eased 4.5 cents to $2.795.

Starting Thursday and continuing through the end of March, planned maintenance on the Pacific Gas & Electric (PG&E) system is expected to cut about 300 MMcf/d of imports, according to Genscape Inc. analyst Joe Bernardi. The work is expected to limit Redwood Path flows to 1,690 MMcf/d for Thursday and to 1,725 MMcf/d from Friday through March 31, the analyst said.

“The Redwood Path has brought in an average of 2,021 MMcf/d over the past month, even with a transient two-day disruption earlier this month that cut flows to about 1,550 MMcf/d.

“PG&E should have ample flexibility with storage to make up the difference. Even with recent demand spikes above around 3.0 Bcf/d, net system-wide storage transactions have only barely flipped to withdrawals after posting 39 straight days of net injections.”

Elsewhere, West Texas prices bucked the broader trend, with several regional hubs posting day/day gains. Waha added 7.0 cents to average 89.0 cents.

Recent indications are that the completion of the Wahalajara project in Mexico has been pushed back once again, implying a delay for a potential release valve for constrained Permian Basin associated gas, according to Genscape.

The firm alerted clients recently that Mexico’s Comision Federal de Electricidad (CFE) “is seeking to tender two LNG cargoes for delivery to the Manzanillo terminal,” senior natural gas analyst Rick Margolin said. “This suggests Wahalajara will not be ready this month as we had been expecting, nor even at the start of next month.

“Wahalajara will ultimately provide Mexico the option to replace LNG imports and some pipeline volumes from South Texas with notably cheaper supplies” from West Texas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |