Natural Gas Futures Steady, but Spec Trading Behind ‘Rare’ Intraday Price Behavior; Cash Mixed

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

International

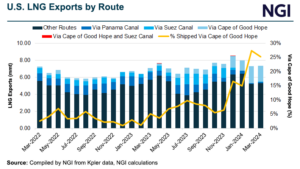

With geopolitical tensions in the Middle East continuing to make the Suez Canal a risky crossing, almost 20% of all U.S. LNG exports have taken the longer route around southern Africa so far this year, according to data from Kpler. After conflict in Israel and Gaza sparked off in October, the threat of rocket attacks…

April 19, 2024Markets

Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.