Markets | Natural Gas Prices | NGI All News Access

Natural Gas Futures Slide Further on Easing Demand Despite Rising War Jitters; Cash Plummets

Natural gas futures prices fell on Monday as weather gained the upper hand early in the trading session despite intensifying concerns regarding the Russia-Ukraine conflict. After reaching a $4.683/MMBtu intraday high, the April Nymex futures contract settled 6.8 cents lower at $4.402. May futures slipped 6.5 cents to $4.420.

At A Glance:

- Production falls to 97 Bcf/d

- Forecasts for mixed demand

- NGI models draw of 41 Bcf

Spot gas prices also continued to retreat amid an increasingly warm outlook for the coming week. NGI’s Spot Gas National Avg. dropped $1.570 to $4.395.

Although Russia’s war on Ukraine continued to wreak havoc on oil markets at the start of the week, natural gas traders quickly pushed uncertainties related to the crisis to the back burner. April futures opened Monday’s session 15.0 cents higher than Friday’s close, but notably warm changes in the 15-day forecast quickly sapped momentum.

Bespoke Weather Services said the magnitude of the warmth was seen for the coming week, with the potential for chilly weather to return to the Lower 48 next week. However, the cold air mass moving south from Canada appeared to be targeting the Rockies and Plains, rather than areas that would offer “a more substantial boost” in late-season natural gas demand.

Bespoke added that models have shown some colder risks in the 11- to 15-day time frame for over a week now, but they have yet to progress forward in the forecast. This keeps confidence lower. “The reality is also that, by the middle of March, it requires a much more anomalous temperature regime to have a material impact,” the forecaster said.

EBW Analytics Group pointed out that daily heating demand could sink 8-10 Bcf/d from Monday to the weekend. At the same time, production could rise as much as 2.0 Bcf/d as pipelines affected by freeze-offs thaw.

This “may create physical market pressure and open the door to downward pressure for the April contract,” EBW senior analyst Eli Rubin said.

Simmering War Concerns

Fundamentals, however, are only part of the story, EBW noted. Despite North American natural gas being relatively insulated from a fundamentals perspective, “Nymex gas appears to benefit from bullish commodity sentiment” stemming from Russia’s Ukraine invasion, Rubin said.

The European natural gas benchmark Title Transfer Facility contract for April gained about $2 Monday to finish above $32/MMBtu. Spot LNG prices in Asia also followed European contracts higher.

Oil prices, meanwhile, shot past $100/bbl again Monday after news this weekend that BP plc would unload its stake in Russian-controlled oil company Roseneft. Shell plc followed up with an announcement that it would end its involvement in the Nord Stream 2 natural gas pipeline project. Construction on the pipeline is complete, but German Chancellor Olaf Scholz said his country would suspend certification in response to the attack on Ukraine. Norwegian-based supermajor Equinor ASA also said it would end new investments and exit joint ventures in Russia.

The barrage of sanctions imposed on Russia is amplifying risks to supply, according to Rubin. Oil markets already were in a shortage before last week’s invasion, with crude, gasoline and distillate inventories all below five-year minimum levels.

“Spiking geopolitical premiums layered on top of a bullish fundamental structure create tremendous upside price risks” for West Texas Intermediate, he said.

Natural gas, as it did last week when Russia first launched its attack on Ukraine, could remain volatile in the near term, Rubin added. First-of-month pipeline nomination patterns may also (erroneously) suggest a phantom production drop this week, leading to further gains.

The longer-term picture for U.S. gas also is bullish. Over the next month or so, recent strength in the summer and winter 2022-2023 contract suggested that prices could swing to the upside more frequently as the market shifted its focus to the storage injection season. Although milder weather is on the way, the inventories were on pace to end March at around 1.3-1.4 Tcf following a month-long period of steep 200 Bcf withdrawals.

Working gas in storage as of Feb. 18 stood at 1,782 Bcf, according to the Energy Information Administration (EIA), more than 200 Bcf below both year-ago and five-year average levels.

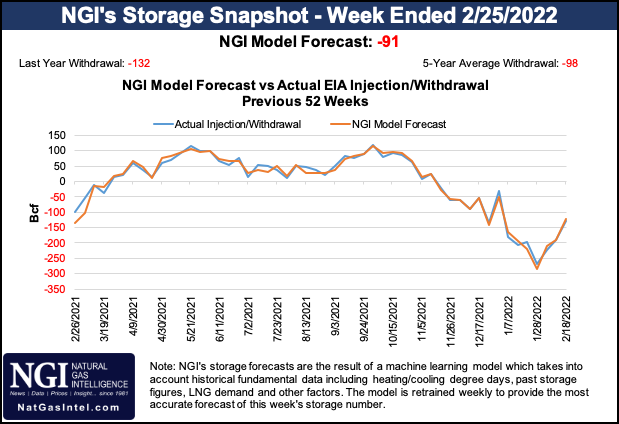

Looking ahead to the next EIA report, scheduled to be released on Thursday, analyst estimates were wide ranging. NGI modeled a 91 Bcf withdrawal for the week ending Feb. 25, while another early projection was for a draw in the 130 Bcf range. For reference, 132 Bcf was pulled out of storage in the same period a year ago, and 98 Bcf is the five-year average pull.

Cash Crashes

Spot gas prices continued to plummet Monday, with massive decreases seen in the Northeast as temperatures were expected to warm through the early part of the week.

NatGasWeather said demand was still “decent” on Monday as chilly air lingered on the East Coast. However, the rest of the country was mild to warm with highs of 50s to 80s, which were forecast to become widespread for Tuesday and Wednesday. There is the potential for a brief bump in demand on Thursday and Friday as a weather system races across the Great Lakes and Northeast, according to the forecaster. However, another warm-up was expected by the weekend.

Northeast prices recorded the sharpest swing to the downside, with Tenn Zone 6 200L spot gas plunging $14.825 to average $8.030 for Tuesday’s gas day. Transco Zone 6 NY dropped $1.365 to average $4.135.

Appalachia also posted steep declines, with Millennium East Pool cash falling 57.0 cents to $4.030 and most other locations sliding between 30.0 and 45.0 cents.

The majority of pricing hubs in Louisiana, Texas, the Midwest and Midcontinent saw losses of between 20.0 cents and 30.0 cents, while the West Coast posted steeper falls. In the Rockies, Transwestern San Juan was down 74.0 cents to $3.660 for Tuesday’s gas day. The SoCal Border Avg., meanwhile, was down 85.0 cents to $3.730.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |