Natural Gas Futures Scratch Out Narrow Gain on Lower-Than-Expected Storage Build As Cristobal Looms

Natural gas futures crept up early Thursday following a smaller-than-expected storage injection, but significant momentum proved difficult to gather amid ongoing demand uncertainty and the specter of a tropical storm nearing the Gulf Coast. The July Nymex contract traded in a narrow range of gains and losses throughout the day and settled at $1.822/MMBtu, up one-tenth of a cent day/day. August rose two-tenths of a cent to $1.917.

Spot gas prices declined across the country, with NGI’s Spot Gas National Avg. down 7.0 cents to $1.665.

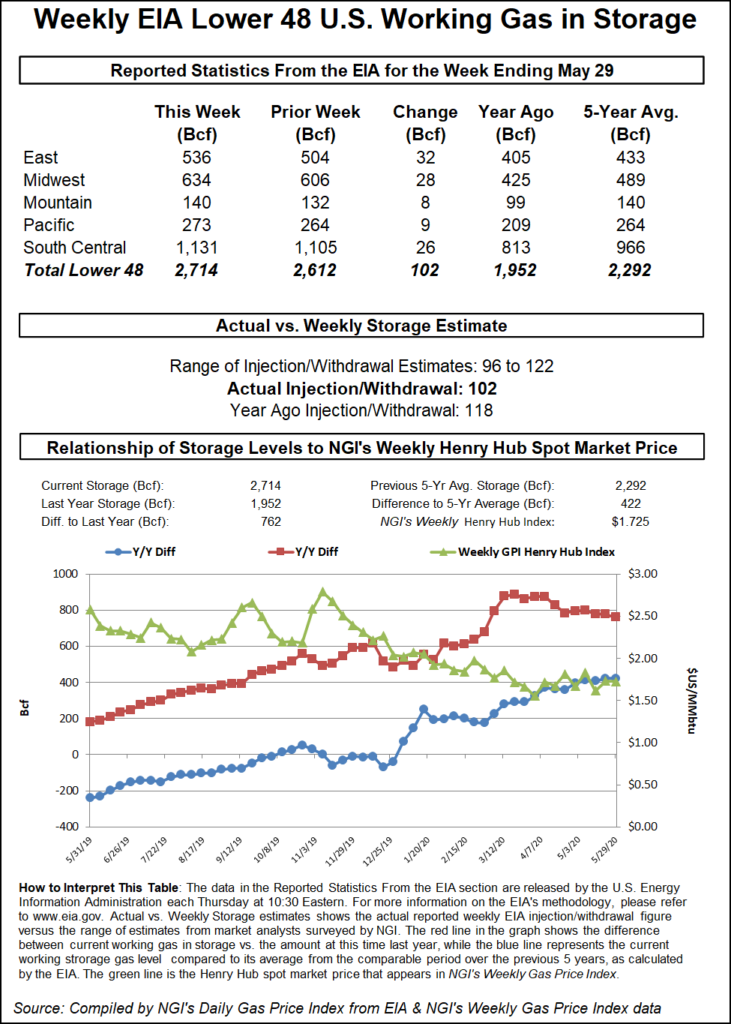

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 102 Bcf in natural gas storage for the week ending May 29. The build came in lower than the average of analysts’ estimates and below the prior week’s injection of 109 Bcf.

Ahead of the report, a Wall Street Journal poll of 12 analysts, brokers and traders produced injection estimates ranging from 96 Bcf to 122 Bcf, with an average of 110 Bcf. That was on par with a Reuters survey. A Bloomberg survey showed a median of 111 Bcf. NGI projected a 104 Bcf build.

The latest injection was below both the 118 Bcf increase in storage recorded in the same week a year earlier and the five-year average build of 103 Bcf for that week, fueling some early bullish sentiment.

Additionally, the gas market has this week taken note of feed gas volumes being delivered to liquefied natural gas (LNG) terminals rising off recent lows, as well as summer heat driving increased power burns.

Still, the level of gas flowing to LNG export plants remains significantly below pre-coronavirus pandemic levels, reflecting dampened international demand in the wake of government-imposed restrictions aimed at slowing the spread of the disease. Depressed gas prices in Europe and Asia have ultimately curtailed demand for U.S. exports.

At the same time, Thursday’s storage injection showed that inventories remained above average levels at a time of elevated demand uncertainty. The latest build lifted inventories to 2,714 Bcf, above the year-earlier level of 1,952 Bcf and above the five-year average of 2,292 Bcf.

Bespoke Weather Services viewed the build as “a little bullish,” but the market remains somewhat dubious about demand drivers, explaining the range-bound trading. “In short,” the firm said, “we really have not accomplished anything in terms of gaining more clarity on containment risks this fall.”

Despite overall investor optimism in increased economic activity this summer, and by extension heightened energy needs, analysts worry that continued triple-digit injections point to a precarious demand outlook for the commercial and industrial sectors, even as they emerge from virus-related shelter-in-place measures.

“To state the obvious, the global pandemic is far from over,” Raymond James & Associates Inc. analysts said in a note to clients. “Unemployment in major economies will remain elevated for years, and there is a risk of a ”second wave’ spurring strict lockdowns this winter across the Northern Hemisphere.”

Most economists say recovery is largely dependent on a revival in consumer spending at a time when confidence is shaky because of the virus and widespread civil unrest in the wake of George Floyd’s death in Minneapolis last week. “This is a consumer-led recession” from which a recovery is dependent on a rebound in consumer activity, said economist Ernest Goss of Creighton University in Omaha.

Meanwhile, Tropical Storm Cristobal, which made landfall in Mexico on Wednesday, could hit parts of the United States this weekend, including Texas and Louisiana, bringing with it heavy rains, high winds and a storm surge, according to the National Oceanic and Atmospheric Administration.

Exploration and production companies were tracking the storm on Thursday and some had begun evacuating nonessential personnel from facilities that could be affected.

“It’s expected to remain below hurricane strength but will provide minor production disruptions in the Gulf of Mexico and potentially inland as well,” developments that could boost gas prices, NatGasWeather said. “However, there’s also expected to be disruptions to LNG exports and demand destruction from showers and cooler air.”

Spot gas prices declined across the country.

While near-term weather forecasts are favorable, with hot conditions continuing in Texas and much of the West into the weekend, “the pattern breaks down mid-next week as a large-scale weather system over the West tracks into the Plains and Midwest, with very comfortable highs of 60s to 80s,” NatGasWeather said. This would drop national cooling degree days “to below normal” and is why “the pattern isn’t hot enough late next week into the following week” to drive stronger demand.

“The pattern for mid-June favors heat becoming focused over the Southwest and Texas,” the firm added. “However, most of the rest of the country will be in the 70s and 80s, aided by weather system tracking across the northern and eastern U.S.” As such, the forecast is “just hot enough the next couple days but not quite hot enough for mid-June besides Texas and the Southwest.”

Spot prices fell mostly by single digits, though SoCal Citygate, where prices plunged 46.5 cents day/day to average $2.075, proved a notable exception. Earlier this week, Southern California Gas launched a two-month planned maintenance project that is expected to disrupt about 150 MMcf/d of flowing supply at the California-Arizona border.

SoCal Border Avg. prices dropped 22.0 cents to average $1.765.

Elsewhere, El Paso Permian fell 4.5 cents to $1.560, and Algonquin Citygate fell 6.0 cents to $1.645. Prices at Chicago Citygate declined 7.0 cents to $1.710.

On the pipeline front, Texas Eastern Transmission (Tetco) said it received an amended corrective action order from the U.S. Pipeline and Hazardous Materials Safety Administration this week that would soon impact operations.

Future capacity impacts are expected for flows southbound from Holbrook to Kosciusko as well as eastbound and northbound through Uniontown, though specific numbers and start dates have not yet been released, according to Genscape Inc. The firm noted that Tetco also cautioned that delivery point operators on the rest of the system running between Kosciusko and Uniontown may experience up to 20% lower operating pressures.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 |