Markets | Natural Gas Prices | NGI All News Access

Natural Gas Futures Plunge to $3.93 on Ho-Hum EIA Storage Stat, Weak Cash

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Earnings

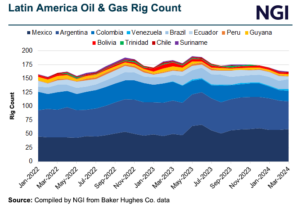

Performance in Latin America during the first quarter proved to be strong for Halliburton Co. and Weatherford International plc, with each reporting double-digit revenue gains from a year ago. The oilfield services giants joined SLB Ltd. and Baker Hughes Co. in reporting their quarterly results. SLB reported a 2% gain in sales year/year across its…

April 25, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.