Natural Gas Futures Not Phased by Slightly Larger-than-Expected EIA Storage Pull

The Energy Information Administration (EIA) on Thursday reported a slightly larger-than-expected 163 Bcf withdrawal from U.S. natural gas stocks, prompting only a modest reaction from a futures market focused on the impact of upcoming polar vortex-influenced cold.

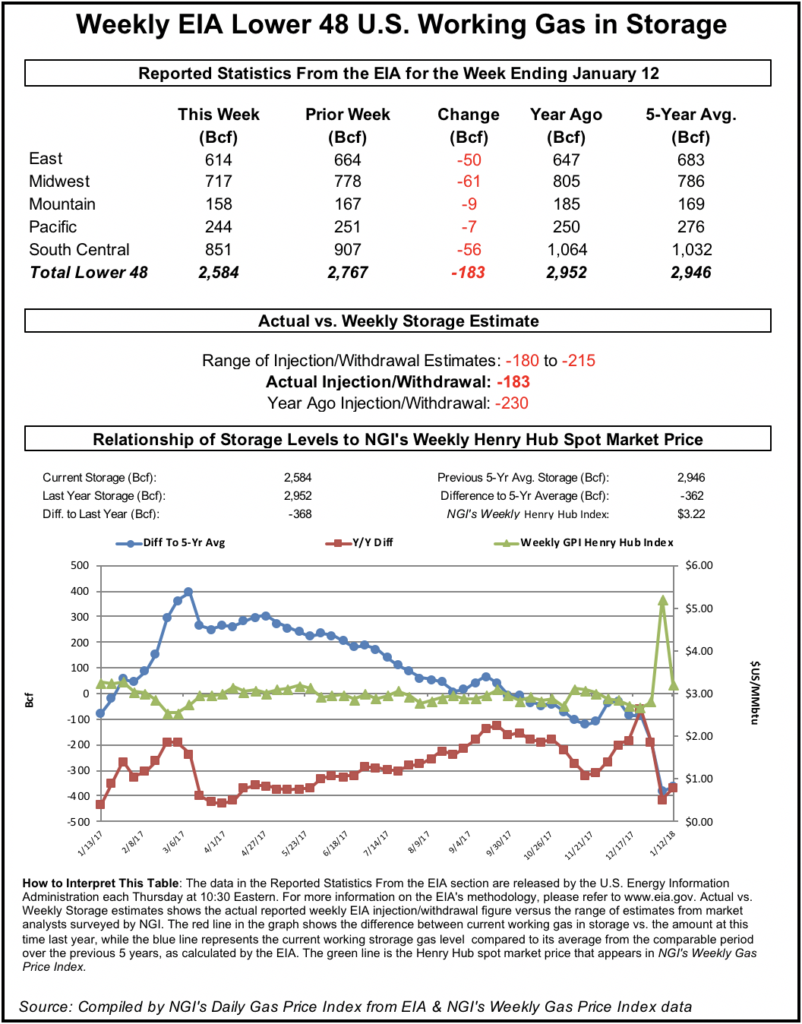

The 163 Bcf withdrawal, recorded for the week ended Jan. 18, falls on the bullish side of major surveys but is bearish versus the five-year average 185 Bcf pull and the 273 Bcf withdrawal EIA recorded in the year-ago period

The figure didn’t provoke a pronounced reaction from the futures market, at least not right away. Prior to the report, February Nymex futures had been trading in a range from around $3.060-3.110. As EIA’s report hit trading screens at 10:30 a.m. ET, the front month traded as high as $3.120 and as low as $3.075 before hovering around $3.075-$3.095 for the next 10 minutes or so, in line with the pre-report trade.

By 11 a.m. ET, futures were trading around $3.071, up 9.1 cents from Wednesday’s settle.

Estimates prior to the report had pointed to a withdrawal slightly smaller than the actual figure. A Bloomberg survey had showed a median expectation for a 155 Bcf pull, while a Reuters survey had showed an average 154 Bcf withdrawal. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a withdrawal of 160 Bcf.

“February gas prices are not particularly impressed with this number, but with cold weather only confined to the East on the week and a large draw both in the Midwest and in the South Central we see this print as indicating significant upside risk on any return of colder weather into the middle of February,” Bespoke Weather Services said.

“With a colder February our end-of-draw expectations have dipped below 1.2 Tcf and can fall further if forecasts cool more than expected; we of course need cold risks on model guidance to rally, but we expect those to build over the coming week and support prices.”

Total Lower 48 working gas in underground storage stood at 2,370 Bcf, 305 Bcf (11.4%) below the five-year average but 33 Bcf (1.4%) higher than last year’s stocks, according to EIA.

By region, the largest withdrawal occurred in the Midwest at 56 Bcf, while 54 Bcf was pulled in the East. The Pacific region withdrew 11 Bcf for the week, while 6 Bcf was pulled from Mountain region stocks. The South Central saw a net 38 Bcf withdrawal, including 29 Bcf from nonsalt and 8 Bcf from salt stocks, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |