NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Natural Gas Forwards Weak Through Summer; Softer Production Growth Supports Winter Prices

Warm weather outlooks kept a firm grip on the front of the natural gas forward curve for the Feb. 6-11 period, while a projected softening in Lower 48 production growth provided a modest uplift to winter 2020-21 prices, according to NGI’s Forward Look.

Price action was quiet early in the four-day trading period as traders maintained positions while awaiting more clarity on late-February weather. Both the American Global Forecast System model and the European datasets experienced extreme volatility late last week, but then unanimously shed a massive amount of demand in weekend weather models. The dramatic turn sent the March Nymex futures contract spiraling to a four-year low on Monday.

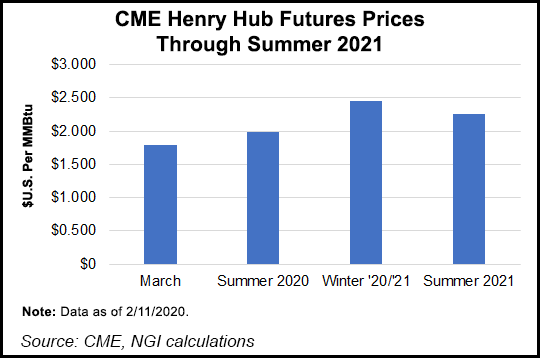

The prompt-month contract ultimately decreased by 7.4 cents from Thursday to settle Tuesday at $1.788. April was down about 6 cents to $1.823, while the summer strip (April-October) was about 4 cents lower at around $1.99. The winter 2020-21 package, meanwhile, rose 2 cents to $2.45.

The “blow to the market” of seeing yet another potential cold forecast smashed is likely to prevent any optimism from building, according to EBW Analytics. Since November, bullish forecasts within the eight- to 15-day window repeatedly have turned warmer, and the gas market may have learned to broadly ignore cold signals until they roll forward into the one to 10-day window, the firm said. As a result, “any longer-term bullish forecasts pose less of a risk to bears, and may drive increased shorting of natural gas.”

The latest weather models are starting to hint at at least some cold weather returning by the end of February. The European ensemble model added more than 10 gas-weighted degree days overnight Tuesday, and then added another 10 heating degree days in Wednesday’s afternoon run, according to NatGasWeather.

The bulk of the change comes next week with a larger piece of colder air moving through the central United States and also trims the warmth in the East and Southeast, the forecaster said. “Clearly, the natural gas markets are happy to see the weather data trend colder with prices solidly higher today.”

The March Nymex gas futures contract settled Wednesday at $1.844, up 5.6 cents from Tuesday’s close. April climbed 5.1 cents to $1.874.

But as winter weather has largely fallen short of expectations, “any subsequent bullish weather will be too little, too late,” according to EBW. The firm said the continued warmth would accelerate seasonal declines in weather-driven demand and further boost storage surpluses. Estimates are pointing to end-of-March inventories reaching 1.80 Tcf or more, which compares to the 1,130 Bcf that sat in storage on March 29, 2019, according to the Energy Information Administration (EIA.)

Meanwhile, fears over liquefied natural gas (LNG) export viability in a weak global natural gas market also is likely to put pressure on Nymex futures, EBW said. As an exporter, U.S. domestic prices need to be sufficiently below international benchmarks to keep LNG exports flowing, or demand for U.S. products may crater, according to the firm.

With the Title Transfer Facility hub in Europe at $2.75/MMBtu and falling, any recovery in Nymex futures “is likely to be shallower than fundamentals may otherwise suggest, with any recovery above $2.00/MMBtu unlikely before summer.”

That’s not to say there isn’t at least some hope for the natural gas market. Producer earnings calls have yet to get into full swing, and the low price environment has prompted some analysts to lower their projections for production growth this year.

In its Short-Term Energy Outlook (STEO) released Tuesday, the EIA said that monthly gas production, which reached a record high 92.1 Bcf/d in 2019, is expected to decline generally throughout 2020, falling from an estimated 95.4 Bcf/d in January to 92.5 Bcf/d in December. The falling production will be experienced primarily in the Appalachian and Permian basins, EIA said.

“In the Appalachia region, low natural gas prices are discouraging natural gas-directed drilling, and in the Permian, low oil prices are expected to reduce associated gas output from oil-directed wells,” EIA said.

Dry natural gas production is expected to stabilize in 2021 at an annual average of 92.6 Bcf/d, a 2% decline from 2020, which would be the first decline in annual average natural gas production since 2016, the agency said.

Forward markets across the United States moved rather uniformly with Nymex futures, with small losses of less than a dime seen through the summer and modest gains for next winter.

Midcontinent declines rounded out the lower end of declines as a series of winter storms elevated demand both last week and again this week, prompting some regional pipelines to declare limitations on their systems.

Panhandle Eastern March prices slipped just 1.0 cent to $1.433 from Feb. 6-11, while April stayed flat at $1.439, according to Forward Look. The summer strip was down 1.0 cent to $1.50, while the winter 2020-21 strip jumped 8.0 cents to $2.11.

NGPL Midcontinent was one of the lone pricing hubs across the country to post gains across the forward curve. March climbed 1.0 cent to $1.385, as did April, which landed at $1.417. Summer prices also moved up 1.0 cent to hit $1.49, while the winter tacked on 7.0 cents to $2.09.

Meanwhile, price movements throughout the Rockies closely aligned with Nymex futures despite the barrage of winter storms that has hit the region this winter.

Northwest S. of Green River saw prices for March fall 7.0 cents between Feb. 6 and 11 to reach $1.508, while April slipped 2 cents to $1.428 and the summer peeled back 1.0 cent to $1.51. Winter prices, however, were up 4.0 cents to $2.28, Forward Look data show.

The weakness in Rockies prices in the face of harsh winter weather could be attributed to healthy storage inventories in the region. Jackson Prairie storage volumes have consistently been above five-year norms throughout 2020 so far, according to Genscape Inc.

Last year, the storage facility filled to capacity at the end of September, and inventories have dropped 5.5 Bcf, from 22.7 Bcf to 17.2 Bcf, since the beginning of 2020, the firm said. The largest net withdrawal in the past 30 days was on Feb. 4, with the second largest happening on Feb. 3, for a combined total withdrawal of nearly 1.6 Bcf across the two-day period.

“Historically, the switch from withdrawals to injections begins for Jackson Prairie in early to mid-March, one month from now,” Genscape natural gas analyst Matthew McDowell said.

Genscape meteorologists are forecasting normal levels of heating degree days throughout the Pacific Northwest this week, but the forecast for next week suggests warmer-than-average temperatures throughout the region. “If warmer weather persists for a notable amount of time through early March, Jackson Prairie could begin its injection season with reservoirs set to mirror 2019’s trend of remaining nearly full for the majority of the year,” McDowell said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |