Markets | Infrastructure | LNG | NGI All News Access | Regulatory

Natural Gas Forwards Swing Sharply Lower as Forecasts Cool

U.S. natural gas forward prices continued on the wild ride they’ve been on the last few weeks, posting steep losses — one week after putting up equally sharp gains — as weather models that had called for scorching temperatures throughout most of July had begun to cool.

August prices plunged an average 11 cents from July 11-17. Balance of summer (August-October) prices dropped an average 12 cents, and the winter strip (November 2019-March 2020) slid an average 10 cents, according to NGI’s Forward Look.

While most market hubs followed the lead of Nymex gas futures, locations out West posted far more dramatic declines as a cold front that moved through the region left below-average temperatures in its wake. The planned return of a major import line into California provided additional pressure on local markets, with August prices plunging as much as 55 cents.

On the other hand, August Nymex gas futures were down closer to a dime between July 11 and 17, with losses there also due in part to cooler weather that has rapidly showed up in forecasts.

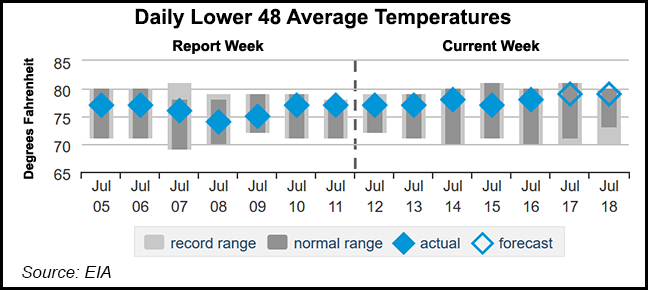

Weather data overnight Thursday held onto earlier outlooks, with a cooler shift expected early this week and slightly warmer changes in the 11- to 15-day period, according to Bespoke Weather Services. In terms of the modeling, while there wasn’t a large gas-weighted degree days (GWDD) change seen, the firm saw less heat in the medium range in the Global Forecast System suite compared to what it showed earlier.

“We do still feel some heat will return, but we are not there yet,” Bespoke chief meteorologist Brian Lovern said. “That said, the 11- to 15-day is not inherently bearish from a weather perspective alone, as it is near normal after peak cooling occurs in the 6- to 10-day time frame. This is the result of some sneaky above normal anomalies up in the Northeast, as best cooling risks stay back in the middle of the nation as we begin the month of August.”

The forecaster maintained there were no major changes to the long-range forecast as a very hot pattern was expected to play out through this weekend, highlighted by temperatures reaching the mid-90s from Chicago to New York City. However, strong weather systems with cooling remain on track to sweep across the central, northern, southern and eastern United States next week with much lighter demand.

Meanwhile, production was returning following Hurricane Barry, which made landfall in Louisiana on July 13. Friday’s initial print was flat to Thursday’s finalized number, even before revisions, according to Bespoke. “It will remain around 1 Bcf or so off the highs, so is not fully back just yet.”

Liquefied natural gas exports preliminarily hit a new high just above 6.5 Bcf on Friday, per Bespoke’s data, pending any revisions. Burns remain weak on a weather-adjusted basis.

“Yes, in absolute terms we are getting new records, but when adjusted for the lofty GWDD totals in place, that’s what makes them look weaker,” Loveren said. “In other words, absolute burns are not all that much higher than last week’s peak, despite the bigger jump up in weather demand.”

Over the six-day period through July 17, August Nymex futures dropped 11 cents, September fell 12 cents and the balance of summer slipped 12 cents to $2.30. The winter strip was down a dime to $2.60, while summer 2020 was down 6 cents to $2.45.

The recent weakness depicts the market’s inability to withstand cooler weather changes amid a growing storage surplus, according to Mobius Risk Group. Before the market determines whether the move lower at the front of the curve was warranted, and whether actual temperatures will be as cool as forecast, there will be a string of three storage data points that will have reference weeks that were substantially warmer than normal, the firm said. The first occurred on Thursday.

The Energy Information Administration (EIA) reported a 62 Bcf build into inventories for the week ending July 12 that was in line with expectations. The injection was higher than the 46 Bcf build for the year-ago period but just below the five-year average of 63 Bcf. The report marked the first below-average build since injections began in March, EIA historical data show.

Prior to the EIA report, estimates had been pointing to a near-average injection close to the actual figure. NGI’s model predicted a 65 Bcf injection.

Bespoke said the reported build, which was a few Bcf below its final projection, is tighter in terms of week/week balances. Given the market’s immediate move lower following the report, however, traders likely viewed the lower build as the result of some production turning off late last week due to Barry.

“The lower production will be an issue in next week’s number as well, though burns, weather adjusted, have definitely been weaker this week. All in all, this report is viewed as very neutral in our opinion,” Bespoke’s Lovern said.

Total Lower 48 working gas in underground storage as of July 12 stood at 2,533 Bcf, 291 Bcf (13.0%) above year-ago levels but 143 Bcf (minus 5.3%) below the five-year average, according to EIA.

By region, the Midwest recorded the largest build of the week at 30 Bcf, followed by the East at 17 Bcf. The Mountain region refilled 7 Bcf, while the Pacific injected 5 Bcf. In the South Central region, a 14 Bcf injection into nonsalt stocks was partially offset by an 11 Bcf withdrawal from salt, according to EIA.

Looking ahead to the next two EIA reporting periods, there is a high likelihood that storage builds fall below the 50 Bcf mark, according to Mobius. How far below this mark those two numbers fall will have a great deal to do with the market’s ability to rebound before the inevitable decline in cooling demand which occurs annually beginning in late July.

“Results near the 50 Bcf mark would likely spur additional selling, and results closer to 30 Bcf could be a catalyst for a final rally ahead of the fall shoulder season,” the Houston-based firm said.

After the next two storage numbers, declining cooling demand will quickly shift the market’s attention to whether a string of triple-digit injections from early September to early October is possible, according to Mobius. “There were six consecutive such builds from early May through mid-June, and a repeat would be a material headwind for the market ahead of withdrawal season.”

August Nymex futures went on to settle Thursday at $2.28, down 1.7 cents. September slipped 1.5 cents to $2.263.

Double-digit declines across the United States paled in comparison to more pronounced losses out West, where temperatures were expected to remain below-normal for the next several days behind a cold front.

Prices in Southern California were hit hardest, likely aided by news that Southern California Gas (SoCalGas), after nearly two years, planned to return a major pipeline to service.

Line 235, a 30-inch diameter natural gas transmission pipeline that carries supplies from the Arizona border through the high desert and into the Los Angeles Basin, was scheduled to return on Sunday following the completion of work that began last summer.

The line has been shut since October 2017, when an explosion and fire ripped apart a portion of it in the middle of a sparsely populated part of the high desert 150 miles northeast of Los Angeles. The repairs followed a root-cause analysis by a third-party expert that took six months, with several more months needed to develop a detailed remediation plan.

SoCal Citygate August prices tumbled 55 cents from July 11-17 to reach $3.164, while the balance of summer plunged 30 cents to $2.82 and the winter strip dropped 14 cents to $3.60, according to Forward Look. The summer 2020 strip was down 12 cents to $2.79.

The planned return of Line 235 is a welcome relief to the Southern California market and should improve the supply picture ahead of hotter weather expected beginning this week. The jet stream was projected to lift northward across the West, allowing the current heat in the Southwest to gradually follow suit into this week, according to AccuWeather.

“A dome of high pressure in the upper levels of the atmosphere will set up over the Intermountain West, setting the stage for above-average temperatures to surge northward,” AccuWeather meteorologist Brandon Buckingham said.

The rise in high temperatures will be most noticeable across the Pacific Northwest as this region has had a lack of very warm days since the middle of June due to occasional cloud cover and showers, according to AccuWeather. Since June 13, Seattle has had only five days of high temperatures reaching or exceeding 80 degrees, and the city has also exceeded its normal monthly rainfall in just the first 15 days.

High temperatures were forecast to reach the middle 80s in Seattle to near 90 in Portland on one or multiple days, according to AccuWeather. Some interior locations, such as Boise, ID, could crack 100.

Nevertheless, widespread losses were seen across the West.

PG&E Citygate August was down 19 cents from July 11-17 to reach $2.682, the balance of summer was down 20 cents to $2.62 and the winter strip was down 20 cents to $2.94, Forward Look data show.

Part of the declines in northern California could also be due to recent proposed decision by a judge associated with the California Public Utility Commission (CPUC) that cleared the way for changes in Pacfic Gas & Electric Corp.’s tariff rates and system management that would take effect starting Oct. 1. The judge’s proposed decision requires PG&E to file a Tier 1 Advice Letter with the CPUC with a requested effective date of Oct. 1 to implement the adopted rates, which would be subject to CPUC Energy Division approval.

“Broadly, this decision does allow for increases in PG&E’s rates, but not as much as the utility had requested,” Genscape natural gas analyst Joe Bernardi said.

In the Pacific Northwest, Northwest Sumas August prices plunged 18 cents to $2.194, and the balance of summer dropped 17 cents to $1.95, Forward Look data show. The winter strip, meanwhile, was down just 4 cents to $3.12.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |