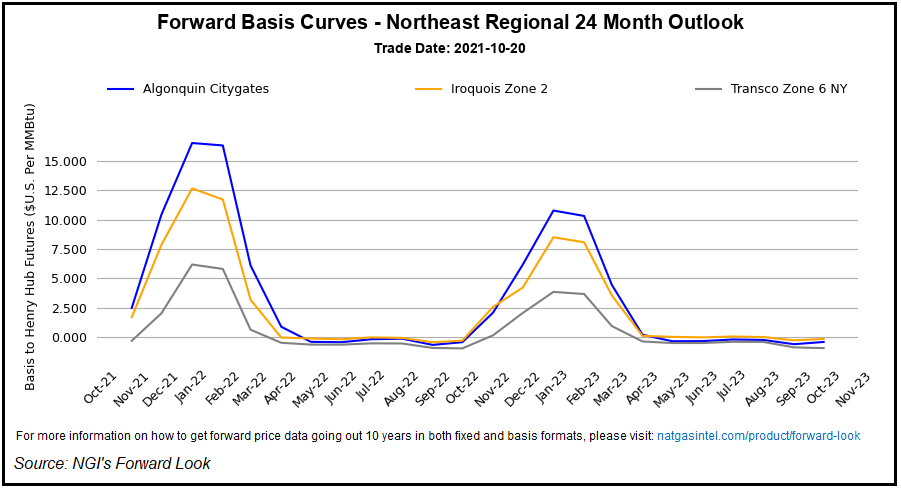

A shrinking storage deficit and fading risks for a frigid start to the U.S. heating season saw front-month natural gas forwards fall sharply during the Oct. 15-20 trading period, NGI’s Forward Look data show.

A 51.2-cent decline in November Henry Hub fixed natural gas prices for the period triggered losses of comparable magnitude at hubs throughout the Lower 48.

The steep losses in forwards trading coincided with heavy discounts for Nymex Henry Hub futures during the period, including some forays below the psychologically significant $5.00 mark. The November Nymex contract settled at $5.115/MMBtu Thursday, down 5.5 cents day/day.

When prices broke above $6.00 earlier in the month, the market had seemed like a coiled spring waiting to go off once winter arrived. However,...